AI SPLURGE: The Four Major US Tech Giants Shed Over $950 Billion in Value Amidst Ambitious Spending Plans

In a remarkable turn of events, the four leading technology companies in the United States have collectively announced plans to invest approximately $650 billion this year. This substantial financial commitment is aimed at developing new data centers and acquiring the necessary equipment, all fueled by their ambition to excel in the emerging market for artificial intelligence (AI) tools.

The spending projections from Alphabet Inc, Amazon.com Inc, Meta Platforms Inc, and Microsoft Corp mark an unprecedented boom in capital expenditures, one that has not been seen in this century. Notably, each company’s spending forecasts for this year are expected to either meet or exceed their combined budgets from the past three years. According to Bloomberg data, these figures would establish a record for capital spending by a single corporation in over a decade.

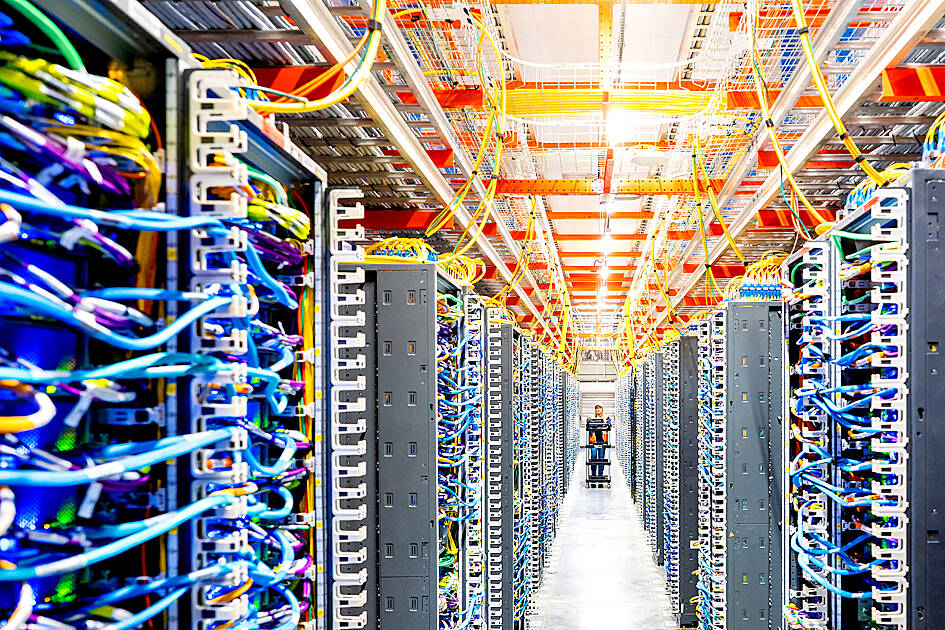

Photo: Reuters

This surge in expenditures, representing an estimated 60 percent increase from the previous year, heralds a new wave of data center construction worldwide. It also signifies a financing boom required to support these ambitious projects. The mad dash to establish expansive facilities filled with servers powered by costly processors has led to record levels of borrowing. Simultaneously, it has raised concerns among communities regarding soaring power and water costs.

Such concentrated spending by a small group of affluent companies could potentially distort key economic indicators such as construction spending, GDP, durable goods, and employment reports. As a result, the overall economy might appear healthier than it truly is.

According to DA Davidson & Co analyst Gil Luria, the four tech giants are engaged in a race where AI computing resources may become a winner-takes-all market. “And none of them is willing to lose,” he remarked.

On January 28, Meta announced that its full-year capital expenditures could rise to $135 billion, reflecting a staggering 87 percent increase. In the same vein, Microsoft reported a 66 percent surge in its second-quarter capital spending, surpassing estimates, and is projected to spend nearly $105 billion in capital for the fiscal year ending in June. This announcement caused a significant one-day drop in its market value.

Just last week, Alphabet startled investors with a forecast for capital expenditures that exceeded analyst expectations, projecting a spend of up to $185 billion. Amazon then raised the bar even higher, announcing a planned $200 billion in capital expenditures, further impacting its share price.

Since releasing their most recent earnings and forecasts, the four companies have collectively experienced a loss exceeding $950 billion in market value. In stark contrast, companies producing AI computing hardware, such as Nvidia Corp, Advanced Micro Devices Inc, and Broadcom Inc, have seen their valuations rise.

While each tech giant has outlined unique strategies for recovering their investments, they share a common belief: tools like OpenAI’s ChatGPT and similar technologies will play increasingly significant roles in both professional and personal spheres. However, constructing the advanced software models fueling this transition is a costly endeavor that requires connecting thousands of highly-priced chips, leading to expansive bills. These investments are predicated on the promise of much greater revenues in the future.

As spending climbs, uncertainty lingers regarding whether these companies can achieve their ambitious goals. With the data center expansion intensifying, competition is heating up for limited resources, such as electricians, cement trucks, and Nvidia chips from Taiwan Semiconductor Manufacturing Co.

“There are and will be bottlenecks,” Luria warned.

Moreover, the financial sustainability of these expenditures raises additional questions. Companies like Meta and Google, which predominantly generate revenue from digital advertising; Amazon, the largest online retailer and cloud service provider; and Microsoft, a leader in business software, possess substantial cash reserves. Their willingness to invest heavily in an AI-driven future could test both their financial cushions and investors’ patience.

Theory Ventures LLC founder Tomasz Tunguz, who previously worked at Google and has drawn parallels between the current AI boom and past investment frenzies, noted that such rapid expansions do not always end favorably. Nevertheless, he acknowledged that these companies are significant economic catalysts in the interim.

In conclusion, the ambitious financial commitments made by these tech giants underscore their determination to lead in the rapidly evolving AI sector. However, as they navigate this unprecedented investment landscape, the sustainability of their plans and the broader economic implications will remain crucial areas of interest.