In today’s unpredictable stock market, recent fluctuations can lead to significant anxiety for retirement investors. After enduring a 326-point drop on Monday, the DOW saw a rebound of 72 points on Tuesday, only to fluctuate again, ultimately finishing relatively unchanged on Wednesday. As of yesterday, however, it surged by 188 points.

In today’s unpredictable stock market, recent fluctuations can lead to significant anxiety for retirement investors. After enduring a 326-point drop on Monday, the DOW saw a rebound of 72 points on Tuesday, only to fluctuate again, ultimately finishing relatively unchanged on Wednesday. As of yesterday, however, it surged by 188 points.

Such erratic shifts can leave anyone considering retirement feeling uneasy. The specter of another downturn reminiscent of 2002 or 2008 can evoke fears of extending the daily grind for another ten years. Just the thought of it is disheartening—who wants to extend their time in the corporate rat race?

We aim to strike a balanced tone. However, the current business landscape seems devoid of the enjoyment it once offered. Instead, creativity and intuition have been supplanted by a reliance on spreadsheets, charts, and strict margin metrics.

Delivering quality work and achieving profitability have become secondary to performance tracking. Every aspect must be meticulously monitored, leading to an environment where actual productivity often takes a back seat. Do you see the disconnect?

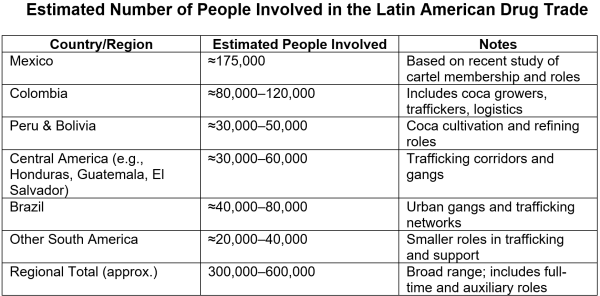

There’s a table for every conceivable metric, and the sheer volume of data can feel overwhelming—one might even say there needs to be a table to track all the tables. Constant updates and extensive discussions around processes have become the norm, often overshadowing the actual work.

Big Bets

It’s astonishing how many individuals base their retirement plans primarily on the stock market, potentially setting themselves up for disappointing golden years. However, what options do they have?

Regular savings accounts are consistently undermined by inflation due to Federal Reserve policies. Social Security is facing its own insolvency challenges, and real estate investment carries specific risks. Yet, saving and growing wealth remains a necessity, making 401(k) plans the focal point of retirement savings for many Americans.

At Economic Prism, we advocate for taking full advantage of available 401(k) plans. Nonetheless, we urge individuals not to rely solely on these accounts for retirement. It’s essential to explore alternative avenues for wealth accumulation, even if contributions are modest.

This requires a shift in mindset regarding investment strategies outside of a 401(k). By focusing on quality, established dividend-paying companies bought at reasonable prices and reinvesting those dividends, you can solidify and expand your stock portfolio. Additionally, consider allocating a small portion of your investment funds—perhaps 10 percent—for more speculative ventures.

What do we mean by speculative ventures?

We’re not advocating for chasing every new trend or engaging in day trading. Instead, we encourage a patient approach, always looking for promising mid-term opportunities in undervalued sectors, particularly during bear markets.

How to Retire a Decade Early

For instance, just a few weeks ago, we highlighted an intriguing opportunity labeled the Mother of All Speculations. This centered on junior gold mining stocks, a segment noticeably affected by recent market movements.

While gold prices fell considerably over the last few years, junior gold mining stocks suffered even more catastrophic losses—down over 80 percent, as measured by the basket of junior gold stocks (NYSE: GDXJ). Despite this, the fundamental factors that drove gold prices up by 645 percent from 2001 to 2011 remain intact.

Across the globe, central banks continue to print money to artificially lower interest rates and cover extravagant government deficits. Simultaneously, gold supply has enjoyed relative stability, suggesting that this imbalance will eventually result in rising gold prices.

Interestingly, as junior gold mining stocks plummeted, the broader market thrived, with the S&P 500 increasing by 165 percent over the same five-year period. Thus, if the strategy is to buy low and sell high, wouldn’t it be more advantageous to sell off an S&P 500 position that’s gained 165 percent while investing in junior gold mining stocks that have declined by 80 percent?

So far this year, the S&P 500 has fallen by 4 percent while the GDXJ has gained 17 percent—a staggering 22 percent differential. Thankfully, gold stocks remain remarkably undervalued, leaving ample room for further growth.

As we have advised, this is a speculative move… don’t invest everything into it. However, we believe it’s a calculated risk worth considering with a small portion of your investment capital. Ultimately, it could mean the difference between enduring another decade of work and enjoying a fulfilling retirement while you’re still young enough to appreciate it.

Sincerely,

MN Gordon

for Economic Prism