Silver Volatility Eases, but Structural Deficits Maintain Positive Outlook

The silver market has recently seen a moderation in volatility. However, the underlying structural deficits in supply and demand continue to bolster a positive outlook for silver prices. This article explores the current trends affecting silver and the implications for investors.

Current Market Trends

Over the past few weeks, fluctuations in silver prices have diminished. Traders are observing a steadier environment compared to earlier months when price swings were more pronounced. This stability is welcome news for many investors and market participants.

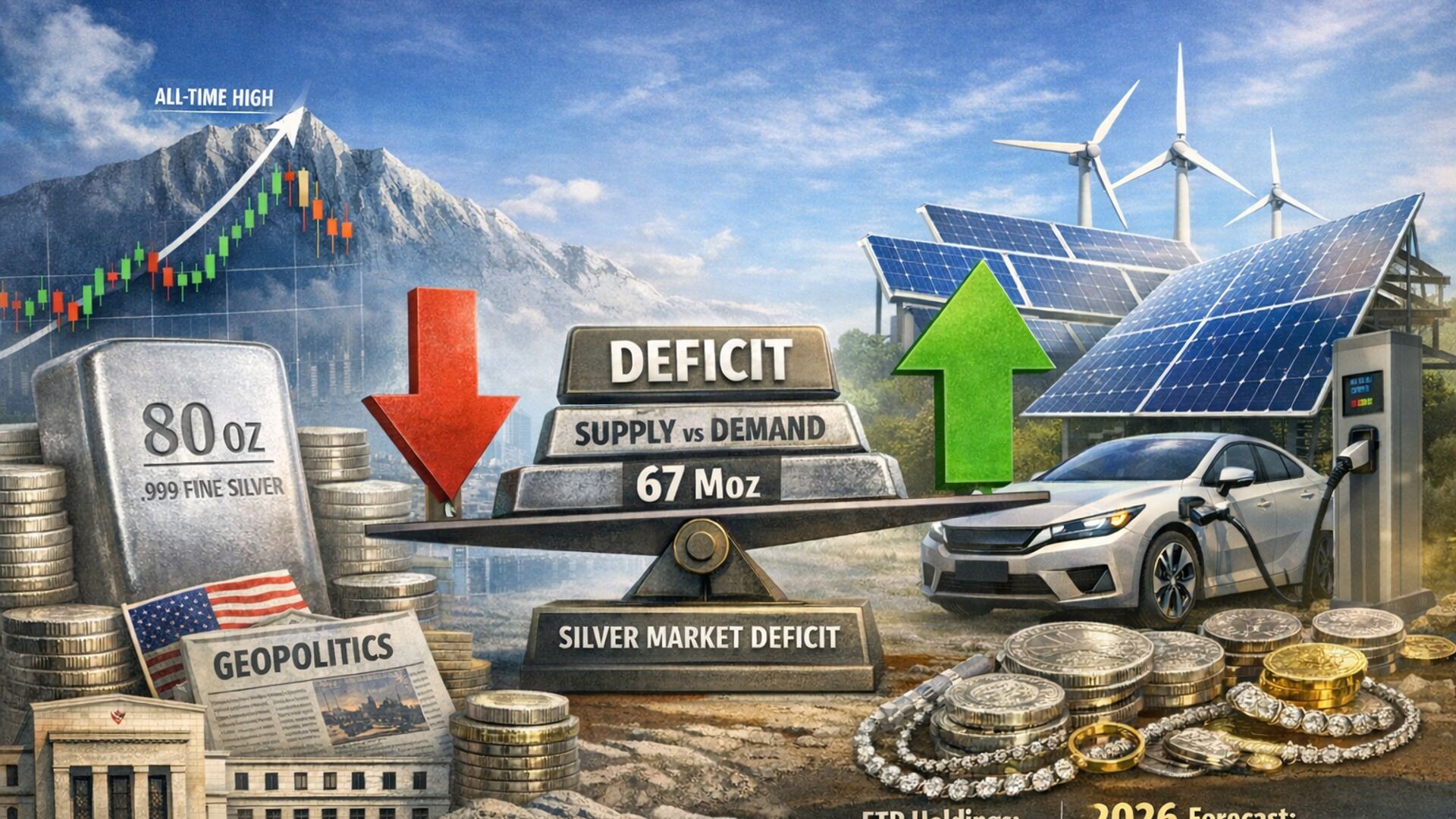

Structural Deficits

Despite the recent calm, the silver market is grappling with structural deficits that could sustain a bullish perspective. Various factors contribute to these deficiencies:

- Increased Industrial Demand: Silver is essential for various industrial applications, including electronics and renewable energy technologies.

- Mining Challenges: Production issues in key silver-mining regions have restricted supply availability.

- Investor Interest: There has been a notable uptick in investment interest in silver, particularly as a hedge against inflation and economic instability.

Future Outlook

Given the combination of reduced volatility and persistent structural deficits, many analysts remain optimistic about silver’s future. The balance of supply and demand will continue to play a critical role, influencing price movements in the coming months. Investors are encouraged to stay informed about market developments, as they can significantly affect their strategies.

Conclusion

In conclusion, while silver market volatility may have eased, the fundamental factors driving demand continue to present a promising outlook. By keeping an eye on the structural deficits and market trends, investors can make informed decisions in this dynamic environment.