In recent years, there has been an increasing focus on the relationship between private debt and artificial intelligence (AI) datacenter activities. Companies like Meta, despite their capacity to borrow independently, are opting to pay an additional 200-300 basis points for financing through private debt. This choice raises concerns among financial analysts about the stability of the market. A recent article by the Wall Street Journal delves into this trend, shedding light on the rapid increase in borrowing as firms invest in AI infrastructure.

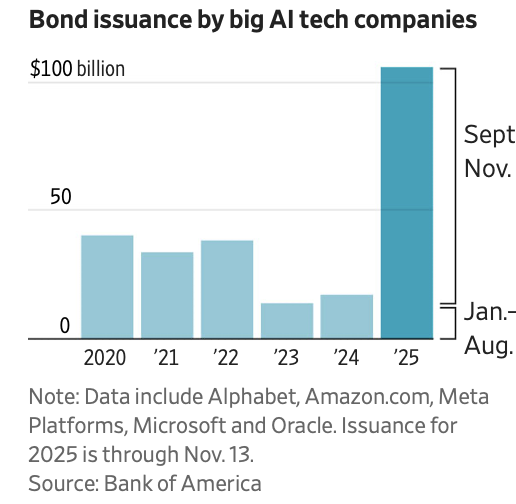

Big Tech borrowing for AI data centers:

2015-2024 average: $32B/year

Sept-Oct 2025 alone: $75B> Meta borrowed $30B

> Oracle borrowed $18B

> $META also did $27B off-balance sheet with Blue OwlAI companies now 14% of IG index

The “money-printing” tech companies are…… pic.twitter.com/IuhBU0LS4M

— junkbondinvestor (@junkbondinvest) November 5, 2025

The Journal describes the current frenzy surrounding AI investments in terms reminiscent of previous economic bubbles, such as the subprime lending crisis. During that time, lenders were motivated by desperation, approving loans for almost anyone. In hindsight, this created a precarious “wall of liquidity” due to excessive leverage. As we strive to assess the ramifications of today’s borrowing trends, it’s crucial to remember that lack of evidence regarding an impending financial crisis doesn’t equate to certainty about its absence.

Historically, there hasn’t been a significant equity bubble—without heavy borrowing akin to that leading up to the 1929 crash—accompanied by the variety of alarming indicators now evident, particularly regarding financial leverage and operational vulnerabilities. This is especially true within intricate arrangements among leading tech firms. Such opaque borrowing strategies are raising alarm bells, as companies pay a premium for financing structures that obscure traditional risk indicators.

To illustrate some concerns about the data center boom, here are a few points derived from the executive summary of “Bubble or Nothing” by the Center for Public Enterprise (hat tip Matt Stoller):

● Cash flow uncertainty continues as AI inference service costs rise. AI service providers are largely similar, resulting in reduced pricing power, which hampers their ability to offset escalating expenses.

● The value of GPUs, essential to the sector, may decline in the near future. The fluctuating demand and the fast-paced release of new GPU technologies create uncertainty about their worth.

● Data center tenants face cyclical capital expenditures, introducing tenant churn risks for developers. This mismatch creates potential credit risks for developers without commitments from leading tech firms.

● Circular financing among hyperscaler tenants generates an interconnected liability web in the industry. These companies finance one another’s expansions, increasing risks for lenders.

● Debt is becoming a more significant factor in financing data centers. While this is common in project finance, the opacity of some recent deals raises questions about the long-term stability of these arrangements.

The rising costs of AI inference and the anticipated decline in GPU values could jeopardize debt funding in the sector. Despite these concerns, the Journal highlights the eagerness of lenders willing to finance AI growth, often dismissing potential risks. They report instances where stock prices fell after announcements of increased capital expenditures, underscoring investors’ apprehensions about profitability in the AI space.

The current situation is indicative of the late-stage subprime lending climate. Lenders appear hesitant to yield ground, driven by apprehensions about being sidelined in a lucrative market:

Silicon Valley’s largest players are well-capitalized and funded the initial AI developments largely on their own. Yet, as investments trend upward, they are increasingly relying on debt, spreading risks across the economy. Some financing is derived from standard corporate bond sales, while larger fees are generated from substantial private deals, enticing many Wall Street players to take part.

While tech giants are expected to invest approximately $3 trillion in AI through 2028, forecasts indicate they may only generate enough revenue to cover half of that. Notably, prominent figures like Goldman Sachs CEO David Solomon are voicing concerns about a potential overinflated market driven by AI.

Funds investing in AI claim little risk since financially robust tech companies maintain solid leases that ensure repayment. However, the landscape is reminiscent of the past when trusted corporations saw their credibility wane.

As the Journal notes, some tech companies face significant financial vulnerabilities. For instance, Oracle’s stock has suffered steep declines, prompting concerns from rating agencies. Meanwhile, the specific tech chips being financed today could soon become outdated.

The rapid expansion of data centers holds profound implications for the economy. As some industries lean heavily on AI growth, there’s a risk of creating a one-dimensional economic structure reliant on technology. In essence, the current AI movement resembles a gamble where external influences may reshape outcomes drastically.

In conclusion, the financial dynamics surrounding AI datacenters pose significant challenges. The prevailing reliance on debt and interlinked financial strategies, combined with pressuring market conditions, creates a precarious environment where the potential for sharp reversals looms large. Stakeholders must tread cautiously in their quest for profitable avenues amidst a rapidly evolving landscape.