Identifying opportunities in the market can lead to significant entrepreneurial achievements. The first business to meet a previously unmet consumer need stands to gain substantial profits. However, without a unique advantage, competition will soon infiltrate the market, leading to reduced profit margins that hover just above breakeven.

Identifying opportunities in the market can lead to significant entrepreneurial achievements. The first business to meet a previously unmet consumer need stands to gain substantial profits. However, without a unique advantage, competition will soon infiltrate the market, leading to reduced profit margins that hover just above breakeven.

Finding and fulfilling market needs is undoubtedly a daunting task. Even the most seasoned entrepreneurs have their fair share of failures alongside their successes. Moreover, triumph in one venture does not guarantee success in future initiatives.

Anyone who has taken a product from concept to market understands the challenges of achieving profitability. For every viable idea, there are countless poor ones. The only definitive way to discern a profitable concept from a disastrous one is through trial and error.

Success and failure offer valuable lessons; they serve as indicators for entrepreneurs and investors about what works, what doesn’t, and what modifications may yield better results. These insights are unique to the market itself.

But what happens when the feedback loop is disrupted and a supposed market gap turns out to be an illusion? What if deceit transforms a barren landscape into a mirage of prosperity? In such instances, intelligent investors can be tricked into wasting their resources.

Swindle and Speculation

In his enduring classic, *Manias, Panics, and Crashes*, author Charles Kindleberger dedicates a chapter to the rise of swindles. One of his notable observations is that speculative booms, often driven by lenient credit policies, lay the groundwork for white-collar crime and financial crises. Kindleberger provides valuable insights here…

“Commercial and financial crises are closely tied to transactions that breach legal and ethical boundaries, however vague those boundaries may be. The tendency to deceive and be deceived parallels the urge to speculate during economic booms. Crashes and panics often provoke even more deceit, as individuals attempt to save themselves. The revelation of a swindle, theft, or fraud often serves as a trigger for panic.”

No doubt, tricks and illusions can bring a lighthearted charm to our lives. Think of the fumblerooski or the classic distraction techniques that keep us on our toes.

However, large-scale schemes designed to swindle individuals of their money are no laughing matter. The repercussions can be devastating, and often, victims may never fully recover.

The Great Stock Market Swindle

Recently, a Bloomberg article, highlighted by ZeroHedge, exemplified the unsettling blend of swindle and speculation that Kindleberger described. Here’s an excerpt:

“Label it the quintessential pyramid scheme for the ‘new normal.’

“In a recent instance of the venture capital exuberance characterizing the U.S. in recent years, along with potential fraud, Bloomberg reports that the vegan food startup, Hampton Creek, employed a dubious strategy: buying its own products to inflate their popularity. Specifically:

‘“In late 2014, aspiring entrepreneur Josh Tetrick convinced investors to inject $90 million into his vegan food startup, Hampton Creek Inc. Tetrick captured the attention of leading Silicon Valley venture capital firms by successfully maneuvering his eggless Just Mayo product into major retailers like Walmart, Kroger, and Safeway within just three years of launching his business.

‘“What Tetrick and his team failed to disclose was their large-scale effort to repurchase their own mayo, which created a misleading impression of robust demand. Well before the funding round finalized, Hampton Creek executives discreetly initiated a campaign to buy substantial quantities of Just Mayo from stores, as corroborated by five former employees and over 250 receipts, expense reports, and emails reviewed by Bloomberg….’

“Is that permissible? While technically not illegal, this practice raises profound ethical concerns (imagine the implications if, hypothetically, Facebook were to utilize click-farms to inflate user numbers—it’s a similar principle) and underscores the culture of monetary excess pervading the VC sector, which may inadvertently nurture fraudulent activities. This is notably reminiscent of the Theranos scandal, now echoed by Hampton Creek.”

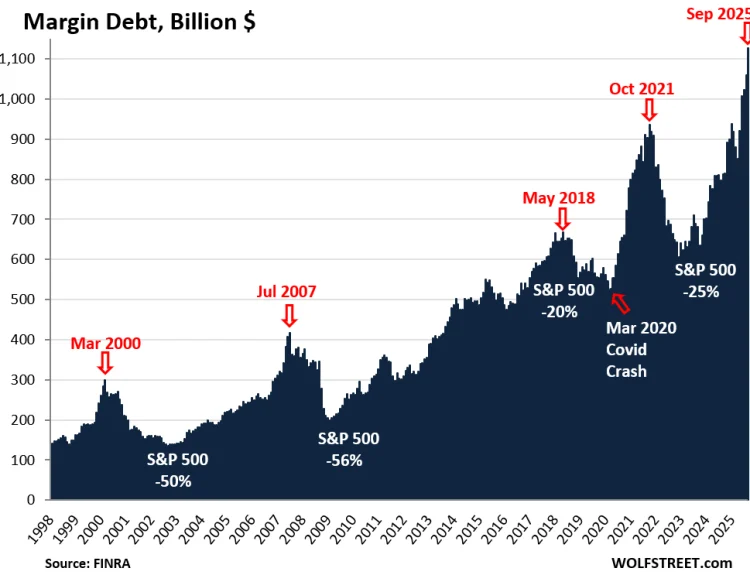

Indeed, one of the defining characteristics of our current era is the prevalence of deception that is often accepted as standard practice. For instance, dividend recapitalization—borrowing funds to pay dividends—was once viewed as a questionable tactic limited to private equity firms. Nowadays, buoyed by the Fed’s historically low interest rates, a range of S&P 500 companies engage in leveraging debt to buy back stock or issue dividends.

This trend could explain why stock prices have soared even in the face of 15 consecutive months of declining earnings. Interpret it as you will. From our perspective, the entire stock market seems to have morphed into a grand deception. Caveat emptor – let the buyer beware.

Sincerely,

MN Gordon

for Economic Prism

Return from The Great Stock Market Swindle to Economic Prism