In recent times, the actions of those in power have escalated to levels that push beyond mere narcissism and grandiosity. A recent article from the Wall Street Journal sheds light on a bewildering proposal from the Trump Administration regarding the use of frozen Russian central bank assets for Ukraine’s reconstruction. This plan suggests that Russia might comply out of a desire to gain favor with Trump, framing the investment into a war-torn country as a lucrative opportunity. However, it’s important to note that previous, more pragmatic attempts to approach this situation—such as the U.S. hiring BlackRock to manage a Ukraine reconstruction fund—failed to yield any significant results.

The crux of the situation lies in the fact that the U.S. is presenting this rather absurd idea to EU officials, who control the majority of these frozen assets, reported to be around €140 billion or more in Euroclear.

Meanwhile, European leaders like Ursula von der Leyen, Emmanuel Macron, Keir Starmer, Friedrich Merz, and Kaja Kallas appear equally misguided, though in a more subdued manner. They are attempting to create a facade of legality surrounding a plan that poses risks to the budgets of EU member states. Von der Leyen’s strategy adds complexity by assigning financial responsibility to each member state involved in this operation, even against their will.

Returning to the Trump proposal, it seems to have incited a rush among European capitals to seize the frozen assets before the U.S. and Russia could potentially reach an agreement. The Journal notes that:

The Trump administration has recently provided its European counterparts with a series of one-page documents outlining its vision for Ukraine’s reconstruction and Russia’s reintegration into the global economy…

These documents describe plans for U.S. financial firms to access approximately $200 billion of frozen Russian assets for various projects in Ukraine, including a substantial new data center powered by a nuclear plant currently under Russian control.

It’s crucial to clarify that the Zaporozhye nuclear power plant isn’t just “currently occupied.” It lies within one of the four regions that voted to join Russia, and according to Russian law, it is now officially part of the country. Consequently, any discussion about utilizing this facility for reconstruction will inevitably come with strict commercial terms.

Moreover, conversations about power generation and reconstruction in Ukraine overlook a critical fact: only Russia possesses the capacity to execute these plans. Much of Ukraine’s energy infrastructure has already suffered damage due to the ongoing conflict, and the country’s electrical grid relies on outdated Soviet-era standards. Western companies are unlikely to invest in repairing and replacing essential components, as the required output surge is better suited to Russian firms that can be motivated to ramp up production for this temporary demand.

There is also the overly optimistic notion that a financially and politically independent Ukraine will emerge post-war. Both Ukraine and the EU seem to be working hard to prevent this from happening, often leading Putin to believe that military victories are necessary to dictate future outcomes. The real question then becomes how much territory Russia chooses to annex versus the prospect of a diminished Ukraine governed by a sympathetic administration.

Returning to the Journal’s coverage:

Another document outlines America’s sweeping strategy for reintegrating Russia’s economy, involving investments in key areas ranging from rare-earth extraction to oil drilling in the Arctic, while also restoring energy flow to Western Europe.

This approach reflects a troubling arrogance, suggesting that Russia somehow still relies on the West.

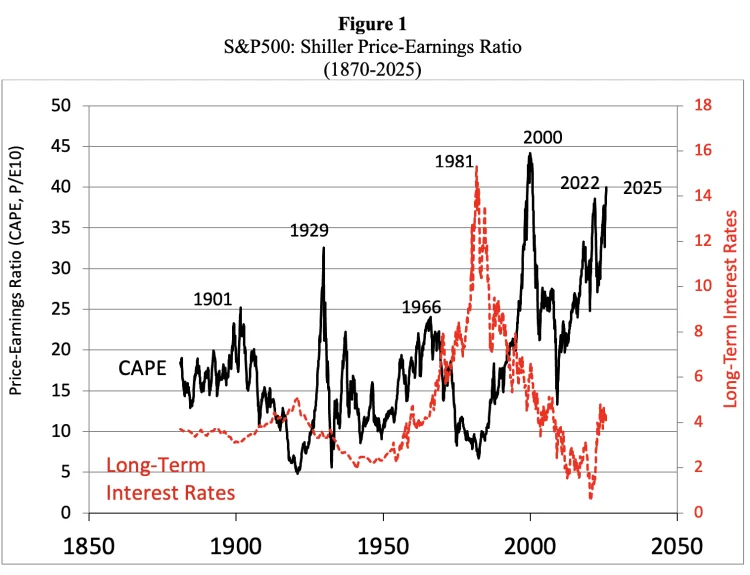

The quiet scandal in global economics:

From 2008 to 2025, Russia’s real GDP per capita grew faster than Germany, the UK, and France despite sanctions, SWIFT bans, export controls, frozen assets and a geopolitical standoff. pic.twitter.com/0C7ijjrCcc

— . (@Lucid_Watcher) December 5, 2025

Yet, the Journal presents a contrasting viewpoint, asserting that Russia is suffering:

A new assessment by a Western intelligence agency claims that Russia has technically been in recession for six months, with its war economy straining to manage inflation and posing systemic risks to its banking sector.

It’s reasonable to assume that Russian negotiators are aware of the U.S. strategy. A sense of disbelief might result from such proposals, reminiscent of dreams for developments like a Riviera-style project in Gaza. Indeed, one official likened the proposed U.S.-Russia energy discussions to the 1945 Yalta Conference.

Readers are invited to share their opinions on these ideas. Given the previous impracticalities that came from U.S. pressures on Ukraine regarding resource extraction, this could be yet another instance of Team Trump operating under delusions.

U.S. officials are stating that Europe’s approach risks exhausting the frozen funds quickly. In contrast, they claim American management could increase that figure to $800 billion by attracting Wall Street executives and private equity investors. One official asserted, “Our sensibility is that we really understand financial growth.”

Meanwhile, von der Leyen is working to push legislation enabling the Commission to seize frozen assets in Euroclear under emergency powers. Belgium has voiced strong concerns over potential liabilities in the event of litigation.

I asked ECB President Lagarde about the potential impact on financial stability of using Russian frozen assets held at Euroclear (140 billion). The ECB has (rightly) indicated that a guarantee would be a breach of the Treaty. Other options urgently needed for Ukraine👇 @wbeke pic.twitter.com/ih9j89n5GV

— Dirk Gotink (@DirkGotink) December 3, 2025

Since Euroclear has firmly expressed that the asset seizure, dressed up as collateral usage for loans, is illegal, it remains unclear how it could be compelled to release the funds. Typically, “possession is nine-tenths of the law,” and it’s highly likely that both Euroclear and Belgium would seek an injunction against such actions.

Belgian Prime Minister Bart De Wever described the European Commission’s proposal as “theft,” emphasizing that more lawful solutions exist for accessing Russian funds. pic.twitter.com/KJR0mQWD5D

— 🪖MilitaryNewsUA🇺🇦 (@front_ukrainian) December 10, 2025

Aside from the possibility of Russia pursuing legal action against Euroclear in courts outside the EU, the potential for further retaliatory measures remains viable:

One of the unintended consequences of the EU’s outlandish plan to appropriate Russia’s frozen assets is that Euroclear, an entity responsible for financial transactions, still holds… pic.twitter.com/6RHLDTpjEk

— Nina 🐙 Byzantina (@NinaByzantina) December 10, 2025

In a curious turn, the Financial Times branded Hungary’s Viktor Orban as a villain for being deemed too lenient toward Russia. They reported:

EU countries are swiftly moving to indefinitely immobilize up to €210 billion in Russian sovereign assets, attempting to bypass Hungary’s opposition before the upcoming leaders’ summit. This initiative aims to leverage the EU’s position in the United States-led peace negotiations regarding Ukraine.

This hurried effort intends to separate the contentious issues of immobilizing assets from discussions about loans for Kyiv, which will be left for EU leaders to address. However, the attempt to rush this process, overriding necessary unanimity, risks alienating Hungary and other dissenting nations, creating lasting discord.

The European Commission is pushing to utilize €210 billion of Russia’s frozen assets to fund a loan package for Ukraine, starting with an initial €90 billion over the next two years. To make this feasible, these assets would need to be permanently immobilized, rather than subject to renewal every six months by unanimous consent from all EU nations.

To achieve this, emergency powers, designed for economic crises, would be invoked to impose indefinite sanctions on these assets. Such an action could be passed with a simple majority, bypassing any individual vetoes.

However, there is no genuine crisis. If the Commission and its allies manage to implement this plan, the subsequent wave of legal challenges could create a crisis of their own making. Previous warnings from Euroclear about the legality of this scheme add weight to potential litigation concerns, as outlined in a recent analysis by Alexander Mercouris.

Speculatively, one could ponder that the fervent pursuit of this plan by von der Leyen represents a key opportunity to expand the powers of the Commission, aligning with her agenda since taking office.

In a more tempered note, Politico’s latest European newsletter offered a less optimistic take than prior reports, dispelling the notion that Orban played a central role in the opposition:

GROUNDHOG DAY

ENVOYS DISCUSS ASSETS SUPERFREEZE: EU ambassadors will today consider granting the Commission emergency powers to indefinitely freeze Russian state assets. Envoys will review updated legal frameworks following an inconclusive discussion last week, according to insiders.What’s at stake: This mechanism is crucial to the Commission’s strategy for mobilizing €210 billion in blocked Russian assets for Ukraine, primarily controlled by Euroclear.

Implications for Budapest: By implementing this plan, countries like Hungary would lose their ability to block the release of sanctioned funds through a simple veto, shifting the financial responsibility onto EU nations.

Moving forward: Recent discussions suggested that narrowing the proposal might secure Belgium’s backing, targeting adoption by the week’s end.

Belgium’s concerns: Prime Minister Bart De Wever has reiterated concerns about financial exposure if these funds require repayment, indicating the possibility of legal actions if the EU proceeds with asset seizures.

Pressure tactics: Reports suggest a potential strategy might involve warning Belgium that failure to comply could isolate it in EU decision-making, similar to Hungary’s situation.

The Politico newsletter mentioned a notable legal perspective:

A legal memo circulated recently claims Belgium’s concerns about retaliation from Russia are overstated, asserting that the risk of litigation is “minimal.” The implication is that challenges to an EU reparations loan would face steep obstacles in international courts.

Those well-versed in legal matters understand that one can usually find legal justification for almost any action. However, Covington & Burling’s stature in this arena is relatively modest compared to premier firms specializing in finance and international law.

While von der Leyen and her cohort are fiercely pursuing their “seize not freeze” initiative, the message from Politico hints at the likelihood of another episode in a long-standing cycle of inaction. The ongoing discourse keeps alive the false hope that there may still be financial and military support awaiting Ukraine, as European leaders appear committed to prolonging the conflict.

_____

1 Contrary to some assertions, BlackRock did not commit to this investment scheme.

2 The reported total fluctuates due to the EU appropriating interest, and some accounts may include sanctioned Russian entities along with central bank holdings. Recent figures suggest Euroclear holds €185 billion of these assets.

3 Recall that Linklaters once endorsed Lehman’s controversial use of Repo 105 for accounting manipulations, which was widely criticized once revealed.