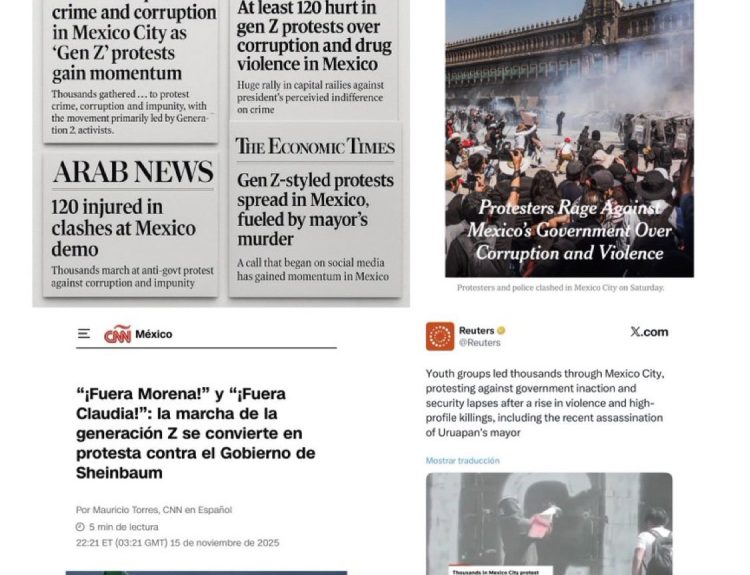

This week, while exploring the Federal Reserve’s balance sheet data, we encountered an intriguing note. It’s unclear how long this note has been on the Federal Reserve’s website, but it certainly caught our attention:

This week, while exploring the Federal Reserve’s balance sheet data, we encountered an intriguing note. It’s unclear how long this note has been on the Federal Reserve’s website, but it certainly caught our attention:

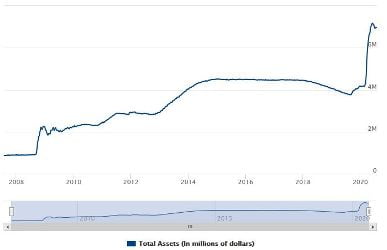

“The Federal Reserve’s balance sheet has expanded and contracted over time. During the 2007-08 financial crisis and subsequent recession, total assets increased significantly from $870 billion in August 2007 to $4.5 trillion in early 2015. Then, reflecting the FOMC’s balance sheet normalization program that took place between October 2017 and August 2019, total assets declined to under $3.8 trillion. Beginning in September 2019, total assets started to increase.”

Just below this note is the following chart:

Does this look like a balance sheet that truly expands and contracts over time?

To be blunt, the Federal Reserve’s balance sheet chart, along with the significant dollar debasement it represents, is utterly disgraceful. The necessity of including this misleading note as a preface to an unimpressive chart is an affront.

This serves as a direct insult to anyone who has worked hard to build even a modest savings account. The effort and time sacrificed to accumulate these dollars are being undermined by the insidious inflation orchestrated by the central bank. Year after year, the value of these earned dollars diminishes.

Additionally, the notion of normalization is a fabrication. It never truly happened. While it is true that $700 billion was trimmed from the Fed’s balance sheet between October 2017 and August 2019, this followed a whopping $3.5 trillion expansion. It was swiftly succeeded by another $3 trillion increase in the balance sheet just this spring.

The Fed’s primary objective has never been to decrease its balance sheet; rather, it has sought to ensure that the Treasury and major banks remain well-funded.

Money Printer Goes BRRR

A secondary outcome of this balance sheet expansion is a thriving stock market. This phenomenon serves, much like the Presidential election, as a distraction.

The real critical issue at hand, which will significantly impact your life, has little to do with the stock market or the upcoming presidential contenders. Instead, it revolves around the Fed’s attempts to suspend the natural credit cycle.

We are referring to interest rates. If you haven’t noticed, they’ve been on a downward trajectory recently—quite significantly. For instance, the yield on the 10-Year Treasury note fell to nearly 0.5 percent earlier this week.

Modern Treasury rate data has been meticulously recorded since 1871, and this past week marked the lowest yield for the 10-Year Treasury in 149 years. What is contributing to this unprecedented situation?

Reaching this remarkable milestone involved decades of deception, propaganda, and unyielding intervention by central planners. A substantial portion of the Fed’s balance sheet assets, as depicted in the aforementioned chart, are U.S. Treasuries.

The Fed enlarges its balance sheet through digital ledger entries, utilizing these funds to acquire Treasuries. This process is known as monetizing the debt—a form of printing money that can be summarized with the phrase money printer goes BRRR. The government subsequently spends this fictitious money through contracts, programs, stimulus measures like the CARES Act, and whatever other spending bills Congress enacts.

The steep rise observed on the right side of the chart for 2020 corresponds to Treasury notes purchased with this fabricated brrr money to finance the CARES Act. This concerted effort by the Fed and the U.S. Treasury is what makes the current national debt of $26.6 trillion feasible.

The Dollar Is Dying

This fake brrr money operates just like Federal Reserve Notes (the dollars we earn through legitimate labor). However, as this counterfeit money circulates, the wealth of savers—including your wealth—is eroded. The value of the dollar continues to decline.

One of life’s unacknowledged joys is witnessing the spectacular collapse of a flawed and unjust system. However, it is regrettable that such a situation adversely affects so many decent individuals.

We are witnessing the destruction of the dollar in real time. This erosion has persisted for 107 years since the Federal Reserve Act was enacted in 1913, and it has intensified since President Richard Nixon severed the gold standard in 1971.

Yet, as the Fed and U.S. Treasury attempt to mask the economic fallout from government lockdown orders by running a $4 trillion budget deficit, a notable shift is occurring. The dollar is indeed on a path to demise, yet those in Congress remain oblivious.

The art of exploitation and the escalating corruption of public officials are vividly apparent in the forthcoming stimulus bill being deliberated in Congress. The overarching notion is that the legitimate needs of ordinary citizens, such as housing and essential expenses, may be met through this fake brrr money. Simultaneously, unnecessary projects like a new FBI building are appended to the bill. All the while, the ongoing increase in the money supply grows ever more alarming.

Such forceful and persistent attempts to substitute the fundamental laws of finance with legislative desires are bound to fail. We are speeding toward absolute financial, moral, and political collapse. The rush to abandon dollars is gaining significant traction…

NASDAQ: 11,000. Nvidia: 453. Tesla: 1,500. Shopify: 1,000. Apple: 450. Amazon: 3,200. Microsoft: 215. S&P 500: 3,350. And many more…

There’s also: Gold: $2,000. Silver: $28. Bitcoin: $12,000.

Select your method for escaping the dollar wisely.

Sincerely,

MN Gordon

for Economic Prism