In today’s fast-paced world, car manufacturing might not seem as captivating as other news, yet its significance remains paramount. Automakers and their suppliers are vital employers in the United States. Meanwhile, Western car manufacturers are facing stiff competition from Chinese electric vehicles (EVs), even among consumers who might not typically opt for EVs. The situation in China is also problematic, grappling with intense competition in the EV sphere, prompting government intervention. Consequently, the overall economic landscape of the automotive industry is concerning, especially with the added burden of tariffs imposed during Trump’s administration.

This article delves into how the automotive sector is adapting to these challenges.

By Metal Miner, the largest metals-related media platform in the U.S. according to third-party rankings. Cross-posted from OilPrice

- U.S. automakers are grappling with rising metal costs and potential shortages due to increased tariffs on imports like steel and aluminum, as well as geopolitical disruptions affecting vital EV minerals.

- The recent 50% tariff on various metal imports could significantly escalate production costs for vehicles, impacting automakers’ profit margins and possibly raising car prices for consumers.

- To counter these challenges, automakers are securing longer-term fixed-price contracts for metals, diversifying their supplier base, sourcing locally, redesigning components, and forming direct agreements with mining companies for battery materials.

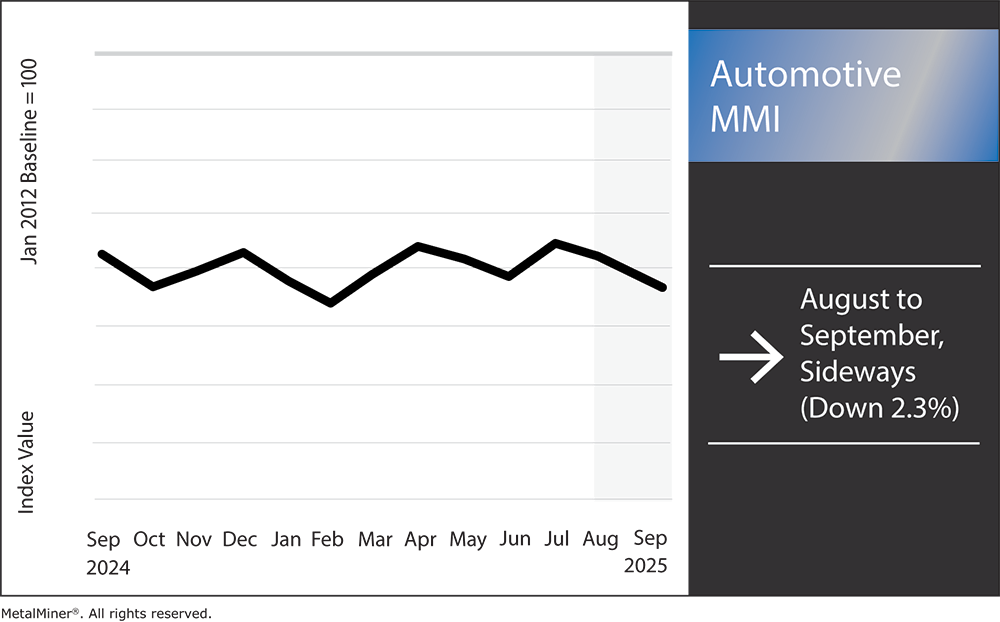

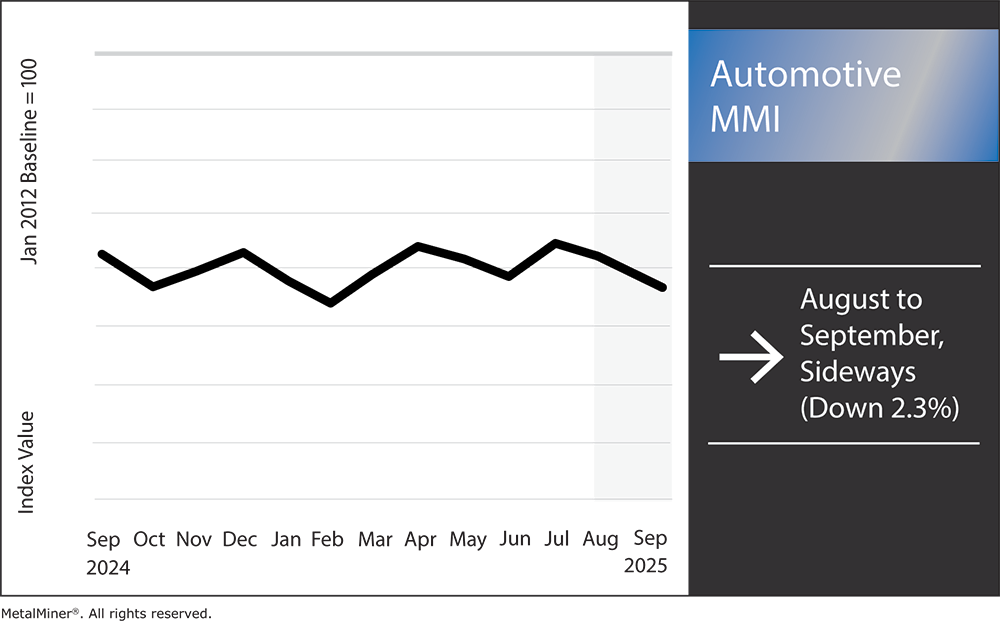

The Automotive MMI (Monthly Metals Index) saw a slight decrease of 2.3%. This decline occurs amidst rising costs and the threat of shortages in the metal supply chains that U.S. manufacturers are facing. Such challenges are largely attributed to steep tariffs on steel, aluminum, and other essential materials, which are increasing raw material expenses.

How Are Tariffs Affecting Costs in the U.S. Automotive Market?

The U.S. government recently raised its metal tariff (initially 25%) to a substantial 50% on an extensive range of imports, including automotive-grade steel and aluminum. These tariffs effectively function as a tax on each vehicle produced with imported materials. Reports from Automotive Dive estimate that the 25% steel tariff alone could contribute an additional $1,500 to the cost of an average vehicle, with expenses likely increasing as tariffs rise further. Overall, this translates to significant additional costs for the industry, endangering automakers’ margins and potentially leading to heightened vehicle prices for consumers.

Hot-dipped galvanized steel prices, September 2025, MetalMiner Insights

Even companies that predominantly use domestically sourced steel do not escape this situation, as local producers have similarly raised prices in response to the overall market increases fueled by tariffs. Thus, automakers face escalating costs even when acquiring “Made in America” steel.

This predicament leaves companies with two primary options: absorb the additional costs or transfer them to consumers through increased vehicle prices. MetalMiner’s weekly newsletter offers free updates on pricing related to tariffs and costs passed along to consumers, helping manufacturers make proactive purchasing decisions rather than responding reactively to market fluctuations.

What Challenges Do Critical Minerals Present?

In addition to tariffs, the U.S. automotive industry faces challenges surrounding critical EV minerals such as lithium and rare earth elements. In early 2025, China halted exports of certain rare earth metals essential for EV motors, leading to immediate complications. As noted by Automotive Logistics, this situation reveals the vulnerability of the automotive supply chain to geopolitical disruptions. With China controlling about 90% of the global rare earth refining capacity, manufacturers now face substantial material scarcities.

In response, automotive firms across the U.S. are racing to establish more dependable sources for these critical minerals. For instance, electric vehicle manufacturer Lucid Group has recently initiated a partnership with a number of U.S. mining and refining companies to enhance domestic production of battery metals and decrease reliance on foreign suppliers. The coalition members are actively pursuing new mining and processing sites to create a robust American battery-material supply chain.

How Are Automakers Addressing These Risks?

To navigate these turbulent conditions, automakers have implemented various strategies. One effective approach involves securing longer-term contracts for essential metals at fixed prices, providing a buffer against unexpected price hikes. For example, General Motors and other companies have already negotiated agreements for two- to three-year steel supplies with Cleveland-Cliffs, ensuring cost predictability amidst tariff fluctuations.

Additionally, manufacturers are diversifying their supplier base and increasing local sourcing whenever feasible, with some re-engineering parts to reduce the amount of imported metals used and investing in recycling to reclaim more scrap. As noted, several automakers have entered into direct agreements with mining companies for lithium and other battery minerals, securing supply straight from the source. Another tactic involves employing improved market intelligence, as procurement teams utilize specialized resources such as MetalMiner Select to monitor price trends, trade actions, and forecasts in real time.

What is the Outlook for 2026, and How Can Procurement Leaders Prepare?

Some analysts suggest that metal prices may stabilize or even decline as the impact of the initial tariff adjustments is absorbed, offering some relief to buyers. However, given the ongoing increase in EV demand, price volatility is unlikely to diminish completely.

To thrive in this landscape, a proactive strategy is essential. Leading firms are utilizing forecasting and benchmarking to inform their purchasing tactics, which can serve as an additional layer of protection. Furthermore, it is crucial to remain vigilant regarding policy changes since trade regulations can shift unexpectedly. Within organizations, U.S. automotive procurement leaders should emphasize building resilient supply chains through dual sourcing or increased inventory to mitigate potential disruptions in the future, even if this entails initial costs.

American companies sourcing metals in 2025 find themselves navigating the intersection of trade policy and the transition to clean energy, presenting a challenging yet pivotal scenario. However, with robust market intelligence, diversified sourcing, and strategic partnerships, procurement leaders can effectively manage the upheaval.