At the start of 2023, there was widespread optimism. Many believed that the stock and bond markets were set to move forward after a challenging year. The prevailing sentiment was that 2022’s downturn would not be repeated.

At the start of 2023, there was widespread optimism. Many believed that the stock and bond markets were set to move forward after a challenging year. The prevailing sentiment was that 2022’s downturn would not be repeated.

The consensus was rooted in the hope that inflation would ease up, leading to a corresponding drop in interest rates. Such a shift would ideally catalyze a robust stock market recovery, benefitting aging baby boomers who rely on their retirement savings.

However, the reality has unfolded quite differently. Inflation remains stubbornly high, interest rates have continued to climb, and both stock and real estate values are plummeting.

In a recent semi-annual testimony before Congress, Fed Chair Jerome Powell emphasized that interest rates would proceed “higher than previously anticipated.” He also expressed readiness to “increase the pace of rate hikes” if necessary.

Essentially, the long-awaited pivot from Powell has been postponed indefinitely. Investors may decide to bet against the Fed by purchasing stocks, but they might find themselves facing disappointing outcomes. Continue reading

I went to the crossroad, fell down on my knees

I went to the crossroad, fell down on my knees

I went to the crossroad, fell down on my knees

Asked the Lord above “have mercy, now save poor Bob, if you please”

– Robert Johnson, Cross Road Blues

Unelected Bureaucrat

Jerome Powell, the Chair of the Federal Reserve, holds a difficult position. Despite overseeing trillions of dollars, he earns a modest salary of $190,000 per year, which pales in comparison to what many CEOs make. Nonetheless, he considers this compensation fair.

Powell’s main responsibility revolves around setting interest rates, a critical role in a centrally managed economy. However, in a truly free market, interest rates would be determined by the interactions between borrowers and lenders, rendering such a position unnecessary.

Nonetheless, other roles in this domain can be even less appealing. Take Lael Brainard, for instance, who resigned from her position as Fed vice chair after less than nine months. She has since taken on the role of Director of the National Economic Council, another arguably ineffective position.

With Brainard’s departure, a pressing question arises: who will next step into the vice chair position? As the National Enquirer would ask, “Enquiring minds want to know.” Continue reading

Enduring a bear market can be a lengthy and challenging process, fraught with opportunities for losses. Each upward movement can, unfortunately, lead to buying at elevated prices only to sell at a loss later.

Enduring a bear market can be a lengthy and challenging process, fraught with opportunities for losses. Each upward movement can, unfortunately, lead to buying at elevated prices only to sell at a loss later.

Significant U.S. stock market indexes appeared to hit a temporary low in the fall of 2022. Since then, they experienced a vigorous bounce that instilled new confidence among investors—perhaps at the most inopportune time.

Many observers have mistakenly interpreted this bear market rally as a precursor to a new bull market. Following a strong performance in January, declarations of a bull market began to surface.

Perhaps these assertions are accurate. Perhaps recent stock market pullbacks represent mere consolidation, and major indexes will soon surpass their previous all-time highs. However, we remain skeptical.

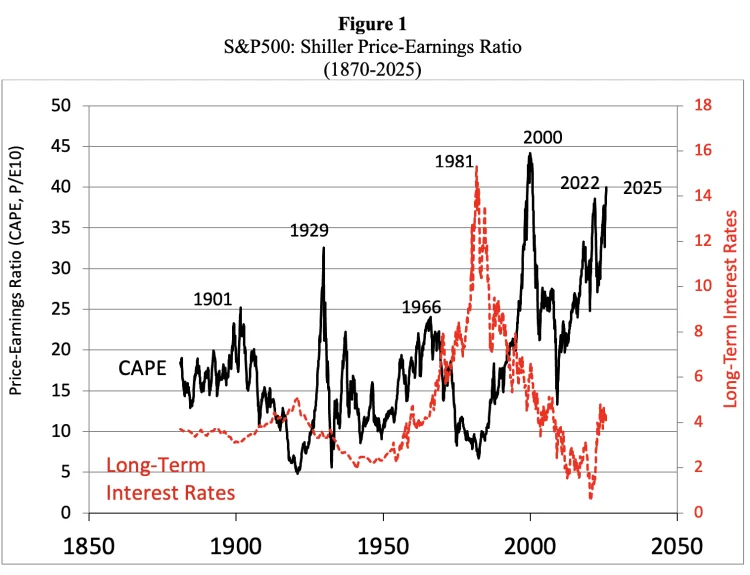

Billionaire investor Jeremy Grantham, co-founder of the Boston-based GMO, recently shared a detailed forecast regarding the direction of the stock market, particularly as indicated by the S&P 500. Continue reading

Sometimes, challenges must worsen before they can improve. For instance, in a kitchen remodel, the old structure must first be demolished to pave the way for the new one. These initial setbacks can often feel disheartening.

Sometimes, challenges must worsen before they can improve. For instance, in a kitchen remodel, the old structure must first be demolished to pave the way for the new one. These initial setbacks can often feel disheartening.

Yet, there’s no circumvention of this necessary process. With determination and adequate resources, the final outcome typically yields significant improvement.

Similarly, revitalizing a stagnant company demands initial sacrifices for eventual gains. The early phases may be demoralizing, and because employees’ futures are at stake, such decisions often become emotional. Nevertheless, these measures can be essential.

Mark Zuckerberg, CEO of Meta, stated recently that 2023 will be the “year of efficiency.” After laying off 11,000 workers in November 2022, speculation surrounds the possibility of more cuts.

Currently, the specter of upcoming layoffs has generated considerable uncertainty about which projects will proceed, which will be halted, and who will be part of those efforts. In this transitional environment, some Meta employees are reportedly receiving pay for doing no actual work. Ironically, for Meta to emerge more efficient, initial inefficiencies may need to occur. Continue reading