Traders work on the floor at the New York Stock Exchange (NYSE) in New York City, U.S., February 11, 2026.

Brendan McDermid | Reuters

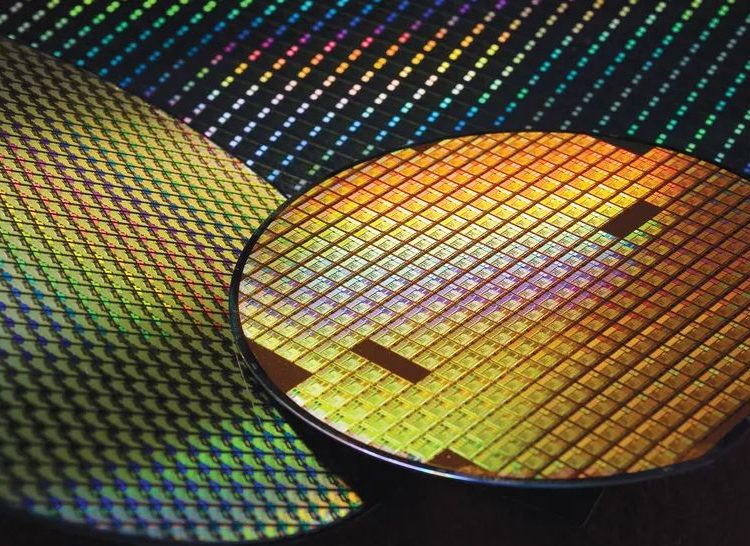

On Thursday, stock prices fell as investors expressed concerns about the potential negative impacts of artificial intelligence (AI) advancements. Many worry that these developments could disrupt entire industries and lead to increased unemployment.

The Dow Jones Industrial Average declined by 530 points, or 1.1%, largely driven down by Cisco Systems, whose shares plummeted 11% following disappointing guidance for the quarter. The S&P 500 also fell 1.1%, while the Nasdaq Composite dropped 1.5%.

Dow Jones Industrial Average, 1-day

This year, several segments of the stock market have been pressured following the introduction of AI tools that may replicate their business operations or erode their profit margins.

Financial institutions like Morgan Stanley faced declines as fears arose that AI could disrupt wealth management services. Meanwhile, shares of logistics and trucking companies like C.H. Robinson plummeted 22%, fueled by concerns that AI could enhance freight efficiencies and undermine certain revenue streams.

Concerns surrounding AI disruption have even extended to the real estate market, negatively impacting stocks such as CBRE and SL Green Realty due to worries that rising unemployment could reduce demand for office spaces.

Software stocks—a sector already struggling with disruption concerns—furthered their losses this year, with Salesforce shares dropping 2%. This stock has now fallen more than 31% year-to-date. Furthermore, shares of Autodesk decreased by over 5%, making its year-to-date drop 26%. The iShares Expanded Tech-Software Sector ETF (IGV) fell 3%, placing it about 32% below its recent peak.

Investment strategist Ross Mayfield from Baird commented, “This is primarily a crowd psychology issue. It’s sell first and analyze later, ensuring that no one gets left holding the bag. Capital that is exiting software has other destinations.”

A downturn in silver, which has gained popularity among retail investors this year, added to Thursday’s risk-averse sentiment. Silver futures plunged by 9%.

In the face of uncertainty, investors turned to more reliable sectors of the market. Stocks of Walmart and Coca-Cola saw increases of 3% and 2%, respectively. Overall, consumer staples and utility sectors led gains among the S&P 500, both rising over 1%.

The previous session concluded with stocks lower, following a brief rally sparked by a strong jobs report. However, doubts arose regarding whether this would signify a consistent increase in employment, particularly as revisions indicated no job growth in the latter half of 2025.

Traders are now preparing for an important inflation report on Friday. Economists surveyed by Dow Jones anticipate that January Consumer Price Index (CPI) will exhibit a 0.3% increase in both headline and core metrics, excluding food and energy prices.

Mayfield noted, “The CPI number carries less weight now following the positive jobs report, as it suggests the Fed can afford to pause their actions for an extended period. If CPI surprises to the upside, there would be a couple of months of data that investors can analyze before the Fed makes a firm decision.” Conversely, if the data comes in lower than expected, he predicts Friday could turn out to be a day favoring riskier investments, though it would require a significant negative figure to notably influence equity markets and federal fund futures.