In recent days, Okta (OKTA) has captured attention following the launch of new Agent Discovery tools designed to identify unauthorized AI agents in corporate settings. This development places AI security and identity governance at the forefront of investment discussions.

Explore our latest analysis for Okta.

Despite the introduction of these AI-centric security solutions and a strengthened partnership with the PGA of America, Okta has seen a one-year total shareholder return of -10.08%. This is particularly striking when contrasted with a 90-day return of +8.95% and a three-year total shareholder return of +20.91%. This trend hints at an upward momentum after enduring a more significant decline of 67.75% over the past five years.

If Okta’s advancements in AI security pique your interest, now might be an excellent opportunity to explore additional AI-related stocks. You can start with our list of 58 profitable AI stocks that are not just burning cash.

With Okta’s shares currently priced at $87.26, indicating an intrinsic value gap of approximately 36% and a notable discount compared to analyst targets, an important question arises: does this indicate a true mispricing, or is the market anticipating future growth?

Most Popular Narrative: 41% Undervalued

The prevalent narrative from Tokyo suggests a fair value of $147.87 for Okta, compared to its last closing price of $87.26, highlighting a significant valuation gap that investors are closely examining.

Okta possesses a solid foundation: a technically sophisticated solution, a strong market presence, and a recurring revenue model. Yet, for it to achieve true success, Todd McKinnon must embrace strategic risks and further evolve the business model. Merely having a superior solution isn’t enough; the business model must address a customer’s “problem” so effectively that they are willing to pay for it—and profitably. Both CrowdStrike and Okta present exciting opportunities in this context. A deeper collaboration or even a merger could fortify both companies, creating a market leader with a lasting influence on the security sector. The subsequent steps are challenging but crucial; Todd McKinnon and Okta have the chance to transform into a sustainable and profitable organization. It’s essential to grasp this opportunity.

Wondering how this narrative transitions from today’s share price to a higher fair value? It heavily relies on improved margins, enhanced profit profiles, and an expected future earnings multiple that assumes Okta will evolve into a more efficient identity platform. The complete analysis details these assumptions with clear financial projections.

Result: Fair Value of $147.87 (UNDERVALUED)

Dive into the full narrative to understand the forecasts in detail.

However, achieving this valuation hinges on Okta maintaining recent revenue and net income growth while also mitigating pressure on retention trends and identity security expenditures.

Discover the key risks to this Okta narrative.

Another Perspective: Earnings Multiple Reverses the Scenario

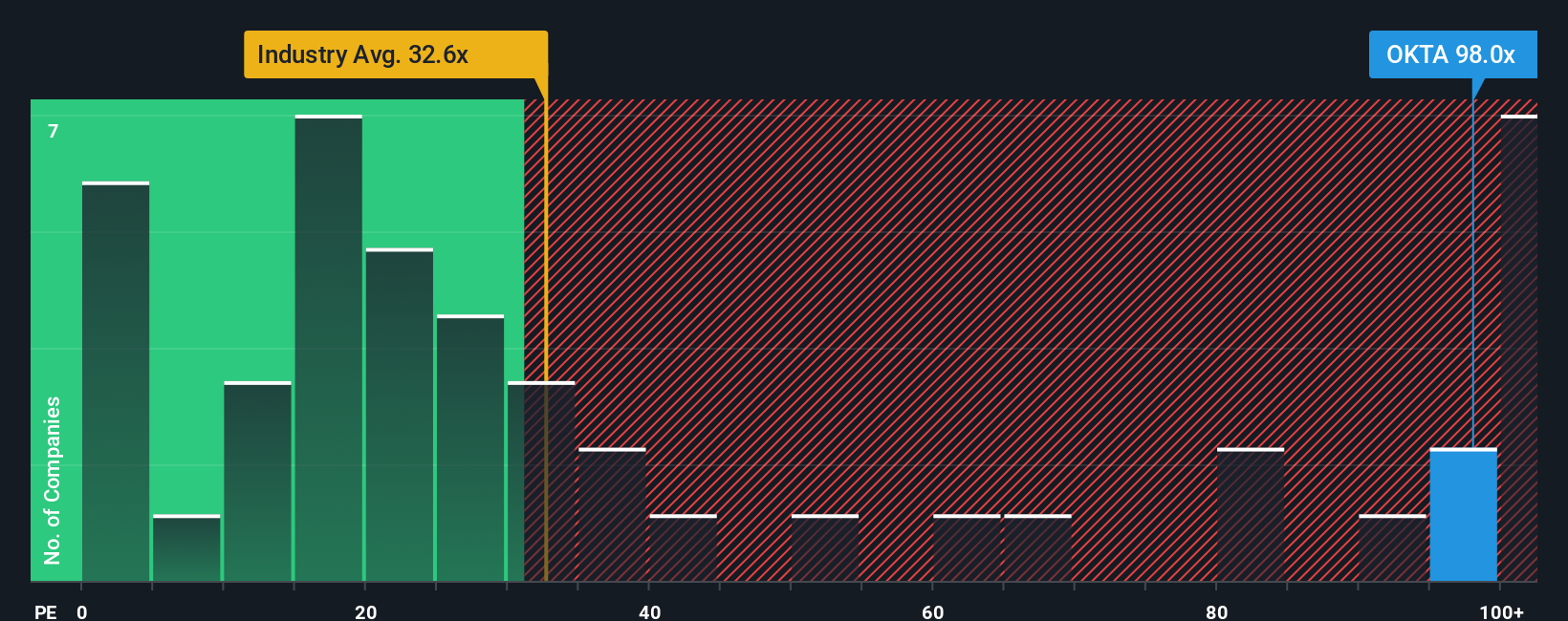

While both Tokyo’s fair value narrative and our model-based evaluation indicate that Okta appears undervalued based on cash flows, its current P/E ratio of 79.3x presents a contrasting picture. This figure is significantly above the IT industry average of 23.2x, the peer average of 31.3x, and even the 35.1x fair ratio suggested by our models. This begs the question: is the discount genuine, or has the earnings multiple already factored in high expectations?

See our valuation breakdown for insights on this pricing.

Next Steps

Faced with mixed signals regarding valuation and growth expectations, it is beneficial to act promptly and assess the story against your own comfort level with the data. To gauge what the market is optimistic about, consider our assessment of 3 key rewards.

Searching for Additional Investment Ideas?

If Okta has sparked your curiosity, do not stop here. Leverage this momentum to seek out other opportunities that align with your strategy before the market shifts.

- Explore potential value plays by reviewing our 55 high-quality undervalued stocks that combine strong fundamentals with prices that may not yet reflect their true value.

- Enhance your focus on income by checking out 13 dividend fortresses that center around companies providing yields over 5%, emphasizing resilience.

- Mitigate your risk by exploring 82 resilient stocks with low risk scores, which highlight businesses with lower risk profiles to help minimize unexpected surprises.

This article by Simply Wall St is general in nature. We offer commentary based on historical data and analyst forecasts using an unbiased approach, and our articles are not intended as financial advice. It does not constitute a recommendation to buy or sell any stock and does not consider your individual objectives or financial situation. We aim to deliver long-term focused analysis driven by fundamental data. Please note that our analysis may not reflect the latest price-sensitive company announcements or qualitative material. Simply Wall St holds no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener analyzes the market daily to identify opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High-growth Tech and AI Companies

Or create your own screen using over 50 metrics.

Have feedback on this article? Concerned about the content? Contact us directly. Alternatively, email editorial-team@simplywallst.com