LONDON — As the world anticipates the excitement of soccer’s World Cup in 2026, major brewers and their investors are optimistic about overcoming recent challenges. They are banking on a shift towards soft drinks and the upcoming global event to bolster their fortunes during a turbulent economic landscape marked by geopolitical issues and health-conscious consumer trends.

Heineken recently disclosed plans to eliminate up to 6,000 jobs over the next two years. Similarly, Carlsberg has cautioned about another difficult year for consumer spending and trade-related challenges, while Budweiser-maker Anheuser-Busch InBev reported its lowest profit growth since 2020. All three companies have experienced a decline in sales volumes.

Despite these setbacks, shares in the three largest European brewers—boasting a combined annual revenue of $114 billion—have risen, as investors project that 2026 will be less challenging than 2025.

AB InBev CEO Michel Doukeris expressed optimism during an investor call on February 12, highlighting the anticipated boost from events like the June-July soccer World Cup across the U.S., Mexico, and Canada, as well as the rapid growth in non-beer and low-alcohol beverages.

Doukeris also noted that difficulties in crucial markets such as China and Brazil, which had experienced sales issues due to adverse weather, are beginning to improve, paving the way for a better outlook in 2026 following “a very complicated” 2025.

After a steep decline in beer sales in 2025 exacerbated a trend of stagnant growth, Heineken’s beer volumes fell by 8.6 percent, while AB InBev’s dropped by 6.5 percent and Carlsberg’s decreased by more than 3 percent since 2022.

Analysts anticipate a potential recovery in beer sales, projecting an average growth of 0.4 percent for AB InBev, 1.1 percent for Heineken, and 3 percent for Carlsberg this year. “Overall, I believe 2026 could see much better volume growth,” commented Javier Gonzalez Lastra, an analyst at Berenberg, adding that 2025 was “pretty horrific” for Heineken.

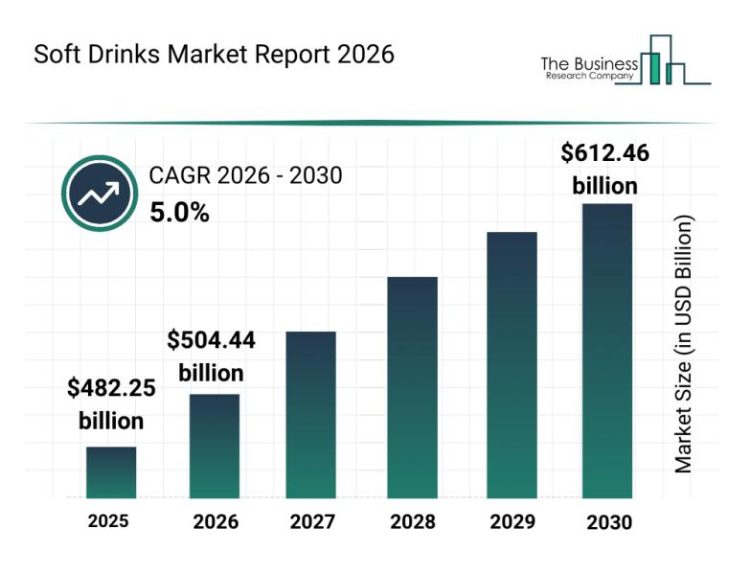

Carlsberg has also made significant strides through its strategic expansion into non-beer beverages, notably with its $4.2 billion acquisition of soft drink company Britvic, which has helped mitigate the impact of declining beer demand.

Key Takeaways

- Major brewers are optimistic about overcoming economic challenges by capitalizing on events like the 2026 World Cup.

- Heineken plans to reduce its workforce by up to 6,000 jobs in the coming years.

- Carlsberg and AB InBev have recently reported declines in sales volumes.

- Analysts predict modest growth in beer volumes this year.

- Carlsberg’s acquisition of Britvic has boosted its diversification into non-beer beverages.

FAQ

What are the major challenges facing these brewers?

Brewers are grappling with geopolitical issues, shifting consumer preferences towards health-conscious products, and economic downturns impacting spending.

What is the expected impact of the 2026 World Cup on beer sales?

The World Cup is anticipated to drive sales and marketing opportunities for major brewers, potentially enhancing their overall financial performance.

How have the brewers performed in recent years?

The brewers have faced declining sales volumes and profit growth, particularly in 2025, but are hopeful for a turnaround in the coming year.