Yves here. Wolf Richter offers two insightful analyses on the latest inflation data. In his accompanying article, Massive Outlier in Owner’s Equivalent of Rent Pushed Down CPI, Core CPI, Core Services CPI: Something Went Awry at the BLS, he examines discrepancies that led to a reduction in essential inflation indicators. This report focuses on the ongoing challenges associated with food price surges.

By Wolf Richter, editor at Wolf Street. Originally published at Wolf Street

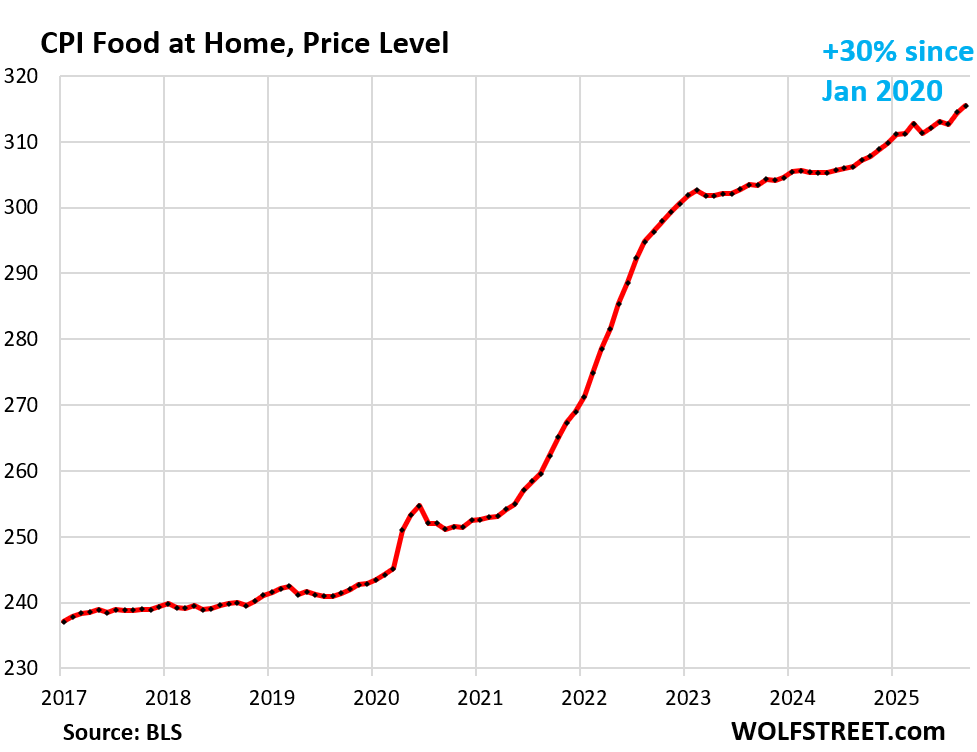

The Consumer Price Index (CPI) for “Food at home” saw an increase of 0.32% in September compared to August, translating to an annualized rate of 4.0%. Year-over-year, the rise stands at 2.7%, marking the highest spike since August 2023. Since January 2020, the CPI for food at home has surged by an impressive 30%.

The “Food at home” CPI encompasses various food and beverage categories purchased for home consumption. Prices for these categories do not always change uniformly. For instance, egg prices have noticeably decreased following their peak due to avian flu, while beef prices have risen significantly. Coffee prices have retreated from their prior highs, and dairy prices have stabilized at elevated levels. Numerous food items contribute to the overall “food at home” CPI.

The accompanying chart illustrates the price trajectory for the CPI food at home: a significant increase from 2021 through 2022, a minor dip in early 2023, followed by a gradual rise that accelerated in mid-2024. Ultimately, food prices have risen by 30% since early 2020.

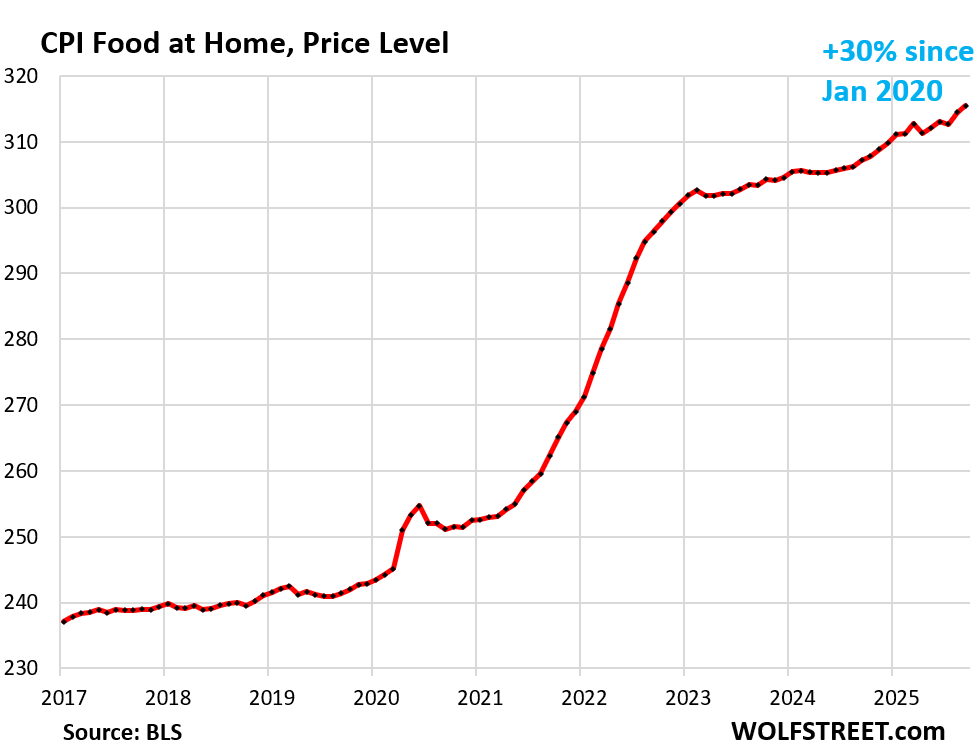

Beef prices have been on the rise for five consecutive years, resulting from a drop in the US cattle herd to a 64-year low for various reasons, leading to a scarce supply. Despite high costs, American demand for beef persists, pushing prices higher. Although consumers frequently express frustrations over elevated beef prices, they continue to purchase it willingly.

In September, overall beef prices increased by 1.2% compared to August, equating to a yearly rise of 14.7%. However, signs indicate that the longstanding surge is beginning to wane.

For example, the average price of ground beef, which skyrocketed by 63% since early 2020, only saw a negligible increase of 0.1% in September. This minor change was so small it could be considered negligible, with the price per pound remaining steady at $6.32.

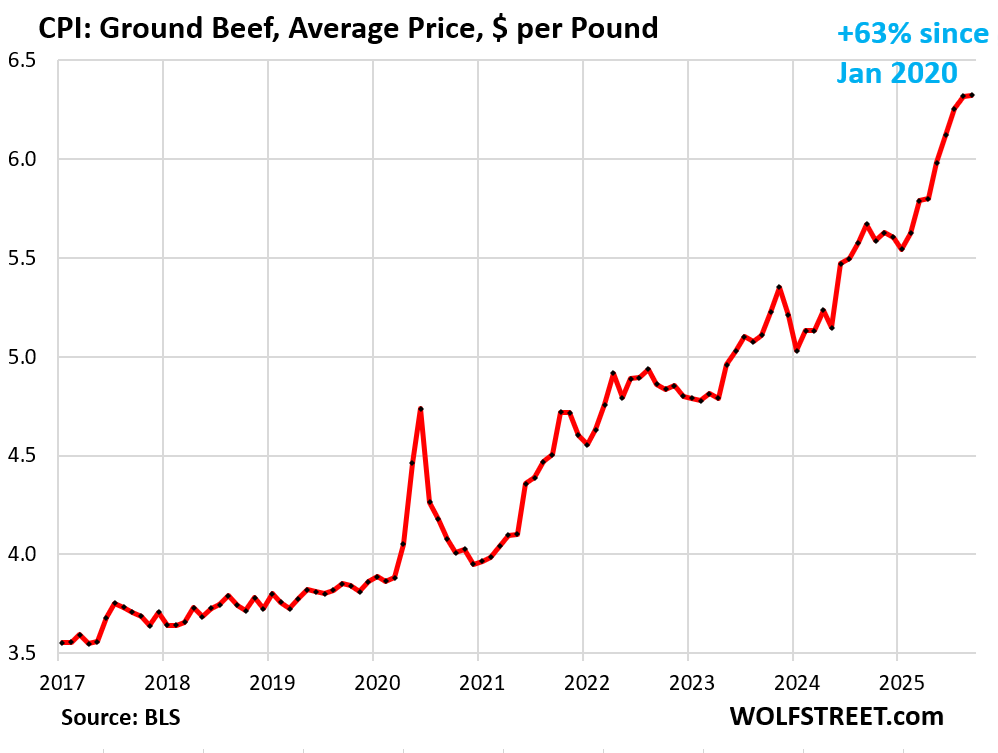

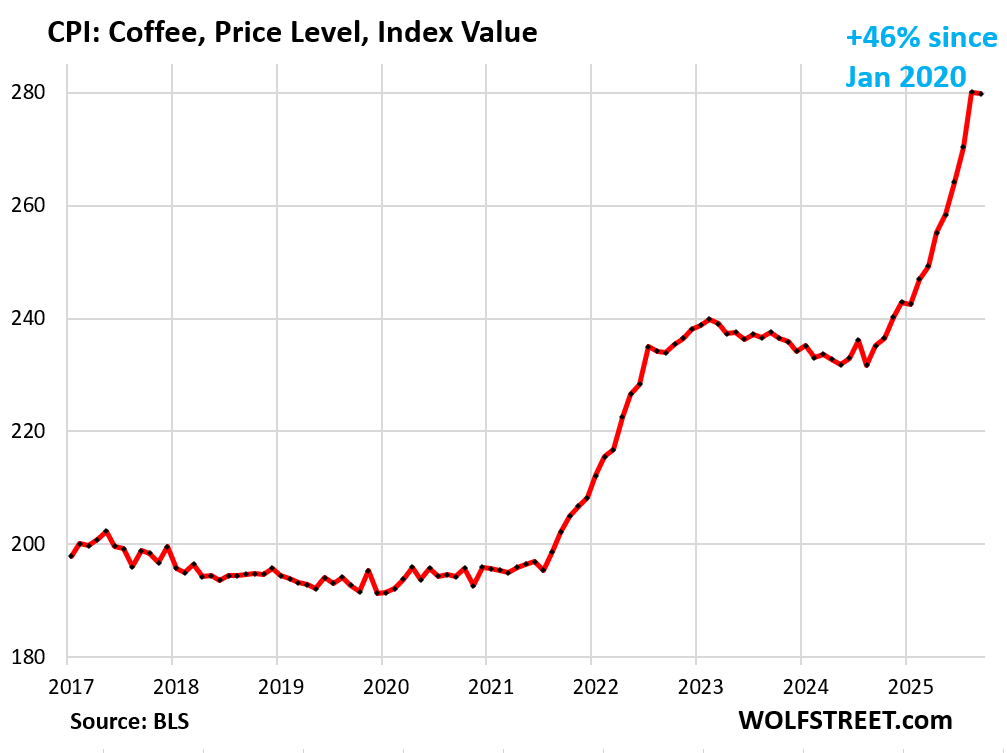

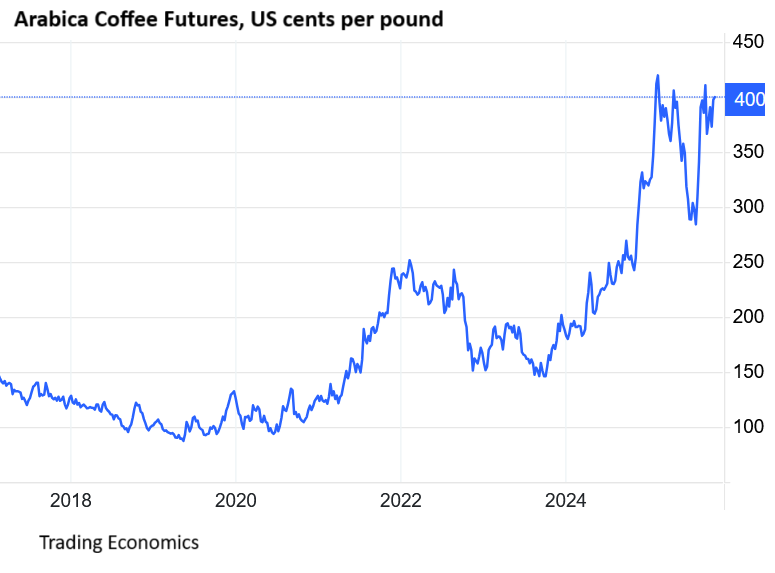

The CPI for roasted coffee—which includes roasted whole beans, ground coffee, and instant coffee—fell by 0.1% in September from August. This decline follows multi-year price hikes that occurred in two phases, roughly aligned with global commodity price trends for green coffee beans:

- +22% from July 2021 to February 2023

- +21% from August 2024 to August 2025.

Since January 2020, the CPI for coffee increased by 46%.

Prices for green coffee beans, as a global commodity, often fluctuate dramatically, influenced by concerns over droughts, poor harvests, and market dynamics, alongside tariffs. For instance, Arabica coffee futures prices—illustrated in the chart via Trading Economics—show:

- +150% from mid-2020 to early 2022, followed by a correction.

- +125% from late 2023 to late 2024.

- In 2025, these prices fluctuated wildly due to tariff announcements, now resting slightly below early February levels.

Such volatile price changes do not fully translate to the retail costs of roasted coffee. While coffee futures skyrocketed by 300% since early 2020, the CPI for roasted coffee sold at retail has risen by only 46% in the same timeframe.

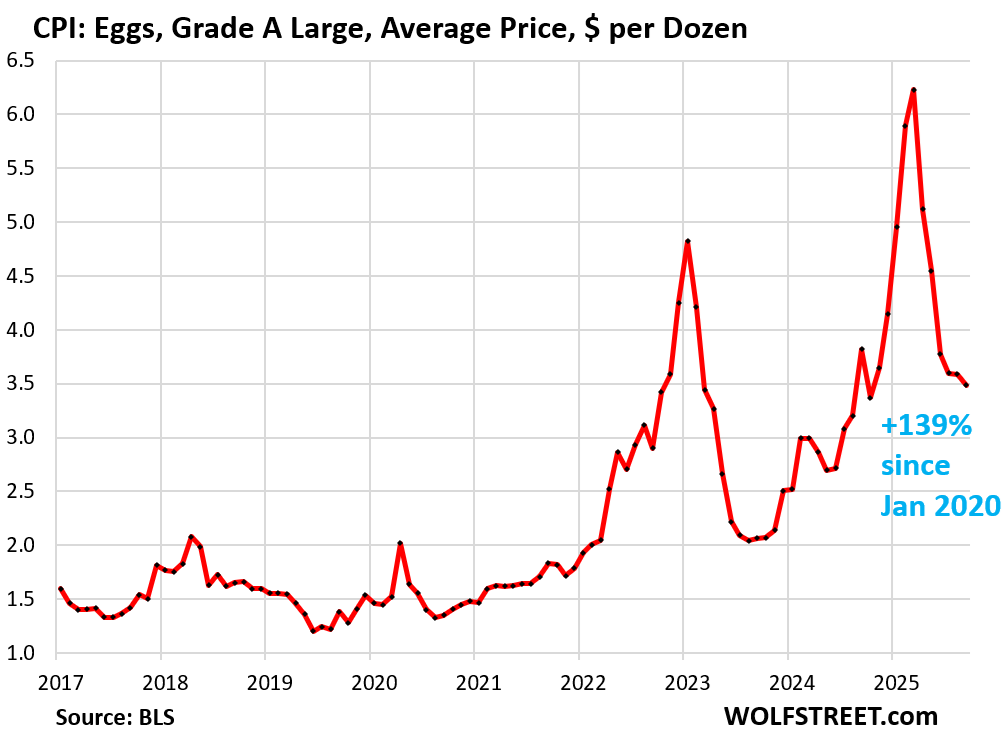

Egg prices have seen a dramatic decrease following their previous peaks yet remain relatively high. Following two waves of avian flu—one in 2022 and another in 2024—supply shortages caused shelves to empty, resulted in purchase restrictions, and triggered massive price surges.

The average price for Grade A Large Eggs skyrocketed by 368%, jumping from $1.33 per dozen in mid-2020 to a peak of $6.23 in March 2025. Although prices have since declined, they remained elevated.

In September, prices fell a further 2.8%, bringing the cost to $3.49 per dozen Grade A large eggs according to the Bureau of Labor Statistics (BLS). They have now dropped by 44% from the March peak yet remain 146% higher than mid-2020 prices.

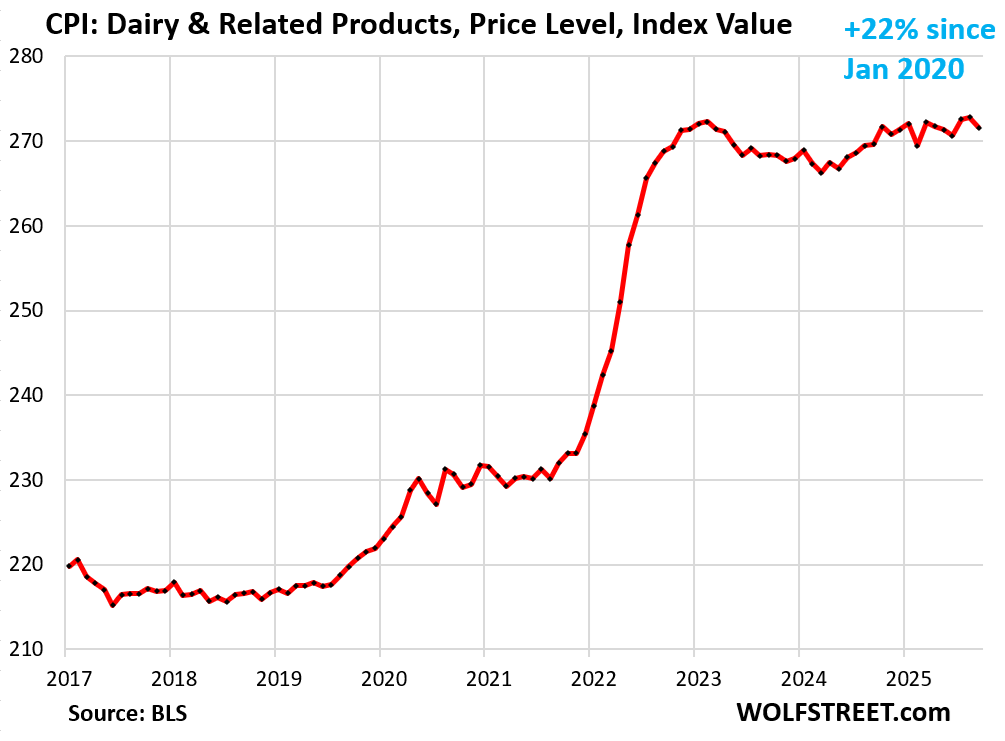

Dairy and related products experienced severe price spikes during the inflationary period between 2020 and 2022, rising by 22%, and have remained at these elevated levels since then.

The CPI for dairy products dipped by 0.5% from August to September, according to the latest BLS data, yet remains 0.7% higher compared to the previous year.

Major Categories of CPI Food at Home

Beef, coffee, eggs, and dairy rank among the most volatile food categories. Other categories have also experienced price surges due to their specific challenges. For example, the prices of baby formula spiked in 2022 and 2023, creating challenges for families with young children that many consumers might have overlooked.

The “Coffee, tea, etc.” category below encompasses tea and “other beverage materials.” The CPI illustrated in the preceding chart pertains specifically to coffee (ground, whole-bean, instant).

The “Beef and veal” category is broader than just the ground beef example provided earlier.

The “Eggs” category includes all varieties of eggs, not merely the Grade A large depicted in the earlier chart.

| MoM | YoY | |

| Food at home | 0.3% | 2.7% |

| Cereals, breads, bakery products | 0.7% | 1.6% |

| Beef and veal | 1.2% | 14.7% |

| Pork | 0.5% | 1.6% |

| Poultry | 0.1% | 1.4% |

| Fish and seafood | -0.3% | 2.1% |

| Eggs | -4.7% | -1.3% |

| Dairy and related products | -0.5% | 0.7% |

| Fresh fruits | -0.5% | -0.2% |

| Fresh vegetables | 0.0% | 2.8% |

| Juices and nonalcoholic drinks | 1.4% | 3.1% |

| Coffee, tea, etc. | -0.1% | 18.9% |

| Fats and oils | 0.3% | -1.7% |

| Baby food & formula | 1.3% | 0.6% |

| Alcoholic beverages at home | 0.0% | 0.3% |

Escalating and erratic food prices, along with persistently high rates following significant spikes, create significant hardships for less affluent consumers, compelling them to make numerous compromises in their food purchases. The issue of food prices warrants serious attention.

In summary, the ongoing inflation in food prices, particularly for staples like beef, coffee, eggs, and dairy, impacts household budgets substantially. As demand remains high while supply struggles to keep pace, these conditions are likely to influence consumer behavior and choices for the foreseeable future.