“How should I approach this one, Bert? Should I play it safe? That’s what you always advised: play it safe… play the odds. Well, here we are: going fast and loose. One ball, corner pocket. Yeah, percentage players end up broke too, right, Bert?”

“How should I approach this one, Bert? Should I play it safe? That’s what you always advised: play it safe… play the odds. Well, here we are: going fast and loose. One ball, corner pocket. Yeah, percentage players end up broke too, right, Bert?”

– Fast Eddie Felson, The Hustler

QT2 Master Plan

Halting excess is often a more daunting task than initiating it. Yet, sometimes it must be done thoroughly. Half measures yield no results.

On June 1, 2022, Federal Reserve Chair Jay Powell initiated Quantitative Tightening (QT) Part 2. “Brace yourself,” was the warning from JPMorgan Chase CEO Jamie Dimon. Were his colleagues in the banking world paying attention?

The ambitious plan for QT2 involved the Fed reducing its Treasury notes and mortgage-backed securities holdings by a total of $47.5 billion per month for the initial three months (July through August 2022). By September 2022, the intent was to accelerate the reduction to $95 billion per month—$60 billion in Treasury notes and $35 billion in mortgage-backed securities.

Wells Fargo Investment Institute took the Fed’s promises seriously and even projected a potential balance sheet reduction of nearly $1.5 trillion by the end of 2023, bringing it down to approximately $7.5 trillion.

For anyone with a memory that spans more than two years, it was abundantly clear that the Fed had no genuine chance of reducing its balance sheet to $7.5 trillion by 2023. At that time, we noted, “We’ll bet dollars to doughnuts this never happens.”

Our confidence wasn’t fueled by unique insights; it was simply an acknowledgment that QT1 had faltered prematurely.

During QT1, it took 24 months for the Fed to reduce its balance sheet by $800 billion between October 2017 and September 2019 (following a $3.5 trillion expansion) and this ended abruptly amid repo chaos.

QT2 Fail

As is often the case with central planners’ schemes, the QT2 blueprint—which intended to extinguish nearly double the assets over 19 months compared to the 24 months of QT1—was nothing more than a fantasy. Clearly, something was destined to break long before the Fed reached its $7.5 trillion goal.

By now, everyone is aware of what has occurred. Silicon Valley Bank faced failure, followed by Signature Bank, First Republic Bank, and Credit Suisse. More banks may also collapse, even amidst orchestrated mega bailouts by proactive central banks.

Regarding the Fed’s balance sheet, it peaked at over $8.9 trillion in April 2022, before declining by approximately $626 billion by the end of February 2023. However, as of March 15, 2023, the Fed’s balance sheet surged by $300 billion. Once you read this, we will likely have more clarity on how many additional hundreds of billions the Fed has conjured up to stabilize the financial system.

In summary, QT2 was an utter failure. From the initial $626 billion reduction, $300 billion was swiftly reinstated. This substantial uptick signifies the return of Quantitative Easing (QE) and raises a pivotal question.

How much credit creation by the Fed—conjured out of thin air—will be needed to address the banking crisis?

A trillion dollars? Five trillion? Ten trillion?

Your guess is as good as ours. In scenarios like this, it’s prudent to think in large, rounded figures. So, do not be astonished if the Fed’s balance sheet surpasses $20 trillion in the coming years.

Inflation Deflation

Inflating the money supply is the essential element of inflation. It precedes everything else. Following this, asset price inflation and consumer price inflation occur in unpredictable and volatile ways.

Are these massive additions to the Fed’s balance sheet inflationary?

Yes, by definition. The inflation of the Fed’s balance sheet introduces additional credit into the financial system. However, the impact of this inflation on asset and consumer prices remains to be seen.

The immediate concern lies in credit contraction and debt deflation. The driving forces behind bank failures remain relentless. As TradeSmith recently pointed out, the money supply (M2) is experiencing contraction for the first time in the contemporary era. Liquidity has vanished from the market.

For instance, investors holding $17 billion of Credit Suisse’s additional tier 1 (AT1) bonds are facing deflationary conditions amid this banking crisis. This includes retail investors in Asia, as well as firms like PIMCO, Invesco, and Legg Mason, whose investments—principal, interest, and everything—have been effectively reduced to nothing.

What about SVB depositors, especially those with accounts exceeding FDIC insurance limits? Is the BTFP bailout inflationary if depositors are merely being restored to full value?

Interpret it as you will. The inherent moral hazard, rewarding bankers for reckless speculation with customer deposits, poses a significant risk.

What undoubtedly drives inflation and consumer prices higher is the enormous deficit spending by Washington. The federal government has already spent $723 billion more than its revenue in the fiscal year 2023, even before reaching the mid-point of the year.

The Congressional Budget Office projects the FY 2023 deficit could reach $1.4 trillion, in addition to the $1.38 trillion deficit incurred during FY 2022. As the credit market tightens and banks struggle, consumer prices are likely to remain elevated.

Will You Play It Fast And Loose?

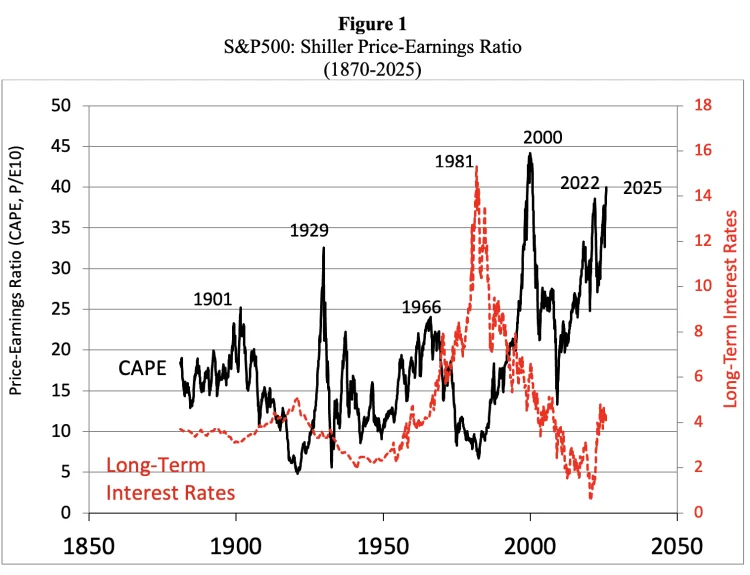

With consumer price inflation lingering near its highest levels in over four decades, it’s likely that substantial deficit spending, coupled with the expanding scope of bank bailouts, will serve as a catalyst for increasing consumer prices. This is especially true as dubious political figures like Senator Elizabeth Warren exploit the banking crisis to advocate for more financial injections into the economy.

However, we anticipate that the most significant developments will occur in asset prices, with great uncertainty surrounding the outcomes.

Those who anticipate that Fed liquidity will boost the stock market should temper their expectations. That day will come, but first, the considerable fallout in the debt market must be addressed—either through reconciliation, write-offs, or bailouts.

This week, Fed Chair Powell raised the federal funds rate by 25 basis points to a range of 4.75 to 5 percent following the Federal Open Market Committee meeting. This move is undeniably deflationary for the debt market and exacerbates the negative carry situation that banks have unwisely entered.

Yet, what could Powell do? Inflation is rampant and needs to be curbed. Mistaken choices made during the COVID Panic require correction. Additionally, with Washington’s spending at reckless levels, Powell must maintain control for as long as politically viable.

Ultimately, this is a losing battle. Interest payments on the national debt have surged by 29 percent year over year. It won’t be long before the Fed resorts to cutting rates to bail out Washington—regardless of inflation concerns.

In the interim, a serious stock market panic looms on the horizon. This will likely go down in the history books and present once-in-a-lifetime buying opportunities—opportunities most individuals will miss. Are you psychologically prepared to seize the moment?

At that moment of supreme fear—when it feels like everything is collapsing, and shares of Bank of America dip below $8—what will your response be?

Will you choose to play it safe? Or will you opt for a fast and loose strategy?

[Editor’s note: As the financial system crumbles and the economy plunges into recession, a significant distraction will be necessary to pacify the masses. In this context, is Washington covertly instigating China to attack Taiwan? Are your finances ready for such unpredictability? Insights into these crucial questions are outlined in a unique Special Report titled, “War in the Strait of Taiwan? How to Exploit the Trend of Escalating Conflict.” You can acquire a copy for less than a penny.]

Sincerely,

MN Gordon

for Economic Prism

Return from Will You Play It Fast And Loose? to Economic Prism