Do you own a house? Are you renting?

Do you own a house? Are you renting?

Your answers to these questions may significantly shape how you view inflation and the economy.

But what if the dynamics influencing your view are about to undergo a dramatic shift, completely altering your perspective?

We’re convinced that monumental changes are looming in the credit market, where what seems like a solid foundation might soon crumble in the way that saturated soil does after an earthquake.

So, where do we start?

In the early 1980s, many financial experts were forecasting future trends while still anchored in the past. Following a decade marked by rampant price inflation, the prevailing wisdom suggested that one should fill their portfolios with gold, fine art, and antiques. This was deemed the ultimate strategy for safeguarding wealth.

Some predicted that the U.S. would face a situation akin to Germany’s Weimar Republic. Notably, Howard Ruff, in his investment newsletter The Ruff Times, foresaw that our currency would soon become hyperinflationary ash, akin to trees incinerated in a California wildfire. It was not just probable—it was inevitable. And imminent!

However, an unexpected turn occurred. Ultra-high interest rates implemented by Fed Chair Paul Volcker precipitated a recession. This marked a turning point: consumer price inflation stabilized, and a new era of asset price inflation—particularly in housing—emerged, though its implications were not immediately apparent.

In September 1981, the yield on the 10-year Treasury Note soared to 15.32 percent. Following this peak, yields entered a 39-year declining trend, reaching a low of just 0.62 percent by June 2020.

During this timeframe, the median sales price of homes in the U.S. surged from $64,900 to $411,200—a staggering increase of 533 percent. In contrast, the U.S. median income rose only 254 percent, from $19,074 to $67,521. This means that median house prices inflated at more than double the rate of median incomes.

The plummeting cost of credit fueled this extraordinary rise in house prices, while cheaper labor from Asia helped disguise consumer price inflation during this period.

It is worth noting that a few visionaries in the late 1970s anticipated this shift. Among them was A. Gary Shilling.

Unlike the prevailing belief that inflation would persist indefinitely, Shilling sensed that the U.S. was entering a prolonged era of lower interest rates and subdued consumer price inflation. In this context, traditional inflation hedges would likely prove disastrous.

Instead, assets linked to debt would flourish.

Three Hour Tour

Driven by conviction, Shilling authored a book to share his insight, published in the early 1980s, aptly titled: Is Inflation Ending? Are You Ready?

Regrettably, the book was a commercial failure. Few, save for a few savvy investors, grasped that consumer price inflation was actually waning. Nevertheless, Shilling’s predictions proved remarkably accurate.

Moreover, he backed his beliefs with investments, achieving financial independence by the mid-1980s through aggressive positioning in long bonds.

Shilling’s prescient call and capital allocation in the long-term decline of interest rates starting in the early 1980s is noteworthy. What’s equally impressive is his ability to stay the course long after many prominent investors exited the scene.

Bill Gross, known as the “bond king,” also recognized and capitalized on this trend early on. By employing the total return bond strategy he developed, Gross transformed PIMCO into a $1.7 trillion asset manager and built his own substantial wealth. However, following the Great Financial Crisis of 2008-09, Gross seemed to lose his touch.

After a public feud with colleague Mohamed El-Erian and amidst personal chaos, including bizarre incidents involving unusual revenge tactics, Gross heavily bet against the price of U.S. government debt, anticipating a rise in interest rates.

However, thanks to the Federal Reserve’s extensive quantitative easing, interest rates fell instead of rising. This miscalculation marked the beginning of the end of Gross’s illustrious career, which officially ended in February 2019.

Post-retirement, Gross filled his time infuriating his upscale neighbors with a perpetual loop of the Gilligan’s Island theme song and participating in a jail diversion program that involved food preparation at a local shelter. Recently, he reportedly made between $15 and $20 million by strategically betting against meme stocks like GameStop and AMC.

Welcome to the Death Zone

Last week, the 77-year-old Gross took a break from what he calls “the death zone” to provide warnings regarding Fed Chair Jay Powell’s new interest rate hiking cycle. He stated:

“I suspect you can’t get above 2.5 to 3 percent without disrupting the economy again. We’ve become accustomed to continually lower rates, and anything much higher will destabilize the housing market.”

Indeed, destabilizing the housing market might just be what’s necessary. In Los Angeles, for example, it now costs $837,000 to create a single housing unit for one homeless individual.

Clearly, there’s a significant amount of malpractice built into Los Angeles’s approach to homelessness, which operates more as a money-draining apparatus than a solution. Additionally, state and local development policies exacerbate the problem. However, these exorbitant prices are also indicative of a housing market experiencing uncontrollable inflation.

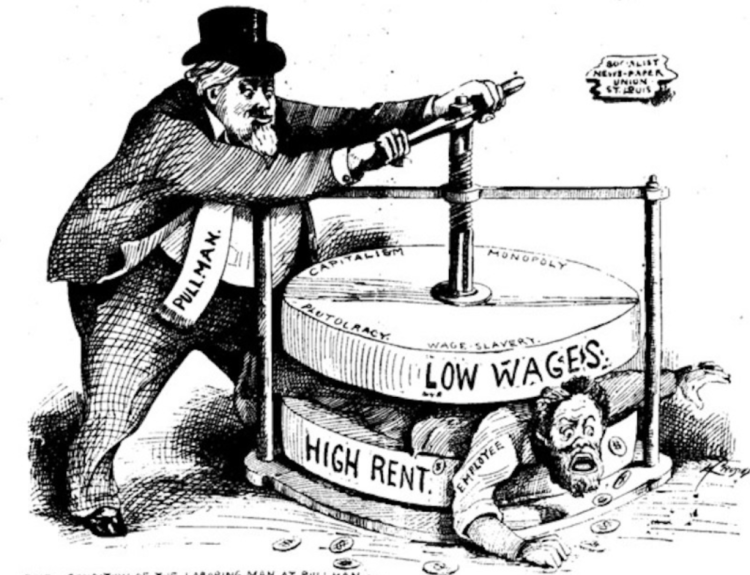

It’s essential to remember that homes, more than any other financial asset, fundamentally divide the wealthy from the impoverished. There are homeowners and there are renters.

Homeowners tend to welcome housing price inflation, as it makes them feel wealthier and more astute when their property values surge. This ensures that they possess an asset comparable to a lottery ticket, capable of being “cashed in” several times throughout the decade.

Homeowners may find income stagnation irrelevant, particularly when they can refinance their mortgages and access equity at increasingly lower interest rates while keeping monthly payments stable.

On the other hand, renters often feel marginalized. Many earn more than their homeowner neighbors but are perpetually locked out of the market due to the 533 percent increase in housing prices over the last 39 years.

Adding insult to injury, renters face escalating monthly rents, in stark contrast to homeowners with fixed mortgage payments. In Miami, for instance, median rents are soaring at an outrageous annual rate of 55.3 percent. Such rates are simply unsustainable.

In several coastal cities, renters might pay thousands more each month for a decrepit two-bedroom apartment than homeowners who bought four-bedroom houses in the mid-1990s. This generational disparity heightens tensions between Millennials and Boomers.

Indeed, the financialization of the housing market over the past 39 years has created a dire situation. But with the resurgence of consumer price inflation, a new inflection point has arrived…

The U.S. economy appears to be in a perilous zone, where rising interest rates will be necessary for years to combat escalating consumer price inflation. The reversal in the credit market is only beginning to unfold.

Conversely, debt-based assets like bonds and houses are set to deflate, which will severely impact home equity as well.

However, it’s not all bleak. As Gross suggests, being in this death zone “allows you to be more happy in the moment.”

What are your thoughts on this perspective?

Sincerely,

MN Gordon

for Economic Prism