Recently, Reuters published a striking headline: “Türkiye’s gas shift threatens Russia and Iran’s last big European market.” You can read it here. This seemed like significant news, but the details at the start left much to be desired:

By the end of 2028, Türkiye could fulfill over half of its gas requirements by boosting production and increasing imports from the U.S., a change that poses a challenge to the last major European market for Russian and Iranian providers.

Why would Türkiye pursue this strategy? According to Reuters, it was suggested by Trump, with the promise that it would bolster Türkiye’s energy security through increased reliance on LNG.

For years, the U.S. has pressured Ankara to sever its energy ties with Russia, even before the conflict in Ukraine. So far, this has not happened, and it’s hard to foresee significant changes in the near future.

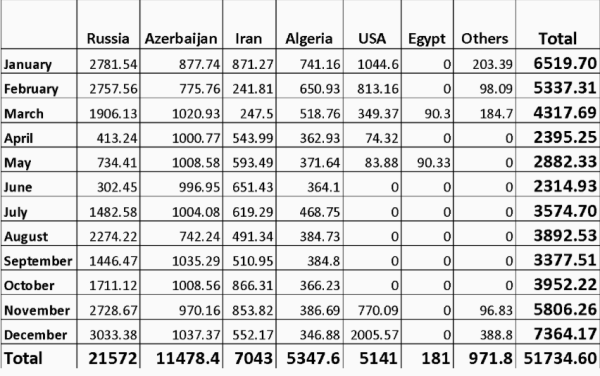

While Türkiye is indeed ramping up LNG imports and bringing oil and gas through pipelines from Azerbaijan and Iraq, it still plans to rely on Russian energy, which accounts for over 40% of its natural gas imports, for the foreseeable future.

In September, Türkiye’s state energy company, BOTAS, signed a 20-year agreement to purchase LNG from Mercuria, but the total of 70 billion cubic meters (bcm) over such a long period falls short of the blockbuster deal it was portrayed as.

Perhaps this is exactly what U.S.-centric think tanks like the Atlantic Council desired. Transitioning from warnings about Türkiye’s energy reliance on Russia (“Türkiye can become an energy hub—but not by going all-in on Russian gas” – Dec. 2022) to merely pretending their counsel is being followed (“How energy and trade are redefining US–Türkiye regional cooperation” – Oct. 2025) indicates a lack of substantive change in the circumstances.

A more tempered analysis from InstituDE highlights crucial points:

- Domestic gas production currently covers only 4% of consumption, necessitating continued reliance on imports.

- In 2022, Russian gas represented 39.5% of Türkiye’s total gas imports; this rose to 42.27% in 2023 and is expected to be 41.3% in 2024.

- Türkiye’s energy demand steadily grows, driven by industrial development, power generation, and rising vehicle usage.

- The vision of establishing Türkiye as an energy hub remains more of a political narrative than a viable commercial reality. Improving domestic energy resilience through diverse supply sources, increased LNG capacity, and enhanced storage is a more attainable goal.

The charts below indicate that an LNG deal for 4 bcm annually is unlikely to bring about transformative changes unless Türkiye opts to hinder its industrial growth at a time when it can hardly afford such setbacks.

While one might fantasize about the possibility of mitigating the impacts of losing the 14% of imports currently sourced from Iran, this scenario needs careful consideration. Currently, cutting off Russian gas appears unfeasible, yet the situation with Iran to the southeast warrants attention.

Trump-Erdogan Meeting: A Disappointment?

Were there any noteworthy outcomes from the Erdogan-Trump meeting on September 25?

A highlight emerged through a reporter’s comments. NTV’s Washington correspondent Hüseyin Günay stated, captured by an Associated Press camera outside the White House, that Türkiye gained nothing from the meeting. He emphasized the F-35 jets, which were “discussed but contingent” upon Türkiye ceasing Russian gas purchases and reducing trade with China. (Türkiye was expelled from the F-35 Joint Strike Fighter program in 2019 due to its acquisition of a Russian air defense system.)

Yet, focusing solely on the F-35 obscures other areas of negotiation and ongoing U.S.-Türkiye cooperation involving the Caucasus, Iran, and Israel.

Despite shared objectives, Washington holds considerable leverage over Erdogan due to Türkiye’s prolonged economic crisis. As political economist Umit Akcay suggests through a comparison with Argentina, which is currently receiving a U.S. bailout:

Between 2021 and 2023, Ankara’s unorthodox monetary strategies led to lower interest rates despite soaring inflation, garnering support from some business factions. While this policy temporarily stimulated growth and aided electoral wins, it ultimately faltered under inflation’s weight and diminished reserves. Since 2023, Ankara has reverted to orthodox policies under Finance Minister Mehmet Şimşek.

Similar to Argentina, both countries demonstrate how short-lived policy expansions can occur without structural transformation. They remain vulnerable to volatile capital flows and the dollar economy, forcing governments back into orthodox policies, leading to deeper dependency and social hardship. Türkiye and the broader Global South can see their futures reflected in Argentina’s challenges, indicating that stability under financial dependency is only temporary.

Refocusing on the Trump-Erdogan meeting, subsequent developments reveal that Türkiye, the U.S., and Israel are largely aligned regarding the Caucasus and potentially against Iran. Each party aims to derive benefits from this collaboration. Whether they will succeed remains uncertain, but it is too early to conclude that Erdogan’s visit (reportedly financed by his command to Turkish Airlines purchase of up to 225 Boeing aircraft) yielded no results.

On October 1, Türkiye announced the freezing of assets belonging to numerous individuals and entities connected to Iran’s uranium enrichment and nuclear operations, aligning with the renewed pressure campaign by the U.S. and its allies against Tehran.

This development was met with strong criticism from Iran. The Iranian Foreign Ministry has remained silent, but some Iranian analysts guardedly warn that this could damage trust and trade between both countries, particularly in energy and finance.

On the same day that Türkiye joined the sanctions campaign against Tehran, Bloomberg reported that Ankara and Washington are approaching a resolution regarding the accusations against the Turkish state lender, Turkiye Halk Bankasi AS. In 2019, the bank was indicted for allegedly evading U.S. sanctions on Iran, facing charges of fraud, money laundering, and sanctions violations.

Bloomberg notes that “a resolution to Halkbank’s almost decade-long saga would significantly enrich U.S.-Türkiye relations.” The bank is likely to incur a manageable fine, thereby avoiding a more protracted legal battle that could have led to severe financial repercussions and loss of access to the U.S. financial system.

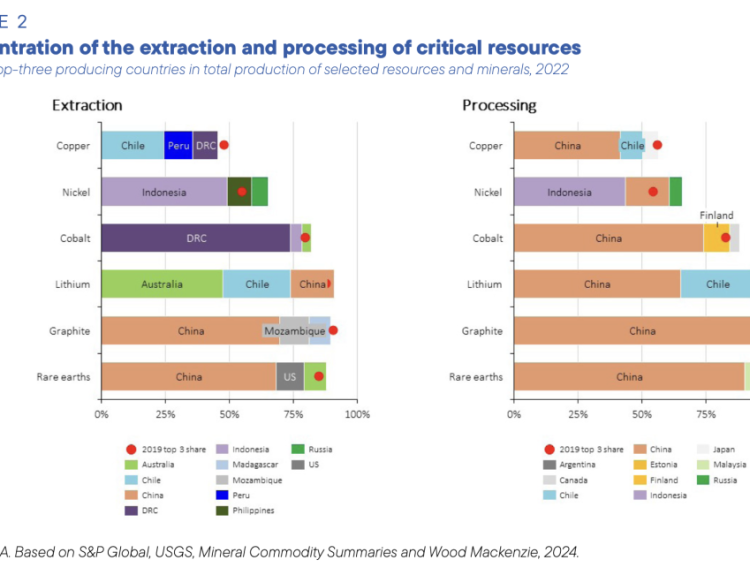

Bloomberg also reported that Türkiye is negotiating with the U.S. regarding the development of its vast rare earth mineral deposits located in central Anatolia. Türkiye and China had signed a memorandum of understanding on this matter two years prior, but talks stalled due to China’s insistence on refining in its territory and reluctance to transfer technology. Progress with Washington remains to be seen, but recent developments highlight potential incentives.

During a meeting between Trump and leaders from Arab and Muslim nations at the UN, Erdogan was notably positioned at Trump’s side. This seemed particularly relevant given the U.S.’s efforts to resolve the conflict in Gaza.

In a somewhat concealed manner, Türkiye has continued shipping Azerbaijani oil to Israel, supporting its actions in Gaza until the recent ceasefire agreement.

Moreover, Türkiye has been pressuring Hamas to accept Trump’s proposal, which would see the group expelled from Gaza. The plan includes turning Gaza and its offshore gas reserves over to international investors. As discussed previously, despite widespread speculation about potential conflict between a Greater Israel and a Greater Türkiye, such an eventuality lies well in the future. For now, both entities are pursuing parallel interests leading toward Tehran.

Cooperation among Turkish intelligence (Millî İstihbarat Teşkilatı or MIT), Mossad, and the CIA is noteworthy, suggesting that their operations are largely intertwined. Recent revelations about MIT’s connections to both Israeli and American agencies highlight their collaborative dynamics during negotiations surrounding the Gaza ceasefire:

Gershon Baskin notes how Türkiye’s spy chief @ibrahimKALIN contributed to facilitating Hamas’ negotiations. https://t.co/6inAFPZl3y pic.twitter.com/2ZesqQvDxl

— Amberin Zaman (@amberinzaman) October 10, 2025

Türkiye seems poised to maintain a crucial role in Zionist strategies concerning Gaza. As evidenced by a recent cooperation deal between Türkiye and UNRWA, there are indications that Türkiye may be preparing to accept refugees from Gaza. The Cradle outlines this situation:

Trump and Netanyahu are preparing for every possible outcome. They seem to have selected Türkiye to provide Hamas with an exit route – a task Erdogan appears willing to accept following his dealings in Washington.

Back in February 2025, Erdogan declared, “The proposals from the new American administration regarding Gaza, influenced by the Zionist lobby, lack any merit from our perspective.”

This perspective, however, seems to have shifted following his visit to Washington.

What prompted this change? That aspect of the story remains unclear in a relationship characterized by transactions.

What Does Washington Have to Offer?

Several possibilities exist:

- Sanctions relief. More than re-entry into the F-35 program, Türkiye is eager to lift the sanctions imposed under the Countering America’s Adversaries Through Sanctions Act (CAATSA) applied in 2020 in response to Ankara’s purchase of the Russian-made S-400 missile defense system. These sanctions have hindered imports of critical components like semiconductors, negatively impacting Türkiye’s defense ambitions, including its own air defense project and locally produced fighter jets.

- Ankara seeks access to the EU’s new $170 billion defense fund. Some EU officials are also discussing the necessity of Türkiye’s support for rearmament.

- Assistance in pursuing Turkish objectives in Syria.

- Potential benefits from a hypothetical conquest of Iran. CIA and MIT analysts have undoubtedly communicated on this front.

- Türkiye likely desires a role in post-conflict Gaza. Was such a role guaranteed? How reliable would such a promise be?

- Lastly, disregarding Türkiye’s gains overlooks the significant advantages it could anticipate from the ongoing TRIPP scheme. (Note: these prospects rely on the CIA-MIT strategy rather than on realistic outcomes).

What might that strategy entail? Let’s analyze known factors and draw some reasonable conclusions based on past experiences.

Türkiye and Iran are in a struggle for influence across the Caucasus, the Levant, and Central Asia. As seen with TRIPP in the Caucasus and the potential fall of Assad in Syria, Ankara envisages an increased role while aiming to diminish Iran’s influence in Central Asia as it expands its own.

TRIPP may contribute slightly, but Iran remains central to Turkish nationalist—and American hegemonic—aspirations. Following Amwaj’s analysis:

Ankara desires Central Asian nations to reduce their reliance on Russia and China, aiming for deeper ties with Türkiye and Azerbaijan. “The aim is to foster independent actors whose sovereignty and territorial integrity can be strengthened—encouraging collaboration with the Turkish government to advance Türkiye’s regional interests,” noted Bruce Pannier, a fellow at the Turan Research Center and Caspian Policy Center.

In contrast, Iran aligns with China and Russia in seeking to limit Western influence in Central Asia. Tehran perceives NATO member Türkiye’s growing presence as a representation of American power, intensifying fears of geopolitical encroachment. The Trump administration’s efforts to incorporate Central Asian nations into the Abraham Accords heightened these anxieties.

This sentiment extends beyond Iran; there is a concerned Russian outlook regarding the strengthening ties among the members of the Organization of Turkic States (OTS).

For the time being, Türkiye balances tensions while collaborating with Iran on energy and trade discussions. Both countries are working to uphold and enhance their positions amidst the rapidly changing geopolitical landscape of Eurasia, as key players such as China, Russia, and India take the lead, with the West eager to assert its influence.

Both nations aspire to elevate their standing among significant Eurasian stakeholders, while Central Asian states are maneuvering to maintain relations with all sides, ensuring a connection with Iran for access to the Gulf and Indian Ocean.

As the concerns raised in the referenced Russian piece about the OTS imply, there is a fear that the ultimate aim of the organization may be to create a structure akin to the EU, enhancing the synergy among its members against larger Eurasian powers. Leaders within the OTS are known for having ambitious visions:

In 2021, Devlet Bahceli presented the “Turkic World” map to Turkish President Recep Tayyip Erdogan.

What if they aimed to carve out a larger segment of a fragmented Iran to ensure terrestrial connectivity among Turkic nations? This map may appear ambitious or unrealistic, yet it represents a genuine long-term goal held by a powerful faction of Turkish expansionists.

Igniting the Conflict

Viewing the TRIPP initiative, along with developments in Syria and Iraq, as part of a broader strategy in preparation for potential conflict with Iran reveals a puzzle coming together.

What is occurring along the western boundary of Iran?

In Syria, the Kurdish-led Syrian Democratic Forces (SDF) and the Al Qaeda-affiliated Syrian government recently agreed to a ceasefire, and the SDF is now signaling imminent integration into the Al Qaeda regime’s military structure. Meanwhile, Israel and Syria are advancing towards a “security pact” that could effectively bring Damascus into the Gulf-American alliance. Israel already occupies parts of southern Syria—potentially necessitating an agreement that includes a corridor between Syria and Iraq.

This situation implies a U.S.-Israeli-backed push for the so-called “David’s Corridor”:

From the Zangezur to David’s Corridor: The Silent Redrawing of Global Trade and the Road to War with Iran

In the evolving global geopolitics, few developments are as significant yet underreported as the emergence of two key corridors: the Zangezur and… pic.twitter.com/EY8JfSA9f8

Understanding the importance of this initiative is crucial. Airstrikes on Iran, as seen during the 12-Day War, are unlikely to achieve desired outcomes and could inflict further harm on Israel. Instead, a successful regime change in Tehran would require a greater military presence on the ground, possibly with extremist forces replacing any U.S.-led coalition.

Recently, Iran’s intelligence minister revealed that during the 12-Day War, the U.S. and Israel aimed to destabilize Iran by leveraging terrorist groups like Daesh. This strategy failed, and subsequent attempts may not benefit from the element of surprise—though it’s a scenario that remains a possibility for future conflicts. Iran is not Syria, and reports indicate that the recent war has only solidified government support within Iran. The U.S.-Israel coalition seems to be banking on ongoing AI-driven influence operations to incite change.

The precise count of extremist fighters in Syria and Türkiye remains unclear, yet some estimates suggest millions are positioned for potential transitions into Lebanon, Iraq, and/or Iran. Recent reports have highlighted a concentration of forces near the Syria-Lebanon border. Moreover, it should be noted that Kurdish forces may be primed to engage against Iranian-backed factions in Iraq. Ankara has dismissed allegations of Mossad-driven infiltration from its border with Iran, evading mention of other operatives.

Should Iraq descend into chaos, it could easily escalate into Iran. Observations indicate that Iran’s borders, extending from northern Iraq to the Caspian Sea, are significantly porous.

Reacting to the recent developments in Gaza, Ali Akbar Velayati, advisor to the Iranian Supreme Leader, suggested that the situation might signal an increase in conflict elsewhere:

“The beginning of the ceasefire in Gaza may coincide with the end of the ceasefire in other regions,” he remarked, referencing Iraq, Yemen, and Lebanon.

Putting this information together provides valuable insights into potential scenarios:

To Sunni brothers and sisters: Soon, there will be a “Sunni Shia” war. The Syrian regime, supported by Erdogan and Netanyahu, will target #Iraq (and enlist others).

This isn’t a strictly “Sunni Shia” conflict; it’s a Zionist divide against all of us, yet the resistance in Iraq is…

— Soureh 🇮🇷🇵🇸 (@Soureh_design2) July 10, 2025