Goldman Sachs Group (NYSE:GS) has made recent moves that highlight its increasing engagement with digital assets and artificial intelligence. By investing in regulated crypto ETFs and partnering with Anthropic, an AI-focused company, the investment bank aims to enhance operational efficiency and better adapt to the evolving financial landscape.

- Goldman Sachs has revealed significant indirect exposure to Bitcoin, Ethereum, XRP, and Solana through compliant cryptocurrency ETFs.

- The bank is collaborating with AI firm Anthropic to develop AI tools designed to automate and improve internal operational processes.

- These initiatives demonstrate Goldman Sachs’ transition towards enhanced access to regulated digital assets and operational efficiencies powered by AI.

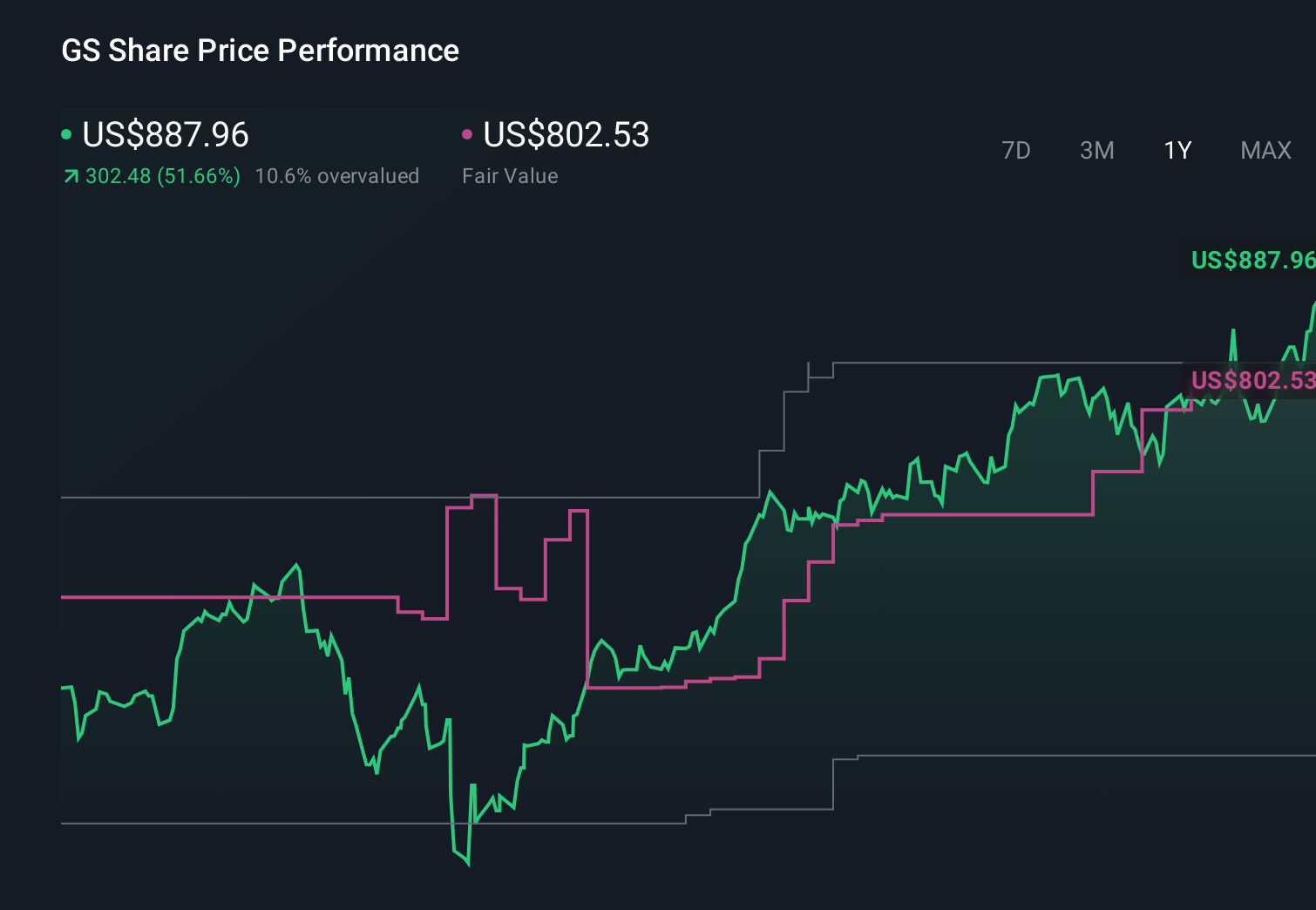

Currently trading at approximately $948.99, Goldman Sachs is aligning its traditional investment banking functions with deeper involvements in the digital asset space, notably through ETFs instead of direct token holdings. With an impressive five-year return of around 700%, the stock has shown considerable long-term growth. For investors monitoring the intersection of conventional finance and cryptocurrency, this ETF-focused approach offers critical insights.

In conjunction with this approach, the partnership with Anthropic indicates that Goldman is not merely investing but also innovatively reshaping its internal processes. As AI tools are integrated and tested within its operations, stakeholders may want to monitor their impact on costs, workforce composition, and risk management over time.

To keep abreast of the significant developments surrounding Goldman Sachs Group, consider adding the company to your watchlist or portfolio. You can also explore our Community for diverse perspectives on Goldman Sachs.

Explore insider trading activities for Goldman Sachs Group following these recent developments.

Quick Assessment

- ⚖️ Price vs Analyst Target: Currently at $948.99, GS trades nearly in line with the analyst price target of $950.50.

- ❌ Simply Wall St Valuation: The shares are considered to be trading 57.9% above their estimated fair value.

- ✅ Recent Momentum: The stock has experienced a modest positive momentum with a 30-day return of about 1.1%.

To determine the most strategic time to buy, sell, or hold Goldman Sachs Group shares, visit Simply Wall St’s company report for an up-to-date analysis of Goldman Sachs Group’s fair value.

Key Considerations

- 📊 The combination of crypto ETF exposure and the Anthropic partnership shows GS’s commitment to engaging with digital assets and AI while maintaining regulatory compliance.

- 📊 Monitor how metrics such as fee income, cost-to-income ratios, and capital allocation towards ETF and AI projects develop as these initiatives expand.

- ⚠️ Notably, there has been significant insider selling over the past three months, which some investors may interpret as a negative sentiment signal.

Dig Deeper

For a comprehensive understanding, including additional risks and opportunities, explore the complete analysis of Goldman Sachs Group. Alternatively, visit the community page for Goldman Sachs Group to gauge how other investors feel about the implications of this news on the company’s future.

This article from Simply Wall St is intended for informational purposes. It provides commentary based on historical data and analyst predictions, employing an impartial methodology. This content is not intended as financial advice and does not consider your personal objectives or financial circumstances. We strive to deliver long-term analyses driven by fundamental information. Please note that our insights may not include the latest price-sensitive announcements or qualitative material. Simply Wall St holds no positions in the stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We’ve developed the ultimate portfolio companion for stock investors, and it’s free.

• Connect unlimited portfolios for a unified view in one currency

• Receive alerts about new warning signs or risks via email or mobile

• Track the fair value of your stocks

Have feedback on this article? Concerns about the content? Contact us directly. Alternatively, email editorial-team@simplywallst.com