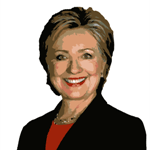

Hillary Clinton’s patronizing remarks have been met with a predictable wave of applause from her Liberal supporters over the years, making it tiresome to voice any disagreement. While her contributions may lack depth, her persistence and considerable financial resources seem to keep her in the limelight.

Hillary Clinton’s patronizing remarks have been met with a predictable wave of applause from her Liberal supporters over the years, making it tiresome to voice any disagreement. While her contributions may lack depth, her persistence and considerable financial resources seem to keep her in the limelight.

No matter how often we hope to see the last of her, she resurfaces unexpectedly, like an unwelcomed itch that never quite goes away. Why must we endure yet another wave of Hillary in 2015? It feels as though this saga has persisted indefinitely.

Take a trip back to 1997, for instance, when we found ourselves subjected to one Progressive’s fervent admiration for Ms. Clinton. This so-called Great Thinker extolled her lackluster intellect as a beacon to guide us into a better future.

Whatever became of that optimistic individual? Perhaps he is still advocating for democracy, albeit at the expense of his friends and neighbors. Amidst the uncertainty, Hillary remains a constant presence. We have learned to adapt to her enduring role in our political landscape. Continue reading

Every year, like clockwork, the first of June brings a dense gloom over coastal Southern California. Visitors often mistake this phenomenon for smog, but it is actually something entirely different. The notorious smog of Los Angeles had all but vanished by the early 1990s due to the implementation of mandatory vehicle emissions testing.

Every year, like clockwork, the first of June brings a dense gloom over coastal Southern California. Visitors often mistake this phenomenon for smog, but it is actually something entirely different. The notorious smog of Los Angeles had all but vanished by the early 1990s due to the implementation of mandatory vehicle emissions testing.

While this was an inconvenient and costly process, it resulted in clearer skies most days, allowing a view of the San Gabriel Mountains from Long Beach and fewer interruptions for school recesses due to high ozone levels.

This June gloom is a natural event, distinct from smog. As daylight temperatures rise inland, a thick marine layer drifts in each morning and blankets the coastal plain. Typically, blue skies reappear once the sun dissipates the fog around 1 PM, only to return each morning anew.

People have varied reactions to this seasonal occurrence. Some find it unbearable, while others appreciate the brief respite from the impending summer heat. Continue reading

“Only invest in things you’d still be happy to hold if the market were to close for a decade,” advises Warren Buffett. This wisdom is particularly pertinent today, as asset prices continue to soar.

“Only invest in things you’d still be happy to hold if the market were to close for a decade,” advises Warren Buffett. This wisdom is particularly pertinent today, as asset prices continue to soar.

Stocks are hovering near historically high valuations. Investing in even the most reputable companies could leave you holding onto underperforming stocks for a decade or longer. This is the risk of engaging in a market that has inflated beyond reason.

We’ve previously discussed the ridiculousness of current valuations so often, we’ve lost track. Regardless of how you analyze it—whether through Shiller’s Cyclically Adjusted Price Earnings (CAPE) ratio or the Buffett indicator—the truth remains: stock prices are exceedingly overpriced and this reality is often disregarded.

Additionally, treasury yields, which inversely correlate with prices, are at the bottom of a 30-year credit cycle. When yields eventually rise, they could continue climbing for the next two decades, which would conversely deflate asset prices as borrowing costs increase. Continue reading

Professional sports often disappoint, as evidenced by the hyped Mayweather vs. Pacquiao fight, which fell flat, resembling nothing more than a gentle sparring match. For true excitement these days, many have turned to alternative entertainment, whether it’s reality TV or social media gossip. However, here at the Economic Prism, we find our thrills in the unpredictable nature of the stock market.

Professional sports often disappoint, as evidenced by the hyped Mayweather vs. Pacquiao fight, which fell flat, resembling nothing more than a gentle sparring match. For true excitement these days, many have turned to alternative entertainment, whether it’s reality TV or social media gossip. However, here at the Economic Prism, we find our thrills in the unpredictable nature of the stock market.

Every day brings new possibilities, and we are braced for something significant—perhaps even a substantial downfall. Just this week, for instance, the stock market experienced a sharp decline, with the S&P 500 dropping a full percent. Surprisingly, what was perceived as positive economic news ended up being seen as negative for the stock market.

New home sales exceeded expectations, and capital equipment orders in the U.S. rose for the second month in a row. Continue reading

### Introduction

The articles touch upon various critical topics that highlight nuances in politics, climate phenomena, financial market dynamics, and the unpredictability of public appeal. The following content explores these themes while maintaining the integrity of original ideas and images presented.

### Conclusion

These reflections remind us of the complex interactions within our society, from the enduring presence of notable public figures to the shifts in environmental and economic landscapes. Understanding these dynamics can help us navigate the ongoing narratives shaping our world.