The arrival of the New Year is often met with a sense of hope and renewed ambition. It presents an opportunity to reset, pursue dreams, and dedicate ourselves to achieving our goals.

The arrival of the New Year is often met with a sense of hope and renewed ambition. It presents an opportunity to reset, pursue dreams, and dedicate ourselves to achieving our goals.

While this optimism is commendable, the reality is that change can often lead to disappointment, even for those who are most committed.

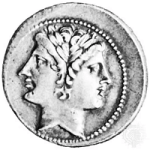

January, named after the Roman deity Janus—who is represented with dual faces—looks both backward and forward. This symbolism serves as a reminder that past decisions, both positive and negative, linger on as we embark on a new year.

Though the calendar marks a fresh start, the remnants of previous actions remain. In the realms of finance and governance, the repercussions of decades of spending decisions and currency devaluation continue to cast a long shadow. The aftermath of these policies significantly affects our day-to-day lives and economic well-being.

As the New Year dawns, the complications from the past do not vanish; instead, they accumulate like layers of refuse in a landfill. The difficulties posed by previous administrations affect our future—the question remains: how will the policies enacted in 2024 affect our jobs, investments, and overall financial health?

Today, let’s focus on one significant issue—a major consequence from 2023 that continues to reverberate.

Stopgap Two-Step

On December 31, 2023, the U.S. national debt reached a staggering $34 trillion. Over the years, many leaders made the questionable choice to allocate funds without adequate public support, essentially deferring financial accountability to future generations—including you.

When challenges are postponed for too long, they inevitably become someone else’s concern. This mindset has dominated Congress for nearly a century. If you were born after 1960, the burgeoning national debt is now your reality.

The recent session of Congress has gifted itself a convenient solution as it transitions into 2024. Last November, lawmakers once again failed to address excessive spending.

Rather than take decisive action, they postponed the hard choices through the passage of a stopgap bill.

This legislation allowed just enough funding to maintain federal operations during the holiday season, ensuring that lawmakers could enjoy their festive celebrations without distractions.

The stopgap bill implemented a two-phase funding approach. The first phase, extending until January 19, focused on essential sectors like military, veterans’ services, transportation, housing, and energy. The remaining government functions were funded only until February 2.

If an agreement is not reached soon, another government shutdown could occur, resulting in federal employees receiving furloughs but being promised back pay once operations resume.

Political Fodder

In truth, establishing permanent furloughs could be beneficial, allowing the government to operate more efficiently without invading every aspect of citizens’ lives while demanding taxes in return.

Numerous bureaucrats with inflated salaries reside in Georgetown, Dupont Circle, and the nearby Virginia suburbs. Shouldn’t they be allowed to transition to other endeavors?

At the Economic Prism, we do not foresee significant changes in 2024. Instead, we expect lawmakers to reach a compromise reducing deficit spending by $1 trillion over the next ten years.

This sounds impressive on paper, but in reality, it means that by 2034, instead of accruing an additional $20 trillion in new debt, the government will only accumulate an additional $19 trillion, while politicians likely secure another pay raise for themselves.

Meanwhile, these negotiations provide ample material for media coverage. For instance, Senate Majority Leader Chuck Schumer recently expressed optimism to reporters about reaching a spending deal to avert a government shutdown.

“We’ve made real good progress. I’m hopeful we can achieve a budget agreement soon, and that avoiding a shutdown is certainly possible,” he stated.

While that may be the case, any resulting agreement will ultimately fall short. We can assure you it will not balance the budget and will continue relying on debt to fulfill its obligations.

As a result, 2024 will starkly highlight the financial struggles facing the U.S. government.

Facing Up to the Wreckage from the Past

Recall that when the stopgap bill was enacted, Moody’s Investor Service downgraded its U.S. credit outlook from ‘stable’ to ‘negative’, although it maintained the U.S. AAA rating.

This decision followed Fitch’s downgrade in the U.S. credit rating from AAA to AA+ and S&P Global Ratings’ action from 2011. Does Moody’s truly believe U.S. credit remains secure?

Clearly, the financial standing of the U.S. government has deteriorated significantly over the last 50 years. Nonetheless, Moody’s continues to evaluate the country’s credit as if its debt profile is stable. Why is that?

By downgrading the credit outlook, Moody’s has set the stage for a potential downgrade in early 2024. Congress’s ability to swiftly enact a new spending resolution will likely influence Moody’s decision. Any delays could lead to an immediate downgrade.

Unfortunately, a downgrade would come far too late to incite genuine concern and will do nothing to compel Washington to balance the budget.

In fact, the pace of deficit spending continues to escalate. As previously noted, the national debt soared to over $34 trillion by the end of 2023, just months after surpassing $33 trillion in September. In less than four months, Washington borrowed an additional trillion dollars.

Here lies the crux of the problem…

If you are a hard-working individual striving to support yourself through your own efforts, you’re likely finding that with time you reap fewer rewards for your labors. Increased taxes will consume a growing portion of your income, while inflation will erode what remains due to deficit spending.

Each New Year presents the challenge of confronting the remnants of past choices, and in 2024, the slate remains as unclean as ever.

[Editor’s note: In light of current economic conditions, innovative investment strategies are more crucial than ever. Discover how to safeguard your wealth and maintain financial privacy by exploring the Financial First Aid Kit.]

Sincerely,

MN Gordon

for Economic Prism

Return from Facing Up to the Wreckage from the Past to Economic Prism