“The LORD sends poverty and wealth; he humbles and he exalts.” – 1 Samuel 2:7

“The LORD sends poverty and wealth; he humbles and he exalts.” – 1 Samuel 2:7

Holy Roll

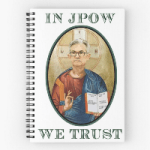

A creative entrepreneur recently produced a humorous graphic featuring Federal Reserve Chairman Jerome Powell, captioned: “IN JPOW WE TRUST.”

You might have come across it.

The illustration depicts Powell vividly dressed in a preacher’s robe, making an elaborate hand gesture with his right hand. His facial expression suggests he’s enduring a great discomfort.

In his left hand, he raises what looks like an open Bible, though the text is minimal and difficult to decipher. Upon closer inspection, you can find noteworthy proclamations like, “STOCKS ONLY GO UP,” “RECESSION CANCELLED,” and “MONEY PRINTER GOES BRRRRRRRR.”

The graphic even incorporates a form of American French slang to illustrate the fate of market bears and stock short-sellers—conversations that might be best suited for informal settings. Continue reading

Federal Reserve Chair Jay Powell aims for a rapid reduction in consumer price inflation, but his efforts are not yielding results.

Federal Reserve Chair Jay Powell aims for a rapid reduction in consumer price inflation, but his efforts are not yielding results.

As reported by the Bureau of Labor Statistics, the consumer price index (CPI) recorded an “official” annual inflation rate of 8.3 percent in August.

This surpassed Wall Street’s projected 8.1 percent and dashed hopes for an imminent ‘Powell pivot.’ Consequently, the Dow Jones Industrial Average (DJIA) plummeted by 1,276 points following the announcement.

Powell desires consumer price inflation around 2 percent, yet the reality is more than 400 percent beyond that. What’s the underlying issue?

To grasp the current state of soaring inflation and the Federal Reserve’s monetary strategy, one must understand the concept of a manipulated currency, which is prevalent in the United States and many parts of the globe. This aligns with a principle articulated by Karl Marx in Plank No. 5 of his Communist Manifesto:

“No. 5. Centralization of credit in the hands of the state, by means of a national bank with state capital and an exclusive monopoly.” Continue reading

A recent White House fact sheet announced President Biden’s initiative to cancel $10,000 of student debt for low- to middle-income borrowers. But who truly benefits from this action?

A recent White House fact sheet announced President Biden’s initiative to cancel $10,000 of student debt for low- to middle-income borrowers. But who truly benefits from this action?

Undoubtedly, the student debt crisis is a significant issue. Approximately 45 million borrowers collectively owe around $1.6 trillion, much of which is tied to federal student loans.

This means the federal government is largely responsible for the predicament, having provided the capital that inflated a higher education bubble, resulting in a cadre of entitled graduates.

The model typically involves encouraging impressionable 18-year-olds to take on sizable government-backed loans, with the promise that a college degree will lead to a prosperous future. However, as tuition skyrocketed—propelled by these loans—the supposed benefits became less tangible.

Ultimately, the cancellation of student debt benefits a compromised education system more than it assists financially burdened students. It enables colleges and universities to sustain inflated tuition structures. Continue reading

Senator Elizabeth Warren may be out of touch, or perhaps she believes the rest of us are oblivious.

Senator Elizabeth Warren may be out of touch, or perhaps she believes the rest of us are oblivious.

Recently, she voiced concerns on CNN, expressing fears that the Federal Reserve’s increase in interest rates could plunge the economy into recession.

But what exactly is she concerned about? The reality is her fears have already materialized.

The U.S. economy is indeed in a recession, as evidenced by GDP figures showing a contraction in both the first and second quarters of 2022.

Traditionally, a recession has been defined as two consecutive quarters of decreasing GDP—a standard that now applies, except it seems lost on President Biden and Warren.

While recessions are not enjoyable, they are often necessary for correcting economic imbalances. The current recession serves as a crucial step to address the inflation crisis that Warren and her colleagues have contributed to. There are repercussions for extensive money printing, and they must be faced eventually. Continue reading