The soft drinks packaging market is a cornerstone of the global beverage industry, encompassing carbonated drinks, juices, flavored water, energy drinks, and ready-to-drink teas and coffees. Today, packaging goes beyond mere containment and transportation; it has become essential for branding, sustainability, consumer convenience, and efficient supply chains. Manufacturers are prioritizing lightweight, recyclable materials and innovative designs that enhance shelf appeal while minimizing environmental impact. The emphasis on eco-friendly packaging and adherence to regulatory standards has sped up material innovation across various formats, including plastic bottles, aluminum cans, glass bottles, and paper-based cartons.

One Click to Access Your Free Sample Report : https://www.persistencemarketresearch.com/samples/36068

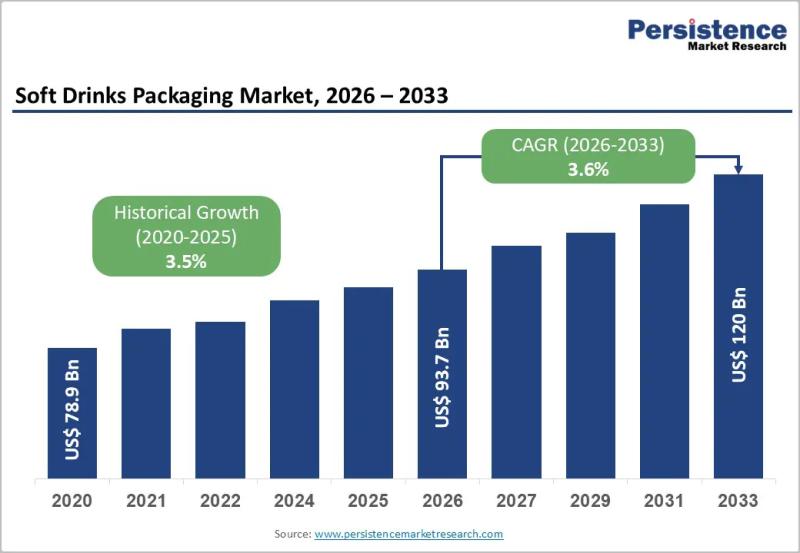

The global soft drinks packaging market is projected to reach a valuation of US$93.7 billion by 2026 and is anticipated to expand to US$120.0 billion by 2033, exhibiting a CAGR of 3.6% from 2026 to 2033. This growth is driven by increasing sustainability regulations, a rising shift towards recyclable materials, and a sustained demand for convenient single-serving formats. Among packaging options, PET bottles continue to lead the market due to their lightweight characteristics, cost efficiency, and compatibility with high-speed filling lines. The Asia Pacific region is expected to dominate the market as urbanization increases and the middle class expands, leading to rising consumption of packaged beverages alongside robust manufacturing capabilities.

Key Highlights from the Report

✦ The market is projected to grow from US$93.7 billion in 2026 to US$120.0 billion by 2033 at a CAGR of 3.6%.

✦ Sustainability regulations are reshaping material selection and packaging design strategies.

✦ PET bottles continue to dominate due to cost-effectiveness and recyclability improvements.

✦ Aluminum cans are gaining traction in premium and energy drink categories.

✦ Asia Pacific leads global demand driven by rising beverage consumption and urbanization.

✦ Single serve and on-the-go packaging formats are supporting steady volume growth.

Market Segmentation Analysis

The soft drinks packaging market is segmented based on material type and application, significantly influencing its performance. By packaging type, it includes bottles, cans, cartons, pouches, and others. PET bottles account for a substantial share due to their durability, transparency, and lightweight nature. Cans, particularly aluminum, are popular for carbonated beverages and energy drinks due to their superior barrier properties and recyclability. Cartons are preferred for juices and flavored drinks, offering extended shelf life and eco-friendly benefits. Flexible pouches are gradually making inroads into niche beverage segments, enhancing portability and reducing material consumption.

From a materials perspective, the market is divided into plastic, metal, glass, and paperboard. Plastic packaging, especially PET and recycled PET, dominates thanks to its cost efficiency and scalability. However, the move towards circular economy models is fostering growth in recycled content plastics and biodegradable alternatives. Metal packaging, primarily aluminum cans, sees increasing adoption due to its high recycling rates and premium perception. Meanwhile, glass is preferred for carbonated soft drinks and specialty beverages where product integrity and brand positioning are essential. End-user segmentation includes carbonated soft drinks, juices, bottled water, sports drinks, and energy drinks, with carbonated soft drinks keeping the largest market share due to consistent global consumption.

Make This Report Fit Your Needs – Customize Now : https://www.persistencemarketresearch.com/request-customization/36068

Regional Insights

Asia Pacific dominates the soft drinks packaging market owing to rapid urban growth, rising disposable incomes, and expanding retail sectors. Countries in this region are experiencing strong growth in the consumption of carbonated beverages, bottled water, and energy drinks. The presence of large beverage manufacturers and contract packaging companies bolsters the local supply chain. Moreover, government initiatives promoting recycling and waste management significantly influence packaging innovation and material choice.

North America is characterized as a mature but stable market, driven by sustainability efforts and premium beverage trends. Beverage companies in this region are increasingly investing in lightweight packaging and recycled materials to align with regulatory and consumer expectations. Europe stands out for its stringent environmental regulations and high recycling targets, fostering the shift towards circular packaging solutions. Meanwhile, Latin America and the Middle East & Africa are emerging markets where urbanization and retail development are gradually boosting demand for packaged soft drinks and related packaging solutions.

Market Drivers

The tightening of sustainability regulations is a significant driving force in the soft drinks packaging market. Governments globally are enacting policies aimed at reducing plastic waste, enhancing recycling rates, and encouraging the use of recycled materials. Beverage companies are responding by redesigning packaging to incorporate recycled PET, lightweight bottles, and materials that can be easily recycled. This regulatory push is fueling innovation and investments in sustainable packaging technologies.

The continuous demand for convenience and single-serve formats also propels this market. Today’s consumers prefer portable, resealable, and lightweight packaging suitable for on-the-go consumption. Single-serve bottles and cans align well with busy lifestyles and the patterns of urban consumption. The growth of quick-service restaurants, convenience stores, and e-commerce beverage sales is further driving the demand for effective and durable packaging formats that maintain product quality during transport and storage.

Market Restraints

Despite its steady growth, the soft drinks packaging market encounters challenges tied to environmental concerns and material costs. Plastic packaging faces criticism for contributing to waste and ocean pollution. While recycling initiatives are gaining momentum, the collection and processing infrastructure varies across regions, limiting circular economy strategies. Additionally, fluctuations in raw material prices, particularly for petroleum-based plastics and aluminum, affect production costs. Manufacturers must navigate the balance between cost management and sustainability investments, impacting their margins. Furthermore, shifting consumer preferences toward healthier beverage options and reduced sugar intake may indirectly influence overall consumption patterns, affecting packaging demand.

Market Opportunities

Significant opportunities arise in the pursuit of advanced sustainable materials. Innovations such as bio-based plastics, compostable packaging, and high recycled content containers are gaining traction. Companies that can effectively introduce environmentally responsible packaging without sacrificing performance or affordability are likely to establish competitive advantages.

Moreover, digital printing and smart packaging technologies present promising growth prospects. Features like QR codes, interactive labels, and traceability enhance consumer engagement and brand transparency. Lightweighting strategies and refillable packaging systems further contribute to cost savings and environmental objectives. Emerging economies with developing beverage markets offer additional avenues for packaging manufacturers seeking new revenue opportunities.

Get Instant Access – Complete Your Purchase : https://www.persistencemarketresearch.com/checkout/36068

Company Insights

• Amcor plc

• Ball Corporation

• Crown Holdings Inc

• Tetra Pak International SA

• Ardagh Group SA

• Berry Global Inc

• Mondi Group

• Owens Illinois Inc

Recent developments in the soft drinks packaging market reflect ongoing trends. In March 2024, major beverage packaging suppliers launched high recycled content PET bottles aimed at meeting sustainability targets. October 2023 saw several global packaging companies announce plans to expand aluminum can production capacity in response to surging demand for energy drinks and premium soft drink options.

Future Outlook and Strategic Perspective

The soft drinks packaging market is poised for a transformative phase, characterized by commitments to sustainability, regulatory compliance, and innovations in materials and design. While a moderate CAGR of 3.6% indicates market maturation, growth toward US$120.0 billion by 2033 underlines ongoing relevance and resilience. The integration of recycled content, circular economy models, and lightweight packaging solutions will dictate competitive strategies across the supply chain.

As beverage companies navigate the balance between environmental responsibility and consumer convenience, packaging will remain a critical lever for growth. Manufacturers that align with sustainability standards, invest in advanced production technologies, and respond to regional demand trends are well-positioned to seize evolving opportunities in the global soft drinks packaging market.

Key Takeaways

- The global soft drinks packaging market is projected to grow from US$93.7 billion in 2026 to US$120.0 billion by 2033.

- Increasing sustainability regulations are reshaping how companies approach packaging materials and design.

- PET bottles dominate the market due to their lightweight and recyclable properties.

- Asia Pacific is anticipated to lead market growth driven by urbanization and rising middle-class consumption.

- Consumer preference for convenience is boosting demand for single-serve and on-the-go packaging formats.

FAQ

What are the main drivers of growth in the soft drinks packaging market?

The main drivers include tightening sustainability regulations, growing consumer demand for convenience, and the shift towards recyclable materials.

How is sustainability influencing packaging design?

Sustainability is pushing manufacturers to adopt eco-friendly materials, redesign for recyclability, and invest in alternative, sustainable packaging solutions.

Which packaging types are most popular in the soft drinks market?

PET bottles and aluminum cans are currently the most popular, favored for their lightweight, durability, and recyclability.

Read More Related Reports :

Japan Disposable Cutlery Market : https://www.persistencemarketresearch.com/market-research/japan-disposable-cutlery-market.asp

Dioctyl Adipate Market : https://www.persistencemarketresearch.com/market-research/dioctyl-adipate-market.asp

PDC Drill Bits Market : https://www.persistencemarketresearch.com/market-research/pdc-drill-bits-market.asp

Contact Us:

Persistence Market Research

Second Floor, 150 Fleet Street,

London, EC4A 2DQ, United Kingdom

USA Phone: +1 646-878-6329

UK Phone: +44 203-837-5656

Email: sales@persistencemarketresearch.com

Web: https://www.persistencemarketresearch.com

About Persistence Market Research:

At Persistence Market Research, we specialize in creating research studies that serve as strategic tools for driving business growth. Established as a proprietary firm in 2012, we have evolved into a registered company in England and Wales in 2023 under the name Persistence Research & Consultancy Services Ltd. We have completed over 3600 custom and syndicate market research projects and delivered more than 2700 projects for other leading market research companies’ clients.

Our approach combines traditional market research methods with modern tools to offer comprehensive research solutions. With a decade of experience, we pride ourselves on deriving actionable insights from data to help businesses stay ahead of the competition. Our client base spans multinational corporations, leading consulting firms, investment funds, and government departments. A significant portion of our sales comes from repeat clients, a testament to the value and trust we’ve built over the years.

This release was published on openPR.