This week marks our fundraising drive at Naked Capitalism. So far, 997 generous donors have contributed to our initiatives aimed at combating corruption and predatory practices, particularly within the financial sector. We invite you to join us by visiting our donation page, where you can learn how to donate via check, credit card, debit card, PayPal, Clover, or Wise. For more insights, take a look at our fundraising goals, our accomplishments over the past year, and the current goal, bonuses for our exceptional writers.

While I do not claim to be an expert in French political affairs, it appears that President Macron’s position is increasingly precarious. Although his term runs until May 2027, the swift dissolution of Prime Minister Sébastien Lecornu’s government indicates that Macron’s hold on power is weakening, making it unlikely he can endure this turbulence for much longer.

Here are some initial insights. According to LeMonde:

President Emmanuel Macron’s office announced that Prime Minister Sébastien Lecornu had resigned on the morning of October 6, only hours after unveiling his new government. His resignation within 27 days marks the shortest tenure for a prime minister in modern French history, plunging the nation back into political uncertainty.

Just the evening before, Lecornu had introduced a cabinet nearly identical to that of his predecessor, François Bayrou. However, immediate fractures surfaced as members from various parties within the ruling coalition voiced skepticism about the lack of significant change.

It remains unclear how Macron will respond. Thus far, he has resisted calls for new snap elections while also dismissing ideas of resigning before his term concludes in 2027.

Jean-Luc Mélenchon, leader of the radical-left La France Insoumise (LFI) party, has called for a motion to remove Macron from office. Following Lecornu’s resignation, Mathilde Panot, a prominent LFI member, stated on X, “The countdown has begun. Macron must go.”

The Paris stock market dipped by over 2% shortly after the news broke.

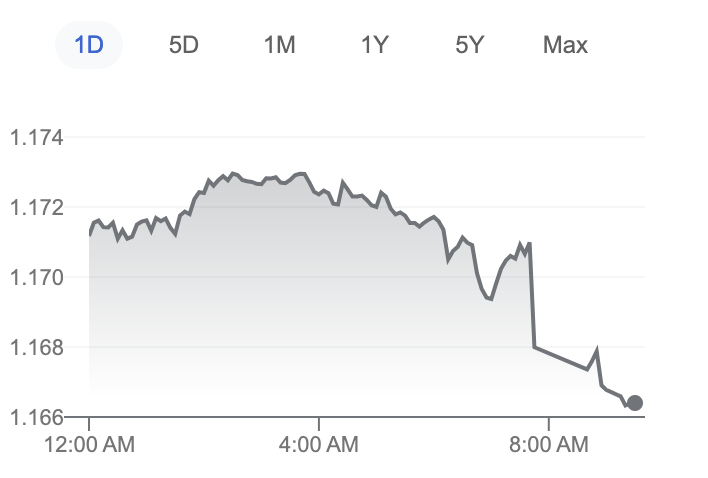

The euro has also depreciated against the dollar, likely in reaction to this unexpected resignation:

As reported by the Financial Times:

France’s Prime Minister Sébastien Lecornu has resigned less than a month after his appointment, resulting in a market sell-off driven by concerns regarding dysfunction within the Eurozone’s second-largest economy.

Lecornu’s resignation follows indications from allies in the center-right Les Républicains party that they might withdraw from his government due to his preference for including ministers from Macron’s Renaissance party.

The leftwing Socialist party also threatened to oppose his cabinet unless Lecornu halted Macron’s controversial pension reforms.

This marks the third prime ministerial appointment by Macron since the summer 2024 snap parliamentary elections, which left the French National Assembly deeply divided and governance almost impossible.

“The only way to end this crisis is to have a new election,” stated Emmanuel Cau, head of European equities strategy at Barclays, adding that this instability complicates investment decisions in Europe.

The additional yield on French debt over German Bunds, a key metric for market concerns, surged to 0.88 percentage points, nearing its highest level since the Eurozone debt crisis over a decade ago.

According to the Wall Street Journal:

The failure of yet another Macron government underscores the dwindling options available to the president as he attempts to address France’s rising budget deficit while managing a fragmented National Assembly.

France’s borrowing costs have escalated to levels seen in Europe’s more indebted nations, as Macron seeks a prime minister capable of passing a new budget by year-end. The CAC 40 stock index dropped 2% on Monday, while the yield on France’s 10-year bonds rose to 3.6%, surpassing Italy’s.

Immediately following Lecornu’s resignation, opposition leaders demanded the dissolution of the National Assembly and new parliamentary elections, arguing the current assembly is too fractured to yield a functional government.

“Stability cannot be restored without a return to the polls,” claimed Jordan Bardella, president of the far-right National Rally party, on Monday.

Lecornu entered office with promises of a departure from Macron’s past prime ministers, but soon found himself entangled in the same crisis that brought down his predecessors. Left-wing lawmakers pushed for tax hikes on the wealthy to address the budget deficit, while right-wing counterparts criticized the welfare state as contributing to France’s fiscal turmoil.

Neither side indicated a willingness to compromise, leaving Lecornu with limited ability to form a cabinet that would foster consensus across the assembly.

The challenges posed to Macron are compounded by ongoing tensions within leftist parties that won significant votes in the recent elections but have been unable to cooperate effectively. This environment makes it increasingly difficult for Macron to appoint a moderate prime minister who could command majority support in the National Assembly.

Amidst this political turmoil, observers are left pondering whether France has reached a point of being “ungovernable.” The nation has continually run large fiscal deficits to maintain its social safety nets, which citizens are deeply resistant to trimming. Without the ability to issue its own currency, France faces swifter consequences for violation of EU budget rules compared to nations like the US or UK. Attempts to raise taxes on the wealthy remain politically fraught, and any practical industrial policies designed to stimulate growth would take significant time to yield results.

In my perspective, one potential approach to resolving the budgetary deadlock might involve reconsidering France’s military commitments and reducing contributions to NATO. However, both domestic and European leaders have been rallying public opinion against perceived threats from Russia, complicating any hope for a change in direction.

Additional commentary from Twitter:

Lecornu even beats a centuries-old record from the Third Republic; he deserves applause! pic.twitter.com/LEG9myBby2

— Julien (@Teidix) October 6, 2025

🚨🇫🇷 FLASH

Sébastien Lecornu holds a DOUBLE RECORD: the SLOWEST to FORM a GOVERNMENT (26 days) and the FASTEST to RESIGN (27 days). https://t.co/RqdOfk3Nvm pic.twitter.com/nz2MnYTFIy

— Impact (@ImpactMediaFR) October 6, 2025

This ongoing backlash against Macron’s neoliberal and pro-war budget policies correlates with a shift in government dynamics elsewhere, particularly in the Czech Republic, where former Prime Minister Andrej Babis is poised to return to power.

Highlights from Bloomberg:

- Billionaire Andrej Babis is set to form a new Czech government following his strongest election victory to date. He plans to govern with the backing of a far-right party and a populist group.

- Babis’s reinstatement is likely to fortify the ranks of populist leaders within the EU, as his campaign signals intentions to challenge various policies from migration to military support for Ukraine.

- Despite his opposition to any form of “Czexit,” Babis remains a supporter of NATO, but his policy agenda aligns with allies such as Hungary’s Viktor Orban and Slovakia’s Robert Fico.

Interestingly, a recent Bloomberg article suggests that the recent dip in the euro’s value may have limited consequences.

As the initial panic subsides, France’s political risks may have limited potential to further depress the currency. Recent market behavior shows minimal sensitivity to such headlines, and today’s fluctuations are likely the result of traders seeking quick opportunities amidst a quieter market.

Turning back to our central theme of “What lies ahead for France?”, we should clarify that the notion of a Eurozone breakup is not a credible concern at this time. The UK’s experience with exiting the EU, while fraught with economic repercussions, does not apply to Eurozone members like France. A departure from the Eurozone would lead to a catastrophic banking collapse and an immediate loss of confidence, forcing depositors to withdraw funds to avoid adverse currency changes.

This situation doesn’t negate the possibility of non-Eurozone nations contemplating leaving the EU in the future, although NATO’s fragile status is arguably more vulnerable.

In conclusion, the political landscape in France is undeniably shifting, as Macron’s administration grapples with intense scrutiny and instability. With calls for change growing louder and the financial markets responding negatively, the future of French governance remains uncertain. As the situation develops, it will be essential to observe how these dynamics unfold in both domestic and international contexts.