Understanding the Investment Potential of Sally Beauty Holdings

In today’s ever-evolving market landscape, evaluating the potential value of a stock is crucial for making informed investment decisions. This article delves into the current standing of Sally Beauty Holdings, using recent market performance data and financial analysis to provide insights that may help guide your investment strategy.

Current Market Performance

As of the latest trading close, Sally Beauty Holdings’ stock price is $16.55. Over the past week, it has returned 8.8%, with returns of 14.2% over the last month and an impressive 55.3% year-to-date. However, a longer view reveals mixed results: negative returns of 5.6% over three years and modest gains of 6.2% across five years. This variability presents an interesting dilemma for potential investors.

The recent spike in interest surrounding Sally Beauty is largely influenced by a broader fascination with specialty retail stocks, particularly in beauty and personal care. Investors are closely reassessing the associated risks and potential rewards of companies in this sector.

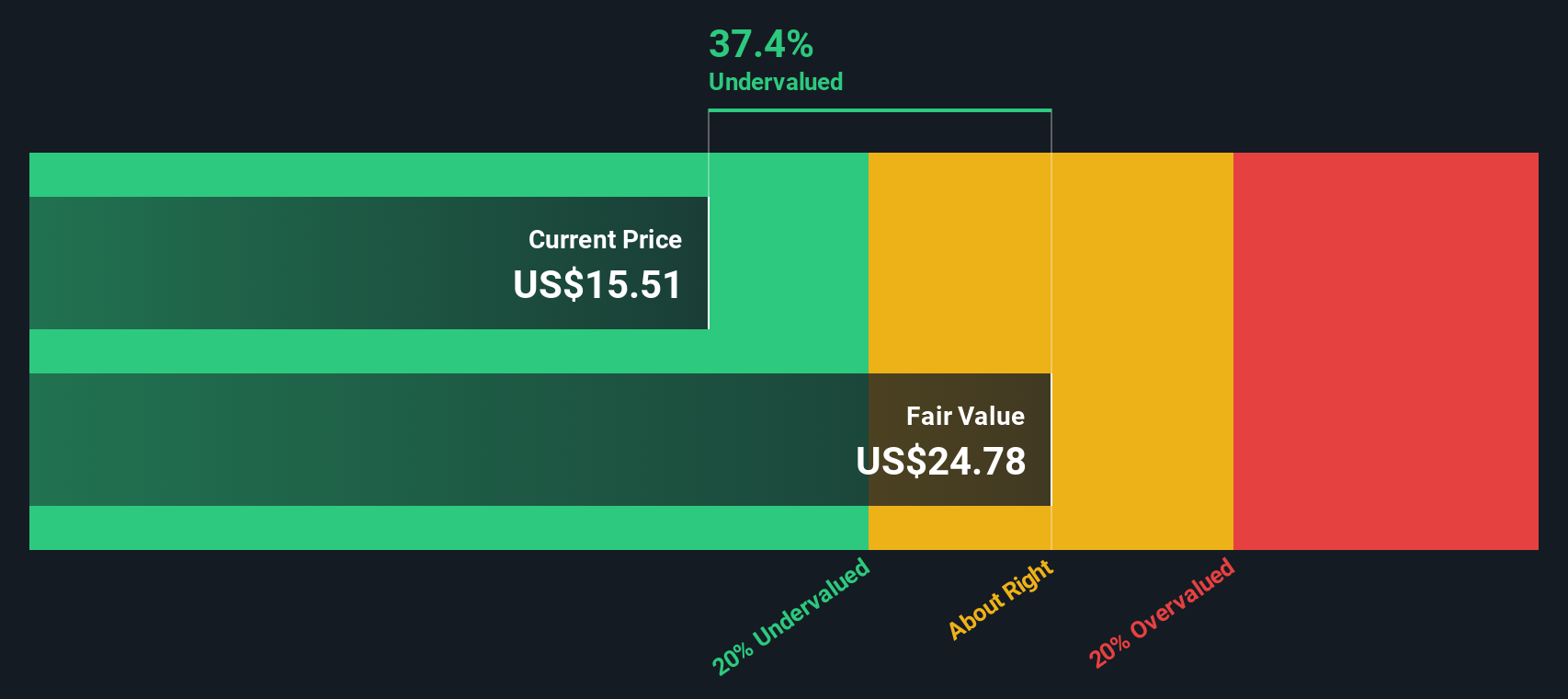

According to Simply Wall Street’s evaluations, Sally Beauty Holdings currently scores 5 out of 6 for being undervalued—a strong indicator that it’s worthwhile to look deeper into various valuation techniques, which we outline below.

Investment Approaches

1. Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model provides an estimation of a company’s present value based on future cash flow projections. For Sally Beauty, a two-stage Free Cash Flow to Equity model has been utilized.

Recent data shows the company achieved a Free Cash Flow (FCF) of approximately $177.2 million over the past twelve months. Projections suggest an FCF of $142 million for the year ending September 30, 2024. The estimates extend to future years, with significant growth anticipated up to 2035, where the FCF could rise to $272.1 million.

Based on these cash flows, the estimated intrinsic value per share is around $26.18, indicating that the stock is approximately 36.8% undervalued compared to its current trading price of $16.55.

Result: UNDERVALUED

Our DCF analysis suggests that Sally Beauty is significantly undervalued, which might make it an attractive option for investors.

For more details on the intrinsic value assessment, check out the valuation section on Simply Wall Street.

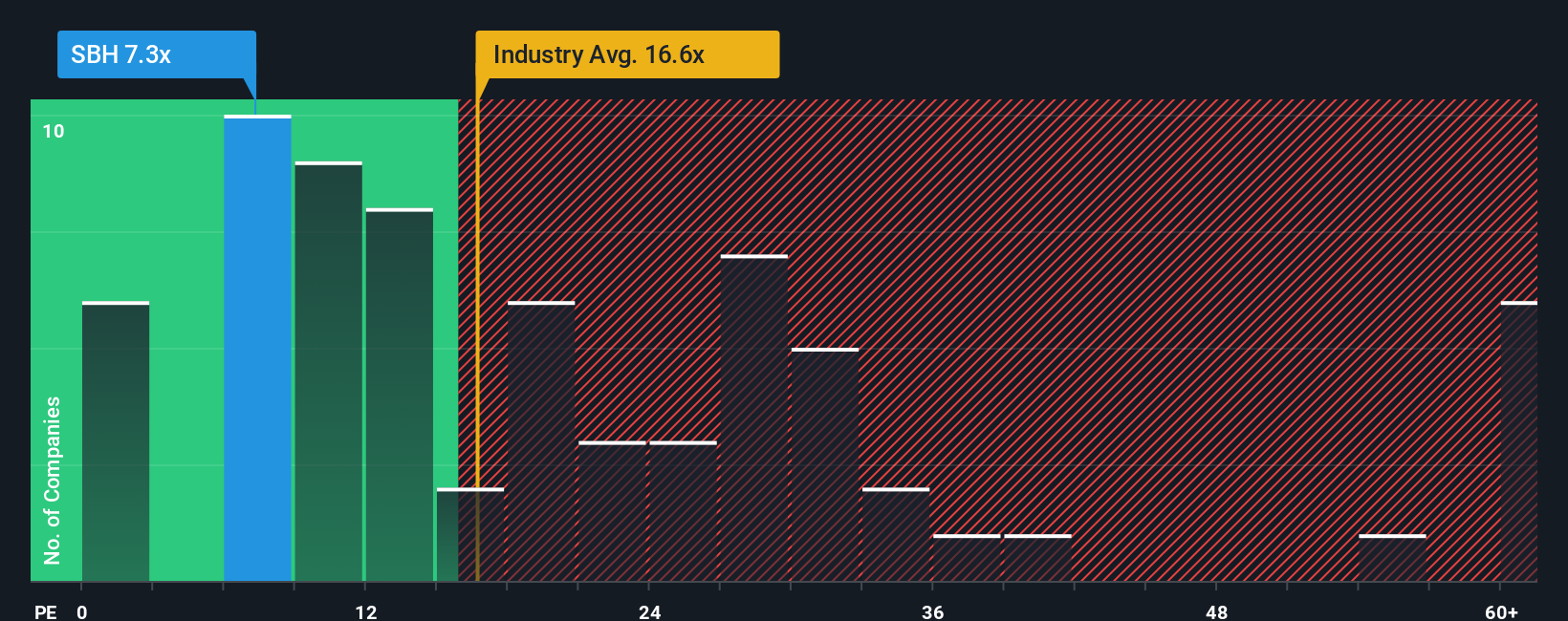

2. Price-to-Earnings (P/E) Ratio Evaluation

The P/E ratio is another critical measure, helping investors understand what they are paying for each dollar of earnings. Currently, Sally Beauty’s P/E ratio stands at 8.24x, substantially below the specialty retail industry average of 20.95x. This lower ratio suggests that the stock price undervalues its earnings compared to peers in the sector.

Simply Wall Street estimates a Fair Ratio of 12.98x for the company. Given that Sally’s current P/E is below this fair ratio, it is yet another indication that the stock may be undervalued based on its earnings performance.

Result: UNDERVALUED

These P/E findings further reinforce the idea that Sally Beauty Holdings is a stock worth considering.

Crafting Your Investment Narrative

Understanding a company’s valuation isn’t just about numbers; it’s also about crafting a narrative—a cohesive story that aligns your financial forecast with fair value assessments. On the Simply Wall Street platform, you can develop your own narrative concerning Sally Beauty Holdings, connecting your expectations of future revenue, earnings, and profitability.

This dynamic approach enables you to stay agile, ensuring that your investment story remains in tune with new information and developments about the company.

Conclusion

In summary, Sally Beauty Holdings offers potential value based on its current undervalued status as revealed by both DCF and P/E analyses. However, it’s essential to assess not only the numbers but also your investment philosophy and narrative surrounding the stock. Take the time to explore community insights, forecast changes, and market trends before making a final decision.

By aligning your research and analysis, you can make well-informed choices in the ever-fluctuating world of stock investments.