This is Naked Capitalism fundraising week. So far, 101 supporters have stepped up to assist our mission of fighting against corruption and exploitative practices, especially in the financial sector. We invite you to join this cause through our donation page, where you can find options to contribute via check, credit card, debit card, PayPal, Clover, or Wise. Learn about the purpose of this fundraiser, our achievements over the past year, and our current aim of enhancing our IT infrastructure.

Yves here. It’s been a while since we last asked our readers about their economic experiences. Given the recent revision to GDP figures, it seems timely to gauge the situation. While anecdotal evidence isn’t equivalent to hard data, it can help clarify puzzling trends.

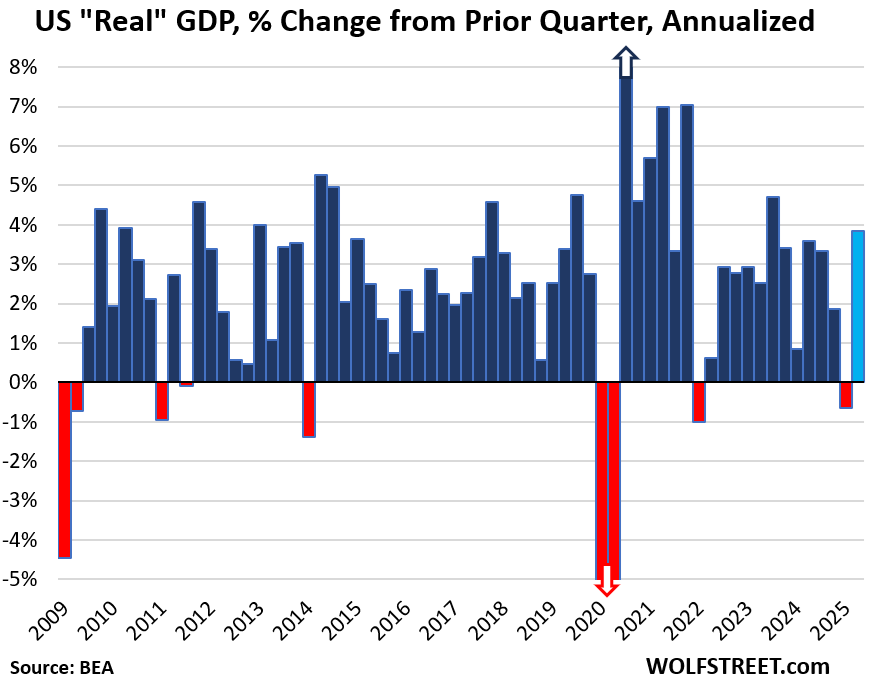

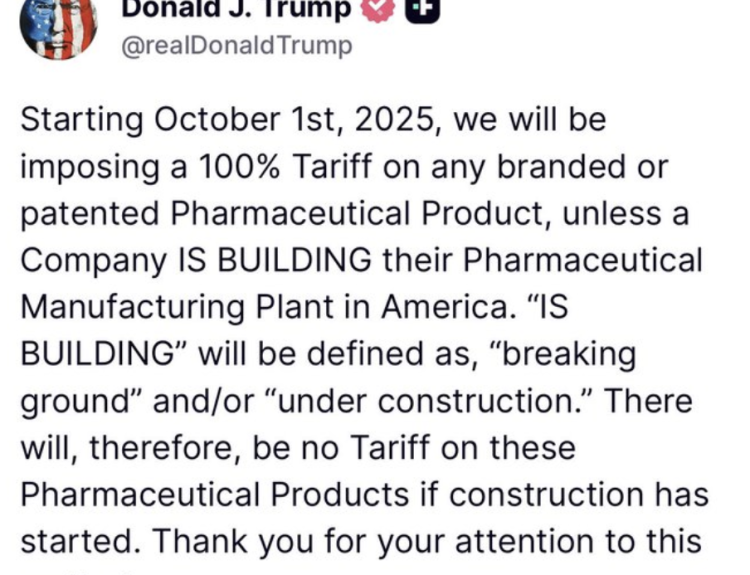

The most striking discrepancy is the remarkably upbeat 3.8% GDP growth for the second quarter, which has been adjusted upward from an initial estimate of 3%. This stands in sharp contrast to the sluggish job growth we’re witnessing. It also seems at odds with numerous reports—both from the media and our readers—indicating that many small businesses are grappling enormously with tariffs, which have hindered their ability to sell products at previous price points, left them struggling to find reliable domestic suppliers, and caused revenue declines that threaten their survival.

Moreover, growth in the U.S. economy appears increasingly dependent on spending at the upper end of the income scale. However, there are signs that this segment is not performing well, from luxury retailers experiencing downturns to a notable decline in art sales.

This situation might mirror the stock market, where a few companies are buoyed by inflated AI valuations. Despite vast investments in AI, as Ed Zitron has detailed, these ventures have yet to translate into significant revenue. Is there hidden strength in other sectors that could offset the overall lack of growth?

By Wolf Richter, editor at Wolf Street. Originally published at Wolf Street

Government consumption and inventories were a larger detriment, adjusted for inflation.

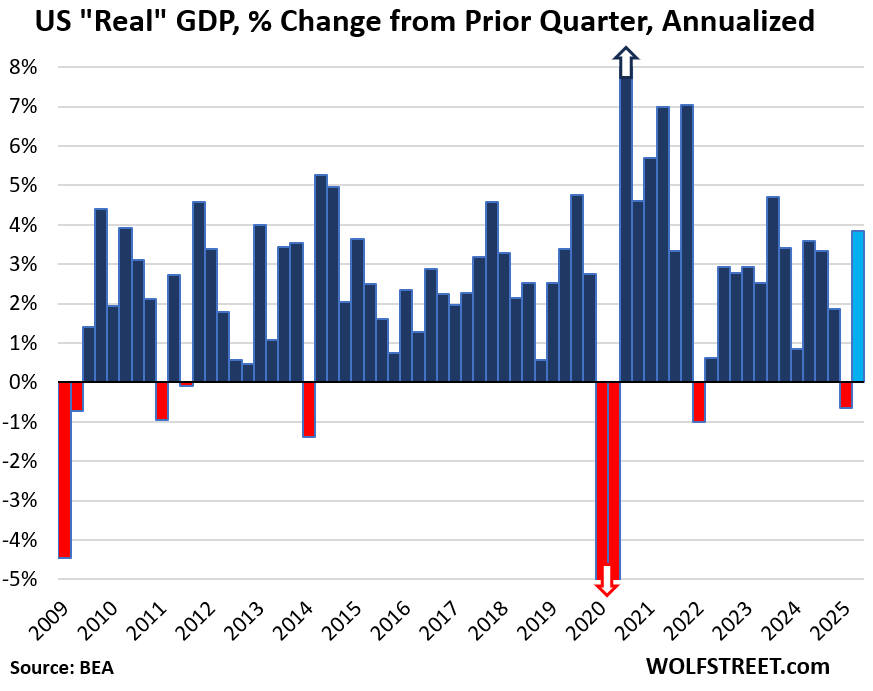

On July 30, the “advance estimate” of GDP for Q2 indicated 3.0% growth, which was constrained by weak consumer spending and falling inventories. The subsequent “second estimate,” released on August 28, revised the GDP growth for Q2 upward to 3.3%.

Today, the “third estimate” has raised the Q2 GDP growth to 3.8%, the fastest acceleration since Q3 2023, primarily driven by increased consumer spending. This rate is noteworthy, given that the average GDP growth over the past decade has been just over 2%. All figures are adjusted for inflation.

The “first estimate” of GDP growth typically garners the most media attention, while revisions often go unnoticed. Hence, I will contrast today’s “third estimate” with the “first estimate,” particularly due to the substantial cumulative revisions.

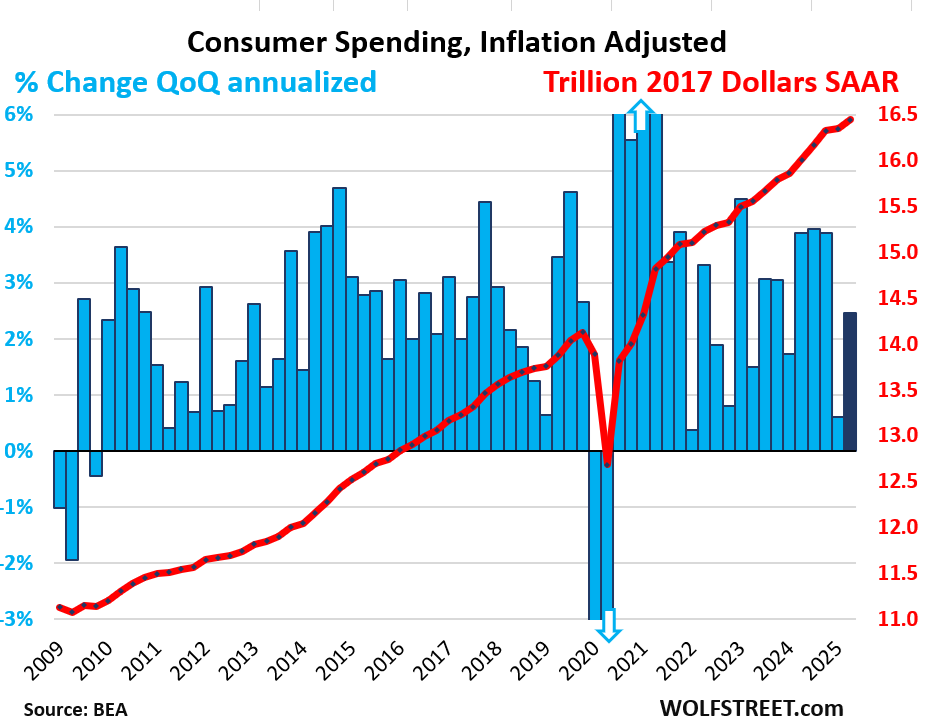

Consumer spending growth has been revised upward to +2.5% for Q2. The initial estimate set consumer spending growth at a concerning 1.4%, which was later adjusted to 1.6%. Today’s substantial upward revision to +2.5%, nearly doubling the first estimate, was the primary contributor to the improved overall GDP growth (all adjusted for inflation).

This 2.5% indicates healthier growth in consumer spending. The red line tracks annualized consumer spending in 2017 dollars (right scale), while the blue bars display the corresponding growth rate in percentage (left scale).

Private fixed investment growth was revised upward to 4.4% from the anemic 0.4% in the initial estimate. This positive revision significantly bolstered the overall GDP growth:

- Investment in equipment was adjusted to +8.5%

- Investment in intellectual property grew to +15.0%.

- Investment in structures, which initially plummeted by 10.3%, was revised to a less severe decline of -7.5% today.

However, residential fixed investment, which includes the construction of single-family and multifamily homes, was initially estimated to decline by -4.6% but has now worsened to -5.1% in the latest revision, which dampened the up-revision of private fixed investment.

Revisions That Depressed Overall Figures Compared to the First Estimate:

Net exports (exports minus imports) were revised downward:

- Imports dipped slightly less, falling -29.3% compared to the initial estimate of -30.3% (imports negatively impact GDP).

- Exports declined by 1.8%, consistent with the first estimate (exports positively impact GDP).

Government consumption contracted by 0.1% across federal, state, and local levels, in contrast to an increase of 0.4% in the first estimate.

The drop in private inventories worsened and subtracted 3.44 percentage points from GDP growth, compared to 3.17 percentage points in the initial estimate. Inventories surged in Q1 due to tariff-related anticipations, and in Q2, they reversed some of that increase.

What Slowdown?

The strong Q2 growth followed a first quarter marked by a spike in imports that pushed GDP growth into negative territory (-0.6%). Moreover, consumer spending in Q1 was weak, prompting many concerns about growth. The first estimate of Q2 consumer spending growth (+1.4%) did little to ease these worries.

However, the revised Q2 figures, particularly the upward revisions in consumer spending back into a healthier range, should alleviate these apprehensions.

Looking ahead, preliminary data for Q3 indicates promising consumer spending trends, as evidenced by strong retail sales in July and August. Perhaps the anticipated downturn in the economy, despite reduced government spending, may be postponed a bit longer.