Recent Developments in e.l.f. Beauty

Shares of e.l.f. Beauty (NYSE: ELF) experienced a notable increase of 2.8% in morning trading after the company released impressive third-quarter results that exceeded expectations and revised its annual forecast upwards. This growth can be attributed to a 38% year-over-year revenue increase, reaching $489.5 million, alongside earnings per share that surpassed estimated figures.

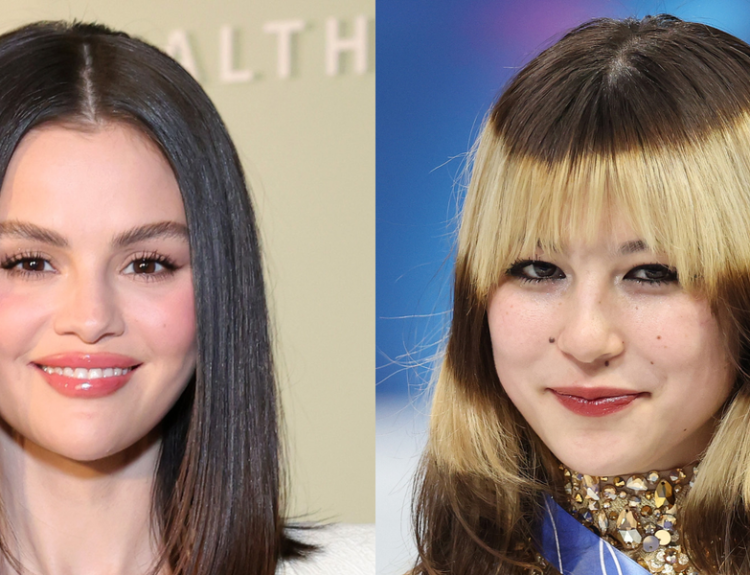

A significant factor contributing to this success was the company’s acquisition of the luxury brand Rhode, created by model Hailey Bieber. The brand made a substantial impact, especially following a record-launch in the United Kingdom. In response to this performance, e.l.f. Beauty’s management has raised its sales and profit projections for the entirety of the fiscal year 2026. This optimistic outlook follows a strong presentation by the company, which showcased its consistent growth over the last decade, marked by an impressive 28 consecutive quarters of net sales growth.

After the initial surge, the shares stabilized at $92.00, reflecting a 1% increase from the previous close.

Are you considering an investment in e.l.f. Beauty? Access our full analysis report here, it’s free.

Market Dynamics and Investor Sentiment

The volatility of e.l.f. Beauty’s shares has been pronounced, with the stock experiencing 41 movements surpassing 5% over the past year. This latest uptick suggests that the market perceives this news as significant, albeit not transformational for its overall outlook on the company.

A major downward shift occurred four months ago when the stock plummeted 32.6% due to mixed third-quarter results for 2025, which disappointed investors and prompted concerns over future financial guidance. Although the adjusted earnings per share of $0.68 exceeded expectations, revenue fell short at $343.9 million. The most troubling revelation was management’s forecast, which projected revenue of $1.56 billion and adjusted EBITDA of $304 million—both considerably below Wall Street estimates. Additionally, the operating margin decreased from 9.3% to 2.2% from the same quarter in the previous year, further heightening investor anxiety.

Despite these fluctuations, e.l.f. Beauty has seen an 18.2% increase since the start of the year. However, trading at $92.00 per share still places it approximately 37.3% below its 52-week high of $146.67 recorded in September 2025. For those who invested $1,000 in e.l.f. Beauty shares five years ago, the current value of that investment would stand at $3,625.

Historically, companies such as Microsoft, Alphabet, Coca-Cola, and Monster Beverage all began as lesser-known growth stories that eventually capitalized on significant trends. We believe we have identified the next big opportunity: a profitable AI semiconductor venture that Wall Street has yet to fully appreciate. Go here for access to our full report, it’s free.

### Conclusion

In summary, e.l.f. Beauty continues to show resilience and growth potential, especially with recent strategic acquisitions and upward revisions in financial guidance. Investors should stay informed and consider market trends while making their investment decisions. As always, research and prudent financial planning are key to navigating the dynamic landscape of stock investments.