Good morning, investors.

The typically unexciting Dow Jones Industrial Average reached another record high on Tuesday, just a day before the release of a highly awaited jobs report.

Today’s focus is on the ongoing stock sell-off triggered by developments in the AI sector.

Investors have developed a tendency to act quickly—selling before thoroughly understanding the implications of AI advancements.

The same instinct that crippled software stocks last week also led to a decline in financial services stocks on Tuesday. This happened after a fintech platform, Altruist, revealed an AI-driven tax planning tool that suggested potential job losses in advisory roles.

Shares of LPL Financial, Charles Schwab, and Raymond James plummeted over 7% following this news.

This negative sentiment spilled over to major Wall Street firms like Morgan Stanley and JPMorgan, which each saw declines of more than 1%.

When viewed collectively with the recent “SaaSpocalypse,”

it appears that AI is prompting investors to reassess entire sectors in real time.

Despite the potential of these new AI tools, much of the market’s reaction seems impulsive and exaggerated.

In reality, the situation is rarely so straightforward. Envisioning a world devoid of legacy software or financial services is challenging.

It’s even harder to picture a stock market functioning without these essential sectors.

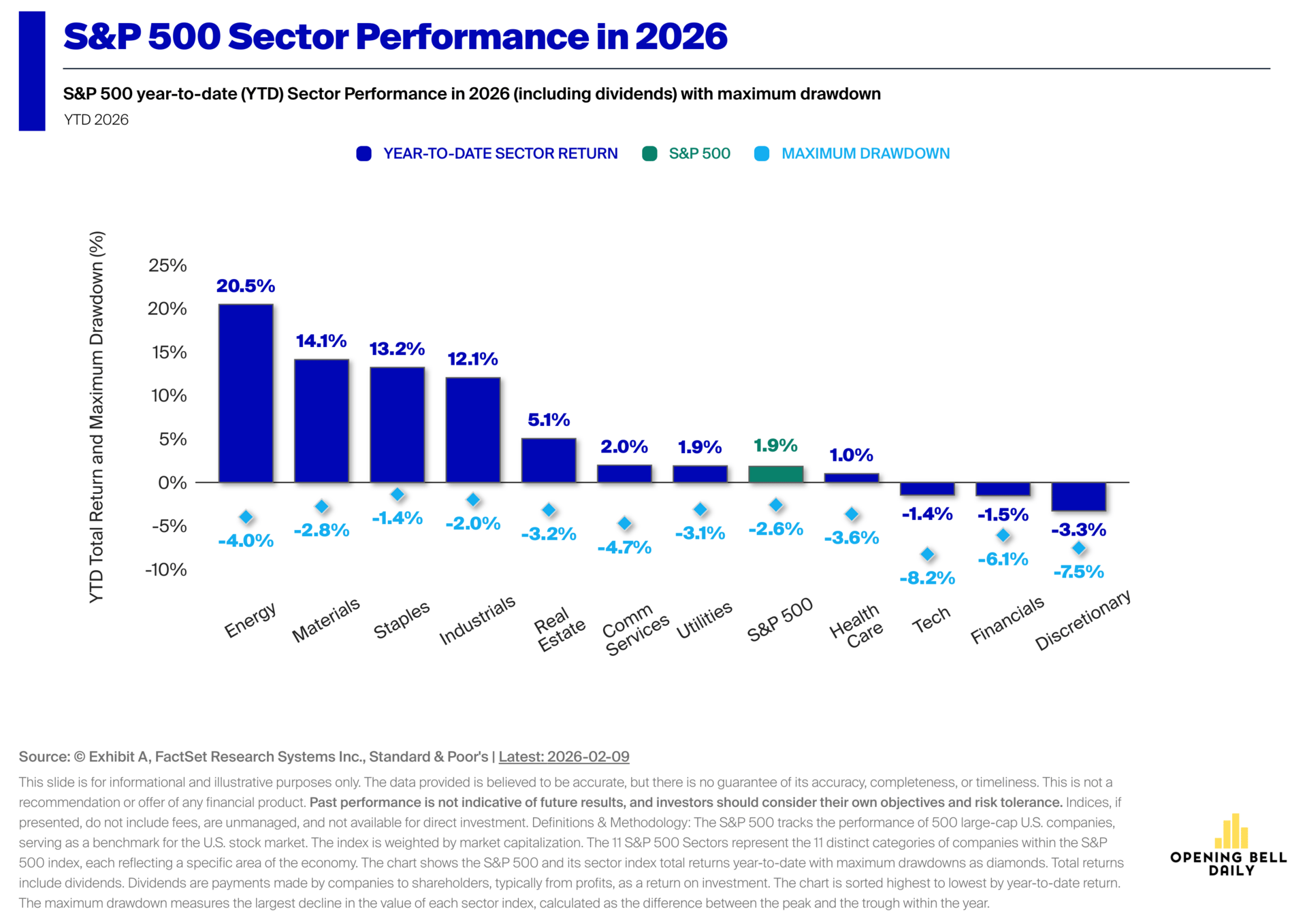

Energy and materials have led the S&P 500 at the start of the year (Chart courtesy of Exhibit A)

AI is fundamentally altering the value distribution

within entire sectors.

Tasks that revolve around routine analysis or documentation—which were once rare—are becoming easily scalable with AI, resulting in a loss of pricing power.

Conversely, companies that focus on distribution, brand integrity, and client relationships seem better positioned to maintain their advantages, as these qualities can’t be easily replaced by technology.

This distinction helps clarify why the sell-off began in the software and financial services sectors.

It’s not surprising that, amid uncertainty, investors opted for broad strategies, such as offloading ETFs rather than making specific stock evaluations.

Winners and losers

will reveal themselves in due time; however, this will require the market to discern between companies leveraging AI for margin improvement and those that face contractions.

Claiming that AI is leading to the disappearance of entire sectors feels premature.

A more nuanced perspective is that AI is catalyzing a market where stock-picking skills are increasingly essential.

Navigating a market that hits record highs week after week, alongside a relentless news cycle and increasing volatility, demands significant effort.

Regardless of market movements,

tastytrade

provides the necessary tools to keep you informed and enable you to navigate through trading decisions.

📉

The US is anticipated to have added 75,000 jobs in January.

This is the median estimate from FactSet and would represent the largest increase since September, exceeding the trailing 12-month average of 48,700. (

FactSet

)

📊

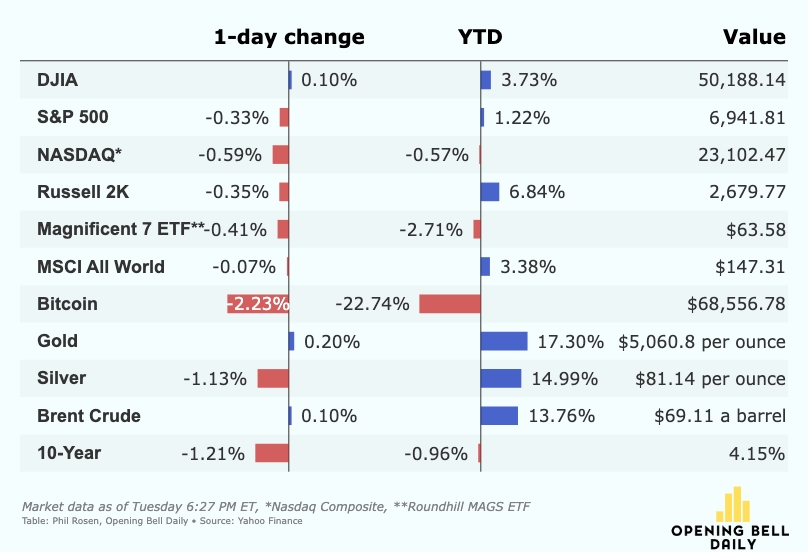

Non-tech stocks are outperforming as the year starts.

Sectors like energy, materials, and consumer staples have significantly outpaced the Magnificent 7 and Big Tech so far in 2026. This signals a broad market rotation. (

Barron’s

)

⛪

The Vatican seeks to enter the equity market.

Its bank recently launched two equity indexes focused on stocks that align with Catholic ethical values, paving the way for potential ETF licensing in the future. (

CNBC

)

I recently had a conversation with Hamilton Reiner, CIO of JPMorgan Asset Management and head of US equity derivatives, where we discussed strategies for portfolio positioning in 2026, using options as a hedge, income ETFs, the AI trade, and reflections from Lehman Brothers in 2008.

-

The White House played down expectations for the upcoming jobs report (

Yahoo Finance

) -

Ford reported its largest earnings miss in four years (

CNBC

) -

Daily life in Cuba is facing severe disruptions due to the US oil blockade (

WSJ

) -

Two voting members of the Fed advocated for maintaining steady rates (

Yahoo Finance

) -

Shares of Lyft plummeted following the announcement of an operating loss in their latest earnings report (

Yahoo Finance

) -

The first publicly traded agentic finance firm has emerged (

Pomp Letter

)

🗓

February 11, 1994:

Global bond prices fell sharply following the Federal Reserve’s first interest rate hike in five years, marking the onset of a significant bond market decline.

📩

Are you interested in connecting with over 200,000 investors who read this newsletter, as well as the 350,000 professionals who have access to it on Bloomberg Terminals?

If so, reply to this email and let us know why we should collaborate.