It seems clear that Fed Chair Jay Powell and Treasury Secretary Janet Yellen should have been more cautious. Throughout 2021, they confidently asserted that the inflation in consumer prices was ‘transitory.’ As the primary figures responsible for this escalating inflation issue, one can only wonder about their misjudgment.

It seems clear that Fed Chair Jay Powell and Treasury Secretary Janet Yellen should have been more cautious. Throughout 2021, they confidently asserted that the inflation in consumer prices was ‘transitory.’ As the primary figures responsible for this escalating inflation issue, one can only wonder about their misjudgment.

As it stands, rampant consumer price inflation has become a lasting concern, and this topic will undoubtedly dominate discussions in 2022. Furthermore, the Federal Reserve’s attempts to manage and control it will likely result in comedic failure.

The central planners and bankers operate under the illusion that they are in full control—a mindset aptly captured in Omar Khayyam’s words, “remould it nearer to the heart’s desire.” However, the harsh truth is that central bankers are often merely reactive, attempting to clean up the chaos that they themselves have created.

The inception of the quantitative easing (QE) strategy by former Fed Chair Ben Bernanke in late November 2008 marked the beginning of a monumental shift. The Fed’s balance sheet was around $800 billion at the time, but today, over 13 years later, it exceeds a staggering $8.7 trillion—more than ten times its original size.

This reckless approach illustrates that once the QE genie is out of the bottle, it cannot be contained without precipitating calamity. The economy and financial markets have adapted to a climate of cheap credit, with businesses and individuals reliant on it. Removing it would lead to the collapse of the entire debt structure.

Furthermore, the consequences of QE highlight that its effects are contingent on the channels through which this artificial money is distributed. This crucial distinction is why the Fed’s efforts to rein in consumer price inflation are destined to fail. Let’s explore this further.

Where the Fake Money Flows

Initially, when the Fed started generating credit to purchase Treasury notes and mortgage-backed securities, critics were alarmed. Many forecasted a hyperinflation scenario akin to that of Weimar Germany.

But can one logically expect price inflation to follow money supply growth?

Sure, it makes sense. However, the nature of the price inflation is the critical question.

During the period from 2008 to 2015, the Fed’s balance sheet grew from $800 billion to about $4.5 trillion. During this time, college tuition and healthcare costs soared. Yet, to the joy of economists like Paul Krugman, most consumer goods and services saw only moderate price increases.

Perhaps the availability of low-cost labor from Asia contributed to keeping consumer prices in check. Still, we argue that the subdued consumer price inflation of that era was fundamentally linked to the allocation of the new money.

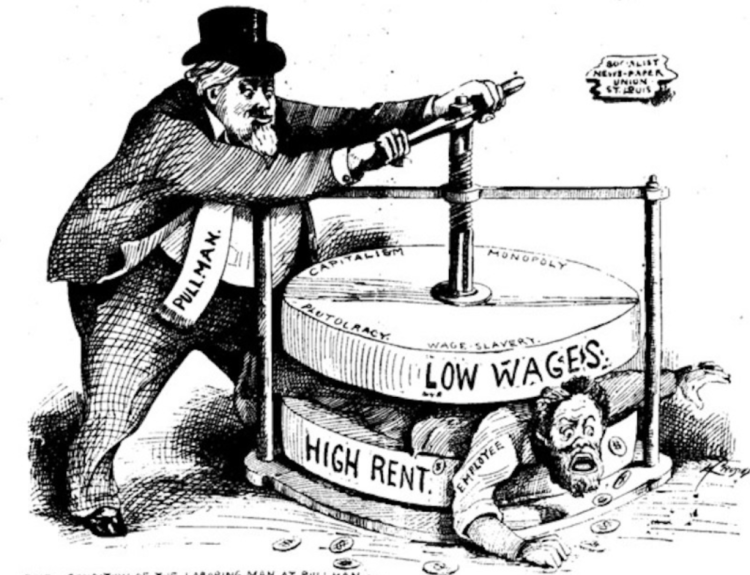

The QE measures and the TARP bailouts initiated in late 2008 effectively served to rescue Wall Street and major corporations, such as General Motors via AIG. Meanwhile, the average worker was left with nothing—losing jobs and homes, with little to no stimulus support.

In short, the inflation of the money supply from 2008 to 2015 predominantly benefited financial assets. Stock and real estate prices surged, with speculative activities flourishing along with companies utilizing cheap loans for stock buybacks.

Throughout this period, the average consumer struggled financially. Those fortunate enough to maintain their homes found some respite through refinancing at lower interest rates, but this barely covered their modest outings for lunch. The multitude of economical imports at stores like Costco and Walmart outpaced any gains in household finances.

From 2015 until late 2019, the Fed attempted to shrink its balance sheet. However, after reducing it by around $700 billion to about $3.8 trillion, chaos ensued. In September 2019, overnight money market rates soared, forcing the Fed to intervene in the repo market.

This turmoil in the repo market would soon be overshadowed by the extensive money printing necessitated by COVID-19 lockdowns. More than $5 trillion was created merely to purchase Treasury notes and mortgage-backed securities, but **this time was fundamentally different**…

This Time It’s Different

The 2008-09 Wall Street bailout opened many individuals’ eyes to the possibilities of financial policy. As the Fed shifted into full bailout mode for businesses in 2020, the public began to ask, where was their bailout? Where was the QE for the people?

Moreover, the public had a moral argument to make. With many losing their jobs due to state-sanctioned economic destruction in response to the pandemic, it seemed only fair that they too should receive help.

The CARES Act, which provided a $1,200 stimulus check along with an extra $600 weekly payment for the unemployed, offered many individuals their first experience with “free money.” They liked it. And they wanted more of it.

A $1,200 check was appealing, but how much better would a $2,000 monthly payment be? Why stop there?

When money is “free,” it feels limitless, doesn’t it?

Consequently, additional stimulus checks arrived with ease, leading many to discover that they could achieve a more comfortable lifestyle without working.

But if everyone is at home watching Netflix or capitalizing on cryptocurrency trading in the metaverse, who is left to prepare pizzas or milk cows? And at what cost?

In fiscal years 2020 and 2021, the federal government recorded deficits of $3.13 trillion and $2.77 trillion, respectively. That’s nearly $6 trillion of artificial money—generated via the Fed’s acquisition of Treasury notes with created credit—introduced into the economy within a mere 24 months.

At the beginning of 2021, the consumer price index (CPI) indicated a 1.4 percent year-over-year inflation rate. By November 2021, however, the CPI had risen to an annualized rate of 6.8 percent, marking the highest inflation in over four decades. If calculated in line with the methods used in the 1980s, the inflation rate would surpass 15 percent.

So, what does this signify?

This week, the minutes from the Fed’s December meeting were disclosed, revealing that committee members are beginning to express worries about inflation. The Fed may soon start reducing its balance sheet and increasing the federal funds rate this year, causing stocks to decline and Treasury yields to rise.

If the Fed pursues these tightening strategies, one can expect asset prices to decrease; however, what about consumer prices?

Not likely. And this is where it becomes different.

Unlike the QE measures from 2008 to 2015, the QE initiatives from 2019 onward were coupled with significant social spending. This was beyond just a bailout for Wall Street.

The $6 trillion of deficit spending represents fake money injected directly into the economy. Higher interest rates and bond sell-offs will not effectively absorb this money, at least not in the same manner as they do for inflation in financial assets.

As asset prices decrease in 2022, an unforeseen outcome may emerge: consumer prices will continue to rise.

The Fed will be left utterly perplexed by this unforeseen circumstance. So, what then?

Will Congress take action to cut deficit spending? Will the Fed raise rates to a level that induces a recession? Could we potentially see hyperinflation similar to that of Weimar Germany emerge in America?

Answers may be forthcoming.

[Editor’s note: Navigating these challenges in 2022 will be crucial for investors. After years of research, we’ve devised the Geometric Wealth Building Program specifically for scenarios like this. If you’re not familiar with Geometric Wealth Building, that’s okay; most folks aren’t. Learn all about it here! Start today!]

Sincerely,

MN Gordon

for Economic Prism