The discussion around housing affordability has recently been reignited by a proposal for 50-year mortgages, notably associated with former President Trump. While many have shared their reservations about this idea, it’s essential to delve deeper into its implications and raise additional concerns that have yet to be fully explored.

Concerns About Long-Term Mortgages

First and foremost, the concept of a 50-year mortgage signals a lack of seriousness in tackling the pressing issue of housing affordability. This suggests that influential stakeholders in the housing market, who benefit from rising prices, are hesitant to adopt effective solutions. A fundamental approach would be to increase the availability of affordable housing in high-cost areas. However, this often clashes with NIMBYism, as affluent homeowners resist proposals that would bring lower-income individuals into their neighborhoods, fearing it might affect their property values.

Interestingly, the idea of prolonged mortgage terms isn’t new; it draws parallels to Japan’s economic bubble in the 1980s. During that time, I visited a modest 900-square-foot apartment in Tokyo, owned by a senior executive at a major bank, priced at a staggering $5 million in 1989 (approximately $13.4 million today). This illustrates the extreme levels of housing market distortion that can arise during speculative bubbles.

A historical reference to Japan’s 50-year mortgage system reveals that as their economic bubble expanded, lenders relaxed credit standards, leading to unprecedented financing terms, such as 100-year mortgages intended for multiple generations.

Alternative Solutions for Affordable Housing

One viable strategy could involve reinstating the legality of single-resident occupancy apartments, which previously offered affordable options for individuals at risk of homelessness. Restrictions on shared bathrooms have unjustly eliminated these housing opportunities, despite their acceptance in environments like dormitories and military facilities.

Many analysts assert that extending mortgage terms merely prolongs the burden on borrowers, often resulting in more interest paid over the life of the loan. This proposal essentially aids the financial sector at the expense of ordinary citizens. The popular 30-year fixed-rate mortgage might seem advantageous, but it’s actually a rare product worldwide, with its design shifting interest rate risk primarily onto lenders. When rates decrease, borrowers typically refinance, disadvantaging lenders who have taken on long-term risks.

However, the refinancing option is not as beneficial for borrowers as it appears. The reality is that the costs associated with refinancing often result in a significant portion of savings going to lenders rather than homeowners. Additionally, this setup increases systemic risk within the housing market, with mortgage guarantors like Freddie Mac and Fannie Mae hedging against these risks in a manner that can exacerbate economic fluctuations.

The Systemic Risks of Long-Term Mortgages

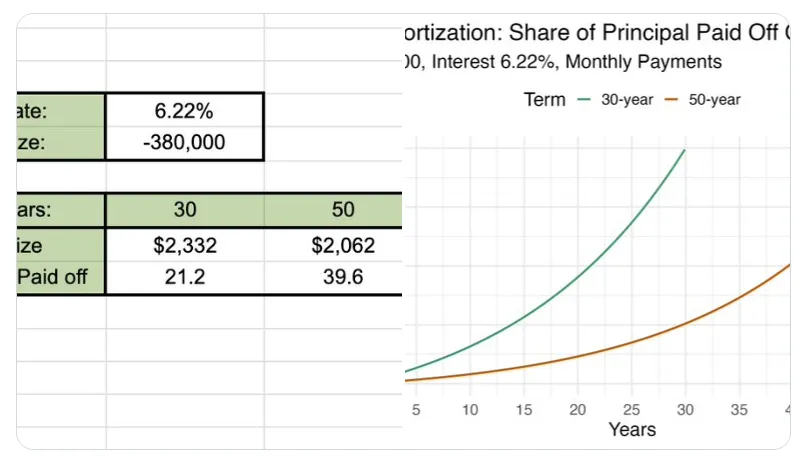

Introducing 50-year mortgages would likely amplify these existing issues. Such a term would shift an even larger share of payments toward interest, leading to higher total interest costs. This amplification can stimulate more pro-cyclical hedging, escalating the risk to the overall economy. The concerns raised by experts and commentators about this mortgage plan are significant and cannot be ignored. For instance, Michael Shedlock has pointed out that a borrower could find themselves paying exorbitant amounts in interest on a seemingly accessible mortgage.

The sentiment on social media has been equally skeptical, with users emphasizing that homeowners often do not stay long enough to see the end of a 50-year term and highlighting the economic injustices it may perpetuate.

Critiques and Real-World Implications

- 50-year mortgages do not address down payment issues, which are significant barriers for many buyers.

- Declining home prices leave many homeowners at risk of negative equity, possibly trapping them in their homes.

- The proposal stifles the much-needed decline in prices, as it may inadvertently sustain higher property values.

- Longer mortgage terms could mean borrowers are managing payments well into their retirement years, blurring the line between owning and renting.

- With 50-year rates likely to be higher than standard rates, any perceived savings could be negligible.

- Many individuals already struggle with understanding property taxes, maintenance, and related costs, exacerbating financial vulnerabilities.

Long-Term Financial Consequences

After just 12 years on a 50-year mortgage, borrowers may find they have repaid remarkably little of the principal balance.

Consider a comparison for a $400,000 loan at a 6% fixed rate over various terms:

Final Thoughts

In conclusion, while the 50-year mortgage may appear to be a solution for making homeownership more attainable, it raises a plethora of financial and economic concerns. As it stands, this proposal seems unlikely to deliver on its promises without exacerbating existing issues within our housing market. It is crucial that we instead explore comprehensive strategies aimed at genuinely addressing the root causes of housing affordability, rather than resorting to flawed and potentially harmful financial products.