“I can calculate the motion of heavenly bodies, but not the madness of people.”

“I can calculate the motion of heavenly bodies, but not the madness of people.”

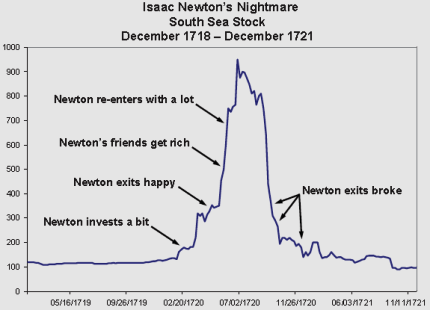

This famous remark by Sir Isaac Newton was made in 1720 after he suffered a £20,000 loss—an immense amount for that era—while speculating on the South Sea Company stock.

Newton’s experience illustrates a profound truth: human behavior, especially when it comes to investing, often defies rationality. It’s driven by emotions and best understood from a detached standpoint.

Despite being a pioneer in mathematics and physics, Newton was still subject to the whims of fear and greed, just like everyone else. In the world of finance, his seemingly logical reasoning gave way to irrational impulses.

This madness of the crowds, while hard to quantify, becomes clear when we examine historical stock price charts.

The South Sea Bubble in 1720 was, like many financial bubbles, artificially inflated by government actions. A parliamentary act granted the South Sea Company a monopoly on trade with the New World, allowing it to finance national debt at low interest rates.

The allure of wealth from far-off lands captivated the public’s imagination, causing many to overlook the minimal returns from such trade. Investors rushed to partake, blinded by greed.

But the real excitement was not in tangible trade but in the paper markets, where growing stock sales created the illusion of universal prosperity.

Initially, Newton navigated this frenzy successfully, exiting his positions for a profit. However, as he observed others accruing wealth, his fear of missing out (FOMO) compelled him to invest even more heavily.

Here’s a sequence depicting Newton’s experience in this turbulent market:

Indeed, Newton’s experience serves as a classic illustration of market psychology.

If you’ve seen your investment portfolio decline recently, rest assured, you are not alone.

Into the Abyss

Entering a bear market is never ideal, but like the inevitable onset of middle age, resisting it is futile.

Accept the circumstances and act accordingly; sometimes, the best advice is to simply “sell in May and go away.”

Moreover, resist the impulse to “buy the dip” until at least November 2023—perhaps even November 2024. Here’s why:

The severity and duration of a bear market tend to be inversely related to the preceding excitement.

The frenzy that drove the NASDAQ composite to 16,212, the Dow Jones Industrial Average (DJIA) to 36,952, and the S&P 500 to 4,818 certainly rivaled the madness of earlier bubbles, including the South Sea Bubble.

In fact, the exuberance that pushed these major indices to record heights roughly six months ago surpassed even the excesses seen during the Roaring Twenties and the 1929 stock market crash.

For instance, the cyclically adjusted price-to-earnings (CAPE) ratio of the S&P 500 was at 32.56 in September 1929. By its peak in November 2021, the CAPE ratio soared to 38.58.

Could it be justifiable to suggest that the bear market we are currently facing might mirror the downturn between late 1929 and June 1932? If so, revisiting that historical devastation could provide valuable insights.

The U.S. stock market began a prolonged decline in the autumn of 1929, coinciding with the onset of the decade-long Great Depression.

Given the rapid market declines of the past month and the possibility of an extended economic downturn, a closer examination is crucial.

Finding Opportunities in a Bear Market

Between September 3 and November 13, 1929, the DJIA plummeted by 49%. This tumultuous period included Black Monday and Black Tuesday, during which the DJIA dropped nearly 13% and 12% on consecutive days.

Yet, as often overlooked, the DJIA rebounded by 48% by April 17, 1930, luring the eager “buy the dip” crowd back into the market just before the next downturn. This cycle repeated itself over the following 26 months, repeatedly trapping investors.

The bear market from 1929 to 1932 was likened by the late Pater Tenebrarum to a rubber ball careening down a flight of stairs—each bounce offered investors another opportunity to incur losses. Taken together, these movements presented many chances to lose money repeatedly.

Ultimately, the rally between November 13, 1929, and April 30, 1930, proved to be a false dawn. By June 1932, the DJIA had plummeted by 89.2% from its peak, taking with it the dreams and aspirations of an entire generation.

While it’s possible that major stock market indices may see some rebounds in the coming weeks and months, it is prudent to approach these rebounds with skepticism.

The wave of coronavirus stimulus has subsided, and the Federal Reserve is only beginning its rate-hiking journey. Unless inflation eases—something that could take years—the Fed’s capacity to support the financial markets will be constrained.

Nevertheless, there are still opportunities in the stock market, as it remains a marketplace of diverse stocks.

For example, Occidental Petroleum Corporation (OXY) has seen a remarkable increase of 107.31% this year, while Chevron Corporation (CVX), a holding in the Wealth Prism Letter portfolio, has risen by 39.04%.

There are numerous opportunities available for those willing to explore them.

[Editor’s note: In a bear market, it’s essential to identify stocks with strong fundamentals. This doesn’t mean purchasing shares of companies like Netflix (NFLX) or Peloton (PTON) out of desperation. We are interested in businesses that do not depend on low interest rates, government interventions, or fleeting trends to drive up their share prices. If you want to join us on this journey, you can find out how right here.]

Sincerely,

MN Gordon

for Economic Prism

Return from Finding Opportunities in a Bear Market to Economic Prism