The late 1970s marked an extraordinary time in economic history, where inflation and unemployment soared simultaneously, leaving economists perplexed. This phenomenon was at odds with the principles they had long relied upon.

The late 1970s marked an extraordinary time in economic history, where inflation and unemployment soared simultaneously, leaving economists perplexed. This phenomenon was at odds with the principles they had long relied upon.

The Phillips curve proposed a simple inverse relationship between inflation and unemployment: as one decreases, the other would inevitably increase. Originally illustrated by Economist William Phillips with UK wage and unemployment data from 1861 to 1957, this elegant curve offered a model for policymakers looking to stabilize economic conditions through intervention.

Yet, in the late-1970s, both inflation and unemployment rose in tandem, a scenario the Phillips curve did not predict. This contradiction highlighted the limitations of the model, revealing it as an example of “elegant nonsense”—one that was only accurate until it was not.

Faced with rising unemployment in the 1970s, the U.S. Treasury, supported by the Federal Reserve, took Keynesian advice and launched into deficit spending to stimulate the economy and create jobs. Adhering to the Phillips curve, they believed they could print money without triggering inflation.

However, contrary to their expectations, they encountered rampant inflation instead of job creation. Subsequent attempts to rectify the situation led to even higher inflation without the promised increase in employment.

Echoes of the Past

The events of the 1970s served as a vivid reminder of the unpredictability of economic behavior. In one decade, consumers may choose to borrow and spend, while in the next, they may favor saving and debt reduction. No graphical model can adequately capture such volatility in human behavior.

Furthermore, any economic data prior to 1971 lost relevance once the gold standard was abandoned, complicating the relationship between inflation and unemployment even further.

Normally, one might assume that a decrease in unemployment translates to economic recovery. For example, from January 2010 to January 2020, the U.S. unemployment rate dropped from 9.8% to 3.5%. Yet, the accompanying economic growth was tepid, averaging just 2.3% GDP growth for the decade.

This gap in understanding may stem from a declining labor participation rate during the same period. Although the official unemployment rate declined, it did not indicate a true increase in employment among the population.

Alternatively, many factors could contribute to this weak GDP growth—an intriguing aspect of the economy is its illusion of predictability.

Curiously, some academics treat the economy as a precise engine, attempting to create models that define its operations, and often justifying interventions based on these flawed theories.

From high unemployment to poverty, and global issues like climate change and political strife, the central planners at the Federal Reserve strive to address every challenge, often stimulating further chaos and consolidating wealth in the process. Their interventions during the coronavirus pandemic could lead to extended economic hardship, far worse than the struggles witnessed in the 1970s.

Decoding Central Planning Failures

Recent reports from the Bureau of Labor Statistics show that consumer prices have surged by 7.0% over the last year, the highest hike since June 1982. If calculated with 1982 methods, current inflation would exceed 15%.

In his quest to hedge responsibility, President Biden has pointed fingers at so-called price-gouging meatpackers and oil companies. This narrative seems designed to divert public scrutiny from Washington’s role in the matter.

The undeniable truth here is that Biden, along with Federal Reserve Chair Jay Powell and Treasury Secretary Janet Yellen, are well aware that the fiscal and monetary policy actions taken in Washington are to blame for the rise in prices. Such truths rarely make their way into mainstream discourse.

Inflation is not merely about increasing prices; it reflects a decline in money’s value. Like any other commodity, the value of money is dictated by the forces of supply and demand. An increase in money supply results in a decrease in its value.

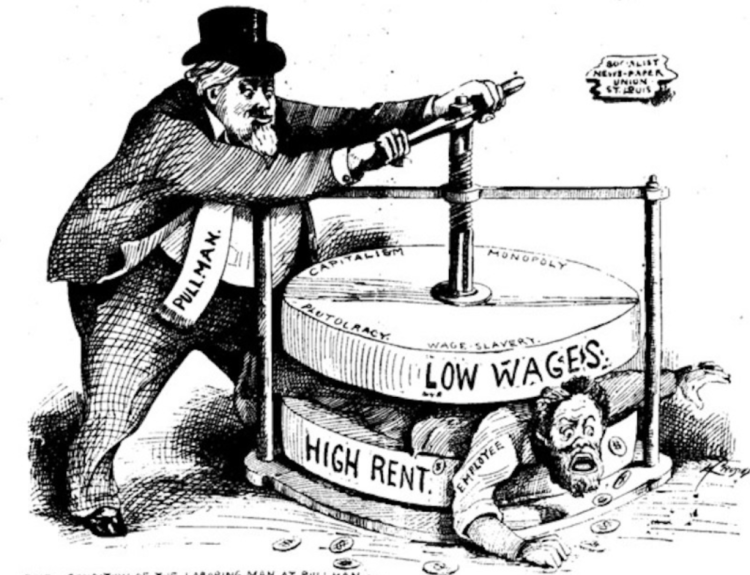

The aggressive policies of the Fed and Treasury, amounting to $8 to $10 trillion in the past two years alone, have resulted in significant inflation and exacerbated wealth inequality.

During a July 2019 congressional session, Powell noted that the link between unemployment and inflation had weakened significantly, suggesting that the Phillips curve had become practically irrelevant. This skepticism came when unemployment was at a historic low of 3.5% and CPI was merely rising at 1.8% annually.

Fast forward to today; with the CPI hitting 7% against an unemployment rate of 3.9%, some economists now claim the Phillips curve is merely ‘hibernating,’ highlighting a bizarre inconsistency in economic theory.

In a recent Financial Times article, former Fed Governor Frederic Mishkin claimed, “Research I presented several years ago suggests that the Phillips curve is not dead, but rather is hibernating.” Such fluctuating positions regarding the validity of this model resemble the randomness of a three-sided coin toss.

The reality remains that central planners wield profound power over economic life. Their flawed decision-making is rooted in questionable theories and their heavy-handed interventions have led to growing inequality and corruption. Their actions have triggered a wave of inflation likely to exceed what we saw in the late 1970s, potentially heading towards the staggering 19.66% CPI from 1917.

Are we enjoying the ride yet?

[Editor’s note: Central planners at the Fed have upended the dollar and have given rise to overwhelming inflation. Don’t let these faltering policies erode your savings and investments. You can take advantage of these challenges to build significant wealth. Discover how, and get started today!]

Sincerely,

MN Gordon

for Economic Prism

Return from How Central Planners Corrupted the World to Economic Prism