Have you ever felt that something is off? If so, it might be wise to heed that instinct. The financial landscape seems to be barreling toward a significant collapse, which could usher in years of economic turmoil.

Have you ever felt that something is off? If so, it might be wise to heed that instinct. The financial landscape seems to be barreling toward a significant collapse, which could usher in years of economic turmoil.

This viewpoint is shaped by years of personal study and reflection. Of course, we acknowledge we might be mistaken…again.

We believed the DOW had reached its high around 13,000, and the decline in labor participation was a sign of economic weakness rather than strength. Thus far, the events have unfolded differently than we expected. Perhaps we have overlooked key factors.

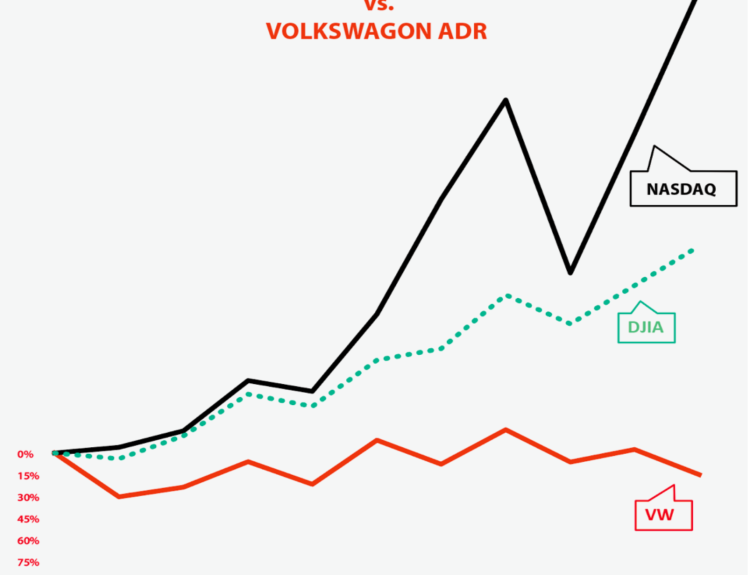

We are struck by the contrast between a stagnant economy and surging stock prices. The array of financial tactics employed to create this phenomenon—TARP, CPFF, MMIFF, TALF, QE, and others—defies our comprehension.

These artificial financial instruments have inflated asset values, leaving the market coated in unregulated chaos. The aftermath of this impending crash is likely to be extremely messy, a situation that appears increasingly inevitable.

Unrest Lies Ahead

In his recent Investment Outlook, Bond King Bill Gross notes a growing sentiment of an ending in the asset markets—a reflection on the bullish trajectory that began in 1981. At that time, long-term Treasury rates were at 14.50 percent, and the Dow stood at a mere 900. A following “20 banger” lifted stocks immensely, enriching fully invested individuals.

Now, however, influential figures such as Stanley Druckenmiller, George Soros, Ray Dalio, and Jeremy Grantham suggest that this 35-year investment supercycle may be nearing its conclusion. They don’t necessarily advocate for panic selling, yet they highlight the likelihood of diminished returns and increasing risks in the near future.

What these experts seem to convey in unison is to enjoy this moment in the bull market; it may not return for us. Unease and low asset returns loom ahead, perhaps even greater turmoil if a bubble bursts.

When does our credit-based financial system falter? It happens when the risks of investable assets outweigh their returns. Not immediately, but slowly, individuals begin to swap stocks and credits for literal cash hidden away.

We may be nearing that juncture as bond yields, credit spreads, and stock prices have propelled financial wealth to a breaking point. A prudent investor could very well perceive a looming end—not another Lehman collapse, but rather a downturn characterized by excessive bullish sentiment.

Sell the Rally

Market cycles are akin to seasonal shifts. A robust spring and summer bull run have driven asset prices to heights unimaginable in 1981. Brief periods of downturn were swiftly followed by a resurgence of optimism and climbing stock values.

To manipulate these conditions, the Fed has consistently supported higher stock prices through accommodative measures, successfully eliminating perceived risks. Speculators willing to take risks have thrived.

Yet human psychology is as volatile as the markets. Trust in stocks, the Fed, and capital gains can vanish just as quickly as it appeared. The fervor of a perpetual bull market can also falter.

After reaching 18,288 on March 2, the DOW has seen fluctuations around 18,000. Is it gathering momentum like a spring prepared to leap higher? Or is it poised for a lengthy decline? This conundrum remains the million-dollar question.

Historically, the consensus during market stagnation has been that it is merely pausing before another upswing. “Buy the dip” has echoed as the path to success. The next downturn may present yet another golden opportunity, but it could also mark the final chance to secure profits near an all-time high.

In essence, “sell the rally” could very well become the prevailing strategy moving forward.

Sincerely,

MN Gordon

for Economic Prism