Understanding the Financial Landscape: A Look at Beauty Health’s Recent Performance

Whether you’re new to investing or a seasoned enthusiast, keeping an eye on the companies in your portfolio is vital for informed decision-making. In recent weeks, Beauty Health Company (NASDAQ:SKIN) has experienced significant fluctuations in its share price, triggering important discussions among investors. This article delves into the company’s recent performance, focusing on what the latest developments mean for its future.

Recent Performance Overview

Beauty Health’s stock has seen a notable decline of 30% over the past month, reversing earlier gains. For those who held shares over the last year, this drop translates to a 35% decrease in value. This shift in price raises questions about the company’s revenue performance and overall prospects, leading many to assess its future potential.

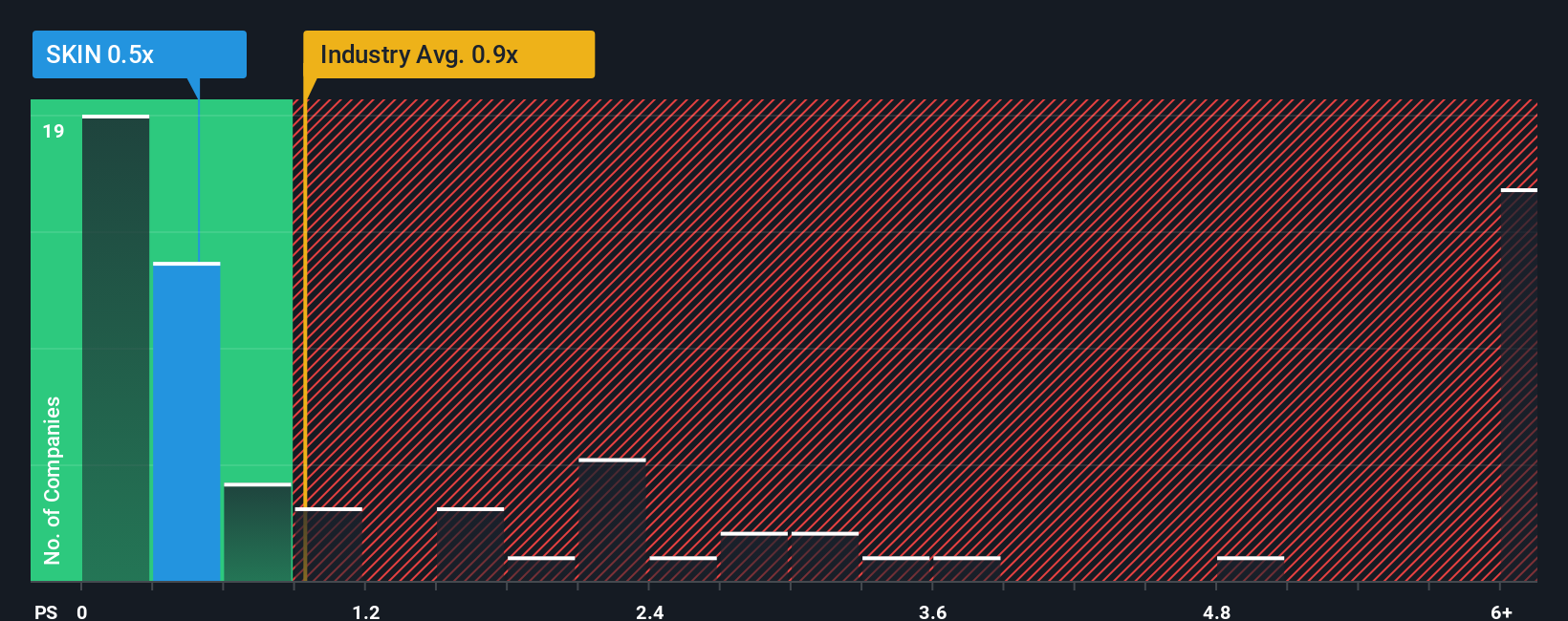

NasdaqCM:SKIN Price to Sales Ratio vs Industry (February 12th, 2026)

Analyzing the Price-to-Sales Ratio

A significant factor in evaluating a company’s prospects is its price-to-sales (P/S) ratio. For Beauty Health, this ratio stands at 0.4x, considerably lower than many competitors within the Personal Products industry, where P/S ratios commonly exceed 1x. While this disparity may seem attractive to potential investors, it’s crucial to understand the underlying factors contributing to this low ratio.

Revenue Trends and Expectations

Despite the alluring P/S ratio, Beauty Health has not enjoyed strong revenue performance. The company’s revenue has fallen by 13% over the past year, raising concerns about future growth. Comparatively, the industry is expecting annual growth of around 4.8%, while Beauty Health is projected to grow at a modest 3.0% in the coming years.

Such data suggests that many investors may be skeptical about Beauty Health’s ability to rebound and meet growth expectations, which is likely impacting its share price.

Implications of the Low P/S Ratio

The recent decline in Beauty Health’s share price has pulled its P/S ratio below that of its industry peers. While the P/S ratio can illuminate a company’s growth potential, relying solely on this metric for investment decisions isn’t advisable.

Beauty Health’s low P/S ratio may indicate market skepticism regarding the company’s forecasted revenue growth. In times of uncertainty, investors tend to seek more stable options that promise better returns.

Risk Factors to Consider

Investment inherently carries risks, and Beauty Health is no exception. Analysts have flagged potential warning signs that investors should heed. Understanding these factors is critical for anyone considering an investment in the company. Remember, historically profitable companies with a track record of strong earnings growth generally pose a lower risk.

If you’re looking for alternatives, consider exploring other companies with reasonable price-to-earnings (P/E) ratios that have demonstrated robust earnings growth.

Conclusion

Beauty Health’s current stock performance serves as a reminder of the complexities of investing. While the low P/S ratio may tempt some investors, the underlying revenue challenges and uncertain growth forecasts warrant careful consideration. As with any investment decision, conducting thorough research and understanding potential risks is essential for navigating the financial landscape effectively.

For a more detailed analysis of Beauty Health, including potential risks and financial health, access a free valuation report to help you make informed decisions moving forward.