Traders work at the New York Stock Exchange on Feb. 10, 2026.

NYSE

On Tuesday, shares of financial services companies plummeted following the announcement of a new AI-driven tax planning tool that claims to deliver results “within minutes.”

LPL Financial saw a decline of nearly 11%, while Charles Schwab and Raymond James Financial both experienced drops of over 9%. Concerns are mounting that AI advancements could significantly disrupt their sectors. Morgan Stanley fell by 4%.

The tech platform Altruist revealed the new tool through its AI platform, Hazel. It claims to assist advisors in formulating completely personalized tax strategies for clients by analyzing their 1040 forms, paystubs, account statements, meeting notes, emails, and CRM data while applying comprehensive tax logic to the evaluation.

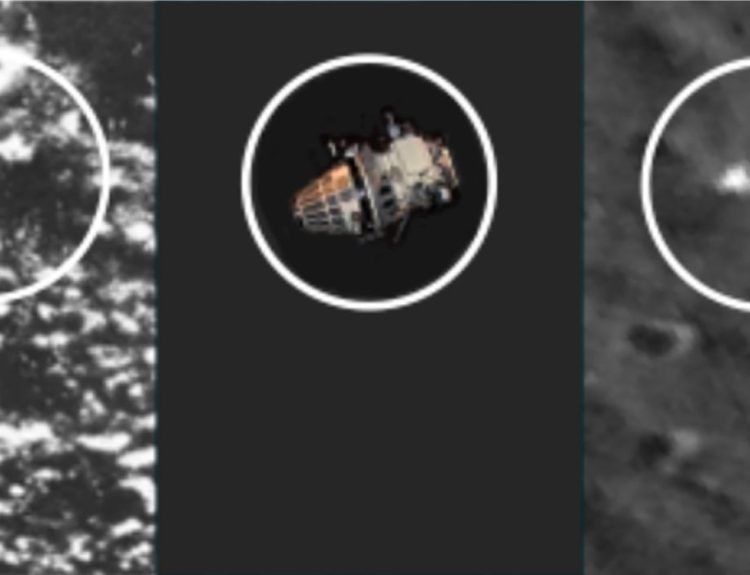

LPL Financial, 5 days

In recent times, the landscape of financial services has encountered significant shifts, particularly with the advent of advanced technology. A recent development underscores how artificial intelligence is influencing this sector, impacting stock performance and investor sentiment alike.

Amid growing concerns over the introduction of new AI-driven solutions, today’s stock market reaction serves as a wake-up call for financial firms. As the technology continues to evolve, its implications for the industry could be profound.

In conclusion, the rapid integration of AI tools in financial services raises both exciting possibilities and considerable risks. Firms must navigate this evolving environment with strategic foresight, ensuring they adapt to changing market dynamics effectively.