The ongoing conflict in Ukraine, particularly in light of Russia’s relentless attacks on its power infrastructure, raises serious concerns about the future. Without a successful negotiation strategy from the US and its European allies, it seems inevitable that the war will continue until a decisive military conclusion is reached. In the past month alone, Russian airstrikes have severely impacted Ukrainian natural gas production, leading to widespread electricity outages and a pressing need for alternative energy sources.

In response to these challenges, there are some hopeful developments. Bloomberg recently reported that “Greece To Supply Ukraine With US Natural Gas For Winter,” offering a glimmer of optimism amidst the dark backdrop of the conflict.

From the very first days of Russia’s full-scale invasion, Greece has been helping us, working together with Europe and with other partners so that we can reach the conditions under which peace becomes possible. And we truly value your support and your commitment…

— Volodymyr Zelenskyy / Володимир Зеленський (@ZelenskyyUa) November 16, 2025

According to Bloomberg:

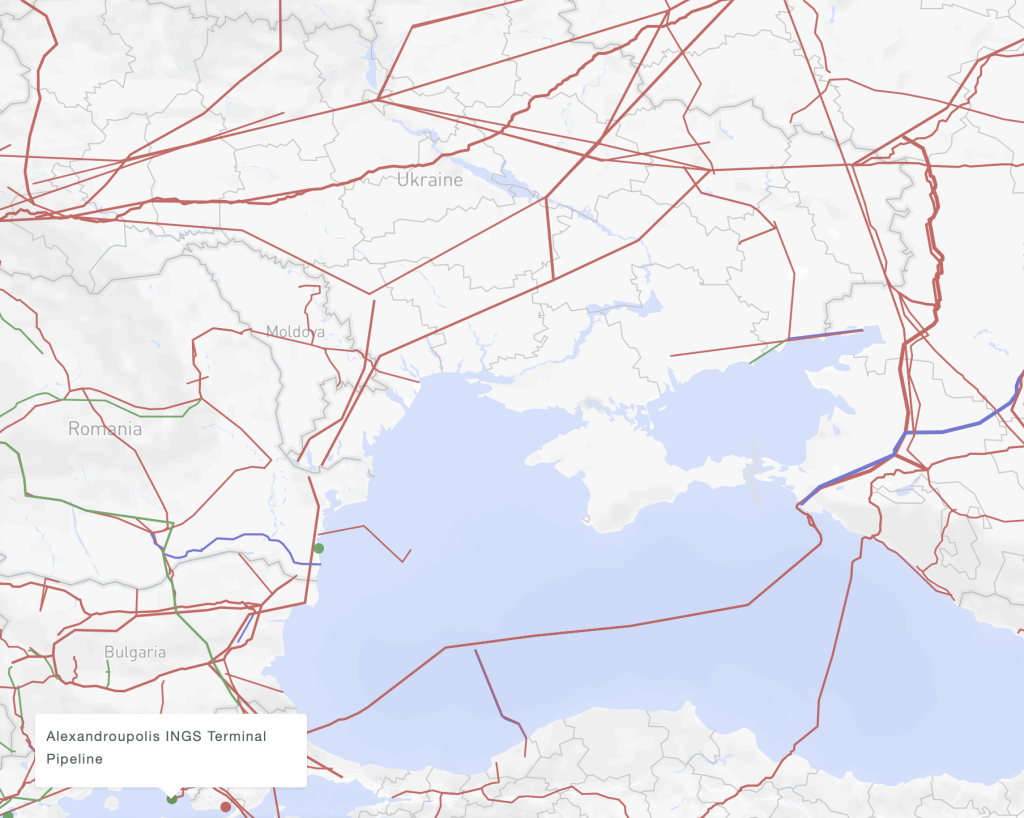

Under the framework of the prospective agreement between DEPA and Naftogaz, LNG originating from the US is expected to be transported through “Route 1,” jointly managed by the gas transmission system operators of Greece, Bulgaria, Romania, Moldova, and Ukraine.

This means US LNG will travel from the Gulf Coast to a floating storage regasification unit in Alexandroupoli, be regasified, and subsequently flow through the pipeline networks to Ukraine.

The prospect of a stable energy supply has generated celebratory sentiments regarding Europe’s overall energy strategy:

Over the past few days, Europe’s energy landscape is coming together like puzzle pieces.

The starting point is Greece’s long-term US LNG deal with Venture Global — Greece, already the Eastern Med LNG hub, now secures stable US volumes to dominate supply to Southern Europe…

— Gulf2Med (@Ethan_0502) November 16, 2025

🇷🇺🇹🇷🇬🇷🇺🇦🇺🇸 Russia’s MFA spokesperson Maria Zakharova just issued a sharp warning to Greece (Nov 20, 2025), accusing Athens of “openly hostile acts” and promising “appropriate response measures.”

— Avi Avidan (@avavidan) November 21, 2025

However, skepticism about the feasibility of this plan is warranted:

Flaws in the Plan

The notion that Greece’s use of US LNG will guarantee warmth and light in Ukraine this winter is fraught with difficulties. Firstly, it ignores the reality that Russia can still target and damage Ukraine’s energy infrastructure unless some undisclosed agreement prevents attacks on US LNG shipments.

Secondly, let’s examine the numbers. According to Athens, 81% of Greece’s LNG imports in the first half of 2025 came from the US, reflecting a significant increase from the same period in 2024. This seems promising, but the total volume of these imports was approximately 1.5 billion cubic meters (bcm). In contrast, Greece’s overall gas consumption in 2024 was about 6.6 bcm.

While Bloomberg and others suggest that Ukraine will benefit from this agreement, it is reported that the actual capacity for Greece’s deal is only about 0.16 bcm for the winter months, which translates to minimal financial gains for DEPA, Greece’s state-owned gas company.

While it is true that Greece recently signed a deal for a long-term supply from Venture Global, this arrangement will not commence until 2030, leaving immediate energy needs unaddressed.

There is an underlying motive to support US LNG exporters rather than a focused effort to assist Ukraine. These agreements actually aim at limiting Türkiye’s reliance on Russian gas and supporting a grander vision of energy flowing west from Central Asia and the Caspian region without Iranian or Russian involvement.

This is particularly pertinent in light of Türkiye’s NATO membership and its continued import of Russian gas through the TurkStream pipeline, now the only significant route for Russian gas into Europe after other transit agreements expired.

Ironically, Europe’s plan could backfire, as closing off TurkStream would negatively impact Greece and other countries in southeastern Europe that currently rely on this pipeline for gas supplies.

In 2024, Greece sourced a substantial portion of its gas through the Sidirokastro Entry Point, where Russian gas rebranded as Turkish entered the market. Consequently, American LNG imports must increase significantly, or else Greece will struggle to power itself and aid Ukraine.

Additionally, Turkey’s gas imports are critical not only for its market but also for supplying Balkan countries like Serbia and Hungary, illustrating the regional impact of any disruption in gas flows.

The Future Challenges of European Energy

There has been speculation about alternative energy projects, like the proposed EastMed pipeline that would transport gas from the Eastern Mediterranean to Europe. However, past resistance from Washington complicates this possibility.

“Frankly, we don’t have 10 years… so we’re looking for options that can get us more gas, more oil for this short transition period,” stated former Undersecretary of State Victoria Nuland.

As Europe increasingly relies on more expensive LNG imports from the US—despite their environmental ramifications—the challenge of decreasing dependence on Russian gas while securing energy needs becomes ever more complex.

This is compounded by Azerbaijan’s inability to meet increased demand for gas supply to Europe, further complicated by geopolitical tensions with Russia. The dream of projects like the Trans-Caspian Pipeline remains just that—a dream, hampered by geopolitical realities.

Ultimately, the feasibility of US LNG compensating for TurkStream’s contribution seems highly improbable, as increasing volumes face logistical and economic challenges. The European energy landscape is fragile, and the recent agreements may only delay the inevitable struggles ahead.

In conclusion, while the prospect of US LNG support creates a sense of hope for Ukraine and Greece, the underlying complexities and geopolitical realities make it evident that these plans might not deliver the promised energy security. The journey ahead is fraught with challenges that require careful navigation to ensure a stable energy future.