Why SentinelOne’s New AI Security Tools Are Important for Shareholders

SentinelOne (S) has introduced innovative Data Security Posture Management (DSPM) tools within its AI Security Platform. These enhancements aim to mitigate data risks in AI pipelines as businesses increasingly integrate AI into their operations.

For investors, the essential takeaway is that these DSPM features are intended to prevent sensitive or high-risk data from entering AI models from the outset. This proactive approach addresses critical issues such as data memorization and pipeline poisoning before the training process begins.

Explore our latest analysis for SentinelOne.

Despite the recent launch of these products and an upcoming earnings call, SentinelOne’s stock has seen a decline of 17.39% over the past 90 days, contributing to a 44.07% decrease in total shareholder return over the past year. This trend indicates a loss of momentum, even as the company introduces new AI security features.

If SentinelOne’s advancements in AI security pique your interest, it may be worthwhile to examine other developments in this sector through our list of 57 profitable AI stocks that aren’t just burning cash.

With the shares down significantly over the past year and currently trading at a 43% intrinsic discount—approximately 50% below the average analyst target—one must consider whether SentinelOne represents a mispriced AI security play or if the market is already factoring in a slowdown in future growth.

Most Popular Narrative: 34.4% Undervalued

At the last closing price of $13.87, the prevailing narrative estimates SentinelOne’s fair value at around $21.15, utilizing an 8.44% discount rate along with comprehensive long-term projections.

Branching out from endpoint security into adjacent markets, such as cloud security, identity management, and data protection—including the Prompt Security acquisition focused on GenAI risk—unlocks substantial cross-selling opportunities. This strategy is expected to enhance average contract values and diversify revenue streams, setting the stage for significant multi-year revenue growth.

This narrative raises questions about the kind of revenue trajectory and margin increases necessary for that fair value to materialize. The analysis anticipates compound growth, enhanced profitability, and an enriched product mix. The underlying details are what truly make this situation intriguing.

Based on this perspective, SentinelOne is perceived as trading at a sharp discount to an estimated fair value of $21.15, with this gap relying on particular expectations regarding future revenue growth, margin enhancements, and a higher earnings multiple over time.

Result: Fair Value of $21.15 (UNDERVALUED)

Review the complete narrative to understand what lies behind the forecasts.

Nonetheless, this assessment relies heavily on effective execution. Increased dependence on partners and additional costs from acquisitions like Prompt Security could put pressure on margins and disrupt the anticipated growth trajectory.

Learn about the key risks associated with the SentinelOne narrative.

Another Perspective: Insights from the P/S Ratio

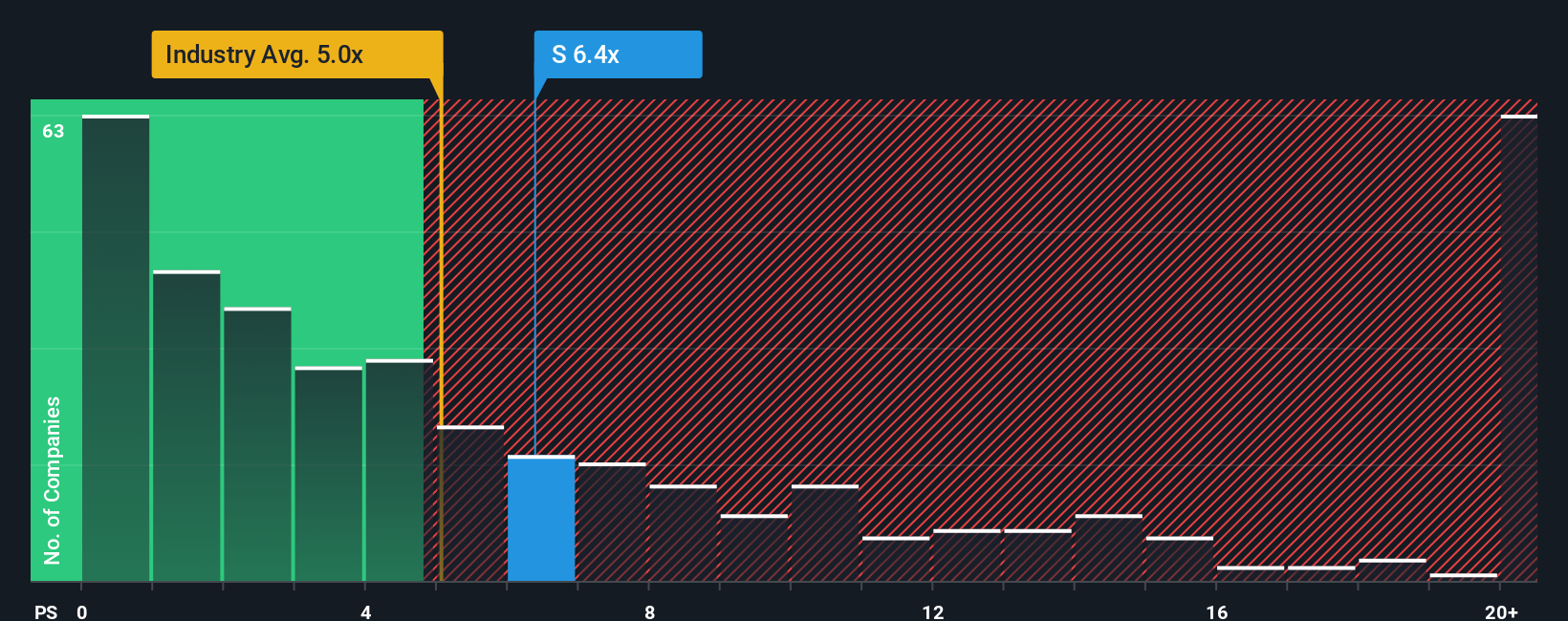

The prevailing narrative and DCF-style fair value calculations indicate that SentinelOne is significantly undervalued. However, the current price-to-sales (P/S) ratio stands at 4.9x, higher than the US Software industry average of 3.6x. It is, nonetheless, below the peer average of 7.1x and close to a fair ratio of 5.2x. This blend of indicators presents both upside potential and valuation risk. Which aspect do you believe the market will prioritize next?

Discover what the numbers reveal about this stock—check out our valuation breakdown.

Create Your Own Narrative Around SentinelOne

If your analysis leads you in a different direction or you wish to challenge your own assumptions, you can easily formulate a new narrative in just a few minutes starting with Customize your approach.

A valuable starting point for your research on SentinelOne includes our analysis, which highlights 2 key rewards and 2 important warning signs that could influence your investment decision.

Seeking Additional Investment Ideas?

If SentinelOne has sparked your interest, don’t stop here. Expanding your watchlist could provide valuable insights that others may overlook.

This article from Simply Wall St is intended for informational purposes only. We present analysis based on historical data and analyst forecasts without financial bias, and it should not be interpreted as financial advice. The content does not constitute a recommendation to buy or sell any stock and does not account for your individual financial goals or circumstances. Our objective is to provide long-term analysis based on fundamental data. Note that our insights might not reflect the latest price-sensitive company updates or qualitative details. Simply Wall St holds no position in any mentioned stocks.

New: Manage All Your Stock Portfolios in One Place

We’ve developed the ultimate portfolio companion for stock investors, and it’s completely free.

• Connect an unlimited number of portfolios and view your total in one currency

• Receive alerts for new warning signs or risks via email or mobile

• Monitor the fair value of your stocks

Do you have feedback on this article? Concerned about the content? Contact us directly. Alternatively, you can email editorial-team@simplywallst.com.