Forex Today: Market Focus on Fed and BoC Rate Decisions

In the world of Forex trading, today’s market movements are predominantly influenced by the upcoming rate decisions from the Federal Reserve (Fed) and the Bank of Canada (BoC). Additionally, gold prices have surged past the $5,200 mark, reflecting investor sentiments and market trends.

Current Market Overview

The Forex market is experiencing heightened volatility as traders prepare for significant decisions from the Fed and BoC. Both central banks are expected to provide updates that could significantly impact currency valuations.

Federal Reserve’s Stance

The Fed’s meeting today will be pivotal, with investors keenly awaiting any hints about future interest rate adjustments. Experts suggest that a cautious approach may continue as the Fed balances economic growth with inflation concerns.

Bank of Canada Insights

Similarly, the BoC is also facing pressure to assess its monetary policy. With recent economic data showing mixed signals, analysts are predicting a more measured approach from Canadian policymakers, focusing on both growth and inflation metrics.

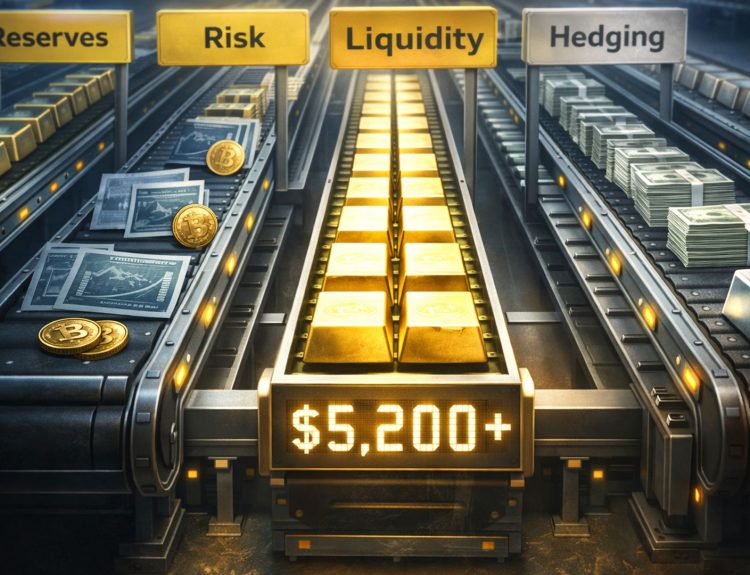

Gold Market Dynamics

Gold has seen a remarkable climb, surpassing the $5,200 threshold. This rise can be attributed to a combination of factors, including geopolitical tensions and shifts in investor sentiment towards safe-haven assets.

Investor Behavior

As uncertainty looms over global markets, many investors are opting for gold as a reliable store of value, pushing prices higher. This trend reflects broader concerns regarding economic stability and inflationary pressures.

Conclusion

In summary, as we navigate through today’s trading sessions, the focus remains on the Fed and BoC rate decisions, while the gold market continues its upward trajectory. Traders should stay alert for any announcements that may influence market directions.