Goldman Sachs Ventures into AI-Driven Accounting

Goldman Sachs Group (NYSE:GS), via Goldman Sachs Alternatives, has recently spearheaded a significant funding round for Fieldguide, an AI-centric accounting and audit platform. This initiative represents the firm’s strategic expansion beyond traditional banking and trading into the realm of AI-powered enterprise software that supports professional services.

- The investment primarily focuses on leveraging technology to tackle widespread challenges, such as the skills gap in accounting and auditing.

- This move illustrates Goldman Sachs’s intent to diversify its service offerings and integrate advanced solutions into its operations.

For investors, this development positions Goldman Sachs at the critical intersection of finance, enterprise software, and AI. Historically recognized for its dominance in investment banking, trading, and wealth management, the firm’s backing of Fieldguide indicates a keen interest in enhancing the technological capabilities of corporate finance and audit teams, complementing its traditional focus.

The pivotal question arises: how will such investments shape Goldman Sachs’s involvement in financing and endorsing AI-driven fintech and enterprise tools? Should AI-based accounting and auditing platforms gain widespread adoption, Goldman Sachs’s participation may redefine its future engagements with corporate clients, advisors, and technology partners in the expansive financial landscape.

To stay informed about the latest developments regarding Goldman Sachs Group, consider adding the stock to your watchlist or portfolio. You can also engage with our Community to gain fresh perspectives on Goldman Sachs Group.

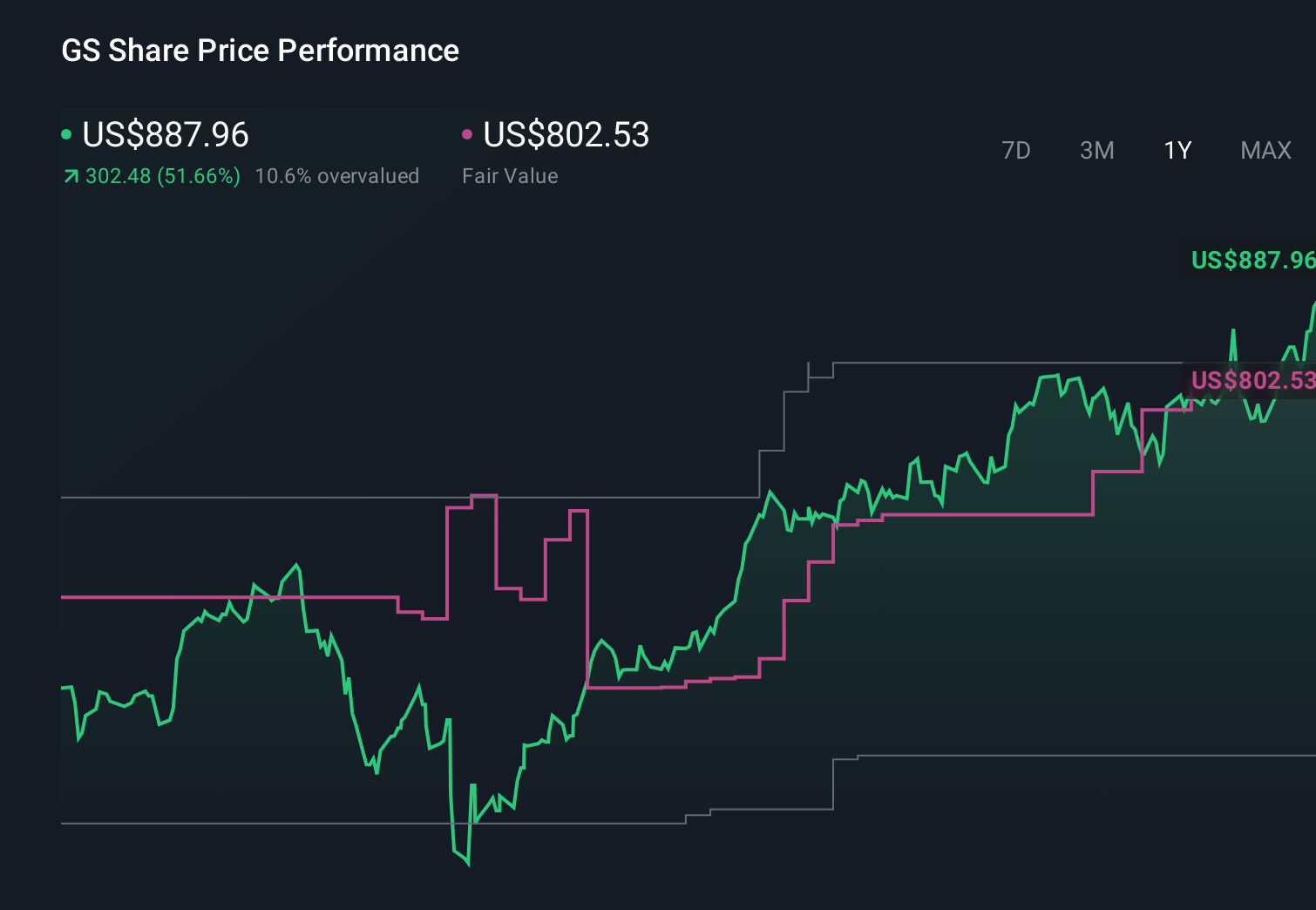

Why Goldman Sachs Group could be great value

Goldman Sachs’s leadership in Fieldguide’s $75 million Series C funding underscores its commitment to AI-enhanced accounting and auditing processes, which are closely aligned with its corporate, advisory, and capital markets clientele. For investors, the interest here lies less in potential venture-style gains and more in how Goldman Sachs establishes itself in comparison to competitors like JPMorgan and Morgan Stanley, particularly as a provider of and investor in AI-driven enterprise tools pertinent to professional services.

Integration with Goldman Sachs Group’s Strategy

This AI investment aligns seamlessly with Goldman Sachs’s ongoing narrative of embracing technology, asset management, and capital-efficient activities. Additionally, it complements the firm’s frequent use of bond issuance and medium-term note programs, reflecting a strategy of raising long-term funding while simultaneously supporting areas such as AI, digital initiatives, and alternatives that feature prominently in analyses concerning its long-term earnings potential.

Considerations: Risks and Rewards

- Fostering AI adoption in audit and advisory sectors may enhance Goldman Sachs’s relevance among large corporate clients and accounting firms adapting their operations.

- This move reinforces existing benefits noted by analysts, particularly in relation to efficiency and capital-light business models driven by technology.

- Execution risks are present, as the adoption of AI accounting solutions may encounter hurdles such as slow uptake, regulatory challenges, or issues with data quality that could hinder practical application.

- Goldman Sachs also continues to navigate industry challenges discussed in its broader narratives, including regulatory scrutiny, fee compression, and competition from technology-focused financial entities.

Future Watch Points

Monitor how frequently Goldman Sachs alludes to AI-powered audit and advisory tools in upcoming conferences and fixed income reports, along with whether partnerships like Fieldguide evolve into broader client offerings or financing opportunities that set the firm apart from other global banks. To gain insights into Goldman Sachs’s strategic trajectory, including community perspectives on long-term growth, risks, and capital returns, explore the community narratives for Goldman Sachs Group.

This article by Simply Wall St provides general information. While we offer analysis based on historical data and analyst predictions using an impartial methodology, the content is not a substitute for financial advice. It does not constitute a recommendation to buy or sell any stock and does not consider your individual objectives or financial situation. Our focus is long-term analysis driven by fundamental data, and we acknowledge that our insights may not include the most recent company announcements or qualitative factors. Simply Wall St has no positions in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We’ve created the ultimate portfolio companion for stock investors, and it’s free.

• Connect an unlimited number of portfolios and view your total in a single currency

• Receive alerts for new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com