“When the wave breaks here. Don’t be there. Or you’re gonna get drilled!” – Turtle

“When the wave breaks here. Don’t be there. Or you’re gonna get drilled!” – Turtle

A New Bull Market?

The question on many investors’ minds is whether U.S. stocks have truly entered a new bull market. Following a recent 20 percent rise in the S&P 500 from its low in October 2022, some experts are making this claim. However, we have our doubts.

It’s worth noting that the S&P 500 remains more than 7 percent below its all-time high, which was recorded on December 29, 2021. While it’s possible that the S&P 500 could reach new peaks during this rally, such gains are likely to be fleeting.

Several ominous factors are influencing the stock market, including high interest rates, ongoing Treasury sales, credit market strains, and an impending recession.

We contend that the S&P 500 has grown increasingly risky over the past six months, particularly as leading technology stocks have inflated. Consequently, many investors are unwittingly positioned in the impact zone, poised for significant losses when the inevitable bear market returns.

Before delving deeper, let’s first consider some relevant context.

This week, the Bureau of Labor Statistics released its consumer price index (CPI) report, a vital indicator. The latest figures reveal that consumer price inflation rose at an annual rate of 4 percent in May, more than double the Federal Reserve’s target of 2 percent. This disparity continues to shape Fed monetary policy.

Birth of the Hawkish Rate Pause

Since March 2022, the Federal Reserve has raised the federal funds rate ten times consecutively, bringing it from effectively zero to a range of 5.00 to 5.25 percent. The goal of these rate hikes has been to rein in rampant inflation that the Fed itself helped create.

However, this week marked a pause as the Fed announced it would neither increase nor decrease rates following the Federal Open Market Committee meeting.

Despite keeping rates steady, the Fed needed to adopt a hawkish tone due to inflation still exceeding its 2-percent objective. Thus, the concept of a hawkish rate pause emerged.

While rates were paused, the Fed emphasized potential rate hikes later in the year through projected “dot plots.” Currently, many officials anticipate the federal funds rate could rise to a target range of 5.5 to 5.75 percent—50 basis points higher than its current standing.

Higher interest rates create challenges for debt-heavy sectors like both residential and commercial real estate. For example, the owners of the Westfield San Francisco Centre mall recently defaulted on $558 million in outstanding mortgage debt, shortly after the owner of Hilton Parc 55 defaulted on a $725 million non-recourse loan. The rise in defaults poses risks to the banking sector.

In truth, the Fed seems weary of hiking rates further. Credit markets are on edge, and the banking crisis that surfaced months ago remains unresolved. The current lull in bank failures could very well be the eye of the storm.

In the meantime, this rate pause might give banks a brief respite. Additionally, a cooling economy might help the Fed lower the CPI more effectively.

Recession Watch

As the stock market enjoys a significant bear market rally, will the Fed’s hawkish rhetoric be enough to rein in reckless investor behavior?

We remain skeptical. On Thursday, the S&P 500 climbed by 53 points while the NASDAQ surged by 156 points, signaling that investors might be disregarding the Fed’s warnings regarding its rate pause.

Greedy investors often act irrationally, pushing rallies to their extremes even in the absence of sound fundamentals. This behavior ultimately sets the stage for a more severe downturn when the market corrects.

David Rosenberg, the former chief economist at Merrill Lynch and president of Rosenberg Research, recently cautioned that the stock market’s rally lacks solid footing and warned of a looming recession. He stated:

“You can believe the press headlines or you can believe the leading indicators — which suggest that we do indeed have a 99.15 percent chance of an official [National Bureau of Economic Research] NBER-defined recession. And if that is the case, then it is the first time in recorded history that a fundamental bear market ended before the downturn even arrived.”

While Rosenberg’s statistic may seem overly precise, coming from an expert well-versed in economics, it indicates a high likelihood of recession on the horizon.

Consequently, the stock market continues to rise as a recession looms, leading irrationally optimistic investors closer to substantial losses.

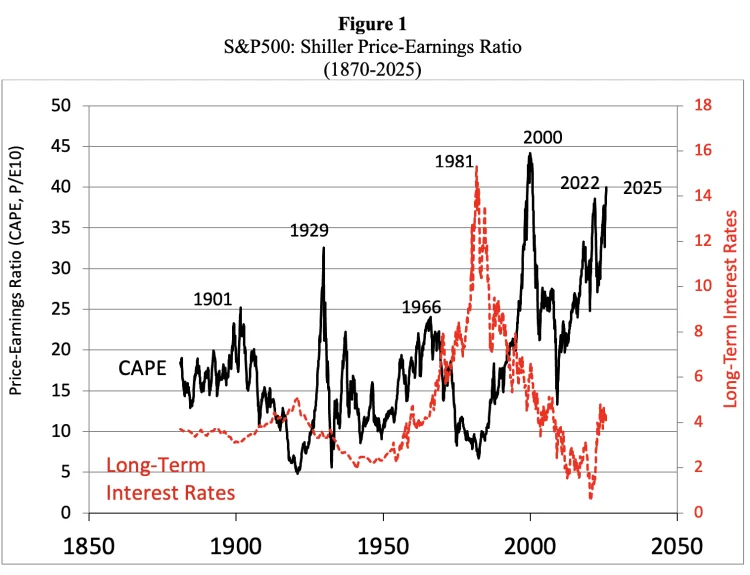

For instance, the S&P 500 is trading at extraordinarily high valuations. The cyclically adjusted price-to-earnings (CAPE) ratio is now above 30, surpassing the levels reached at the peak of the 1929 stock market prior to the Great Depression.

Are You Unknowingly in the Impact Zone?

It’s crucial to recognize that a pause in rate hikes doesn’t equate to bullish sentiment for stocks. This was evident after the Fed halted increases when the federal funds rate reached 5.25 percent on June 29, 2006, the last hike in that cycle.

The Fed held the rate steady at 5.25 percent for roughly 15 months, only to cut rates by 50 basis points on September 18, 2007. By December 2008, the rate had plummeted to zero.

Did this prevent a stock market crash?

The S&P 500 peaked at about 1,586 in October 2007 before gradually declining to around 1,200 by August 2008. A complete free-fall ensued by September 2008, culminating in a bottom of 666 on March 6, 2009—a staggering decline of 58 percent.

While it’s uncertain whether a similar crash is on the horizon today, the current risks of the stock market, as represented by the S&P 500, are significant. Many investors may not fully grasp the implications of recent market movements and how their portfolios have landed them in the impact zone.

Given that the S&P 500 is market capitalization-weighted, it has become increasingly concentrated. Notably, Apple, Microsoft, Amazon, and Nvidia account for roughly 20 percent of the index’s total market value, mirroring the conditions seen during the dot-com bubble.

Investors holding S&P 500 index funds for their supposed diversification are now heavily exposed to these four speculative tech stocks.

They may feel pleased with the index’s year-to-date returns exceeding 15 percent. However, many of these investors fail to see that such gains come with escalating risks.

Instead of broad diversification across various stocks, 20 percent of their portfolios are now tied up in just four high-flying technology stocks.

As a result, when this rally falters and the market dips, they could find themselves squarely in the impact zone. Are you unknowingly in the impact zone as well?

[Editor’s note: If you found this article insightful, please Subscribe to the Economic Prism.]

Sincerely,

MN Gordon

for Economic Prism

Return from Are You Unknowingly in the Impact Zone? to Economic Prism