With the rapid evolution of artificial intelligence (AI), a new product from Anthropic is raising questions about the future viability of traditional Software as a Service (SaaS) business models. This development is causing ripple effects in the stock market, particularly affecting companies like Intuit (NasdaqGS:INTU), as investors reconsider the landscape of software utilization and pricing.

- Anthropic has launched an innovative agentic AI product, prompting concerns about the longevity of conventional SaaS business frameworks.

- This launch is creating a shift in sentiment across the software sector, including companies like Intuit, as investors reassess how AI agents could reshape software consumption and pricing strategies.

- In response, Intuit is accelerating the integration of AI features into its TurboTax, QuickBooks, and Credit Karma platforms, and forming partnerships with fintech companies such as Affirm and Checkr to expand its offerings.

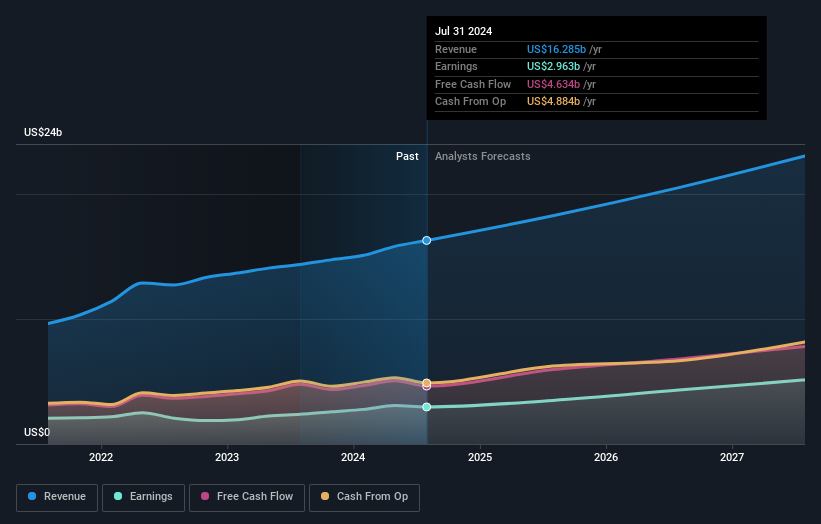

Currently, Intuit’s stock is priced at $443.77, and it has faced challenges recently, with a 31.4% drop in the past month and a 29.5% decline year-to-date. Over the past year, the stock has decreased by 22.8%. However, looking at longer periods, the returns over three and five years are considerably better at 9.4% and 10.6%, respectively.

Set against the rise of Anthropic’s agentic AI and emerging doubts about the future of SaaS business models, investors are closely monitoring how quickly Intuit can transform its AI advancements and fintech partnerships into valued products for consumers. Central questions revolve around how these strategic initiatives will influence Intuit’s position in tax, accounting, and consumer finance applications as AI agents gain traction in the market.

Stay informed on the latest developments regarding Intuit by adding it to your watchlist or your own portfolio. You can also explore our Community for fresh insights on Intuit.

See how Intuit compares to its main competitors

Quick Assessment

- ✅ Price vs Analyst Target: Currently at US$443.77, Intuit’s stock is trading around 43% below the analysts’ consensus target of approximately US$777.85.

- ✅ Simply Wall St Valuation: Shares are assessed to be 43.4% below their estimated fair value, indicating a valuation discrepancy.

- ❌ Recent Momentum: The stock has experienced a significant 31.4% decline over the last 30 days, reflecting a shift in investor sentiment as concerns about AI disruption rise.

For a comprehensive evaluation, check out Simply Wall St’s detailed valuation analysis of Intuit.

Key Considerations

- 📊 Anthropic’s agentic AI raises substantial questions regarding the future relevance of traditional SaaS offerings, making Intuit’s AI enhancements in TurboTax, QuickBooks, and Credit Karma essential to its competitive standing.

- 📊 It is critical to monitor how rapidly new AI tools are adopted by paying customers, given Intuit’s P/E ratio of 29.99, compared to the software industry average of approximately 26.94, along with updates on fintech collaborations with Affirm and Checkr.

- ⚠️ A primary risk lies in the possibility that AI agents might compress pricing power or disrupt segments of Intuit’s subscription model more swiftly than the agency’s AI roadmap can be executed.

Dig Deeper

For a thorough analysis that includes various risks and opportunities, review the complete assessment of Intuit.

This analysis presented by Simply Wall St is intended for informational purposes. The commentary is based on historical data and analyst projections using an unbiased methodology, and it should not be construed as financial advice. The information does not represent a recommendation to buy or sell any stock, nor does it consider your individual financial circumstances. Our aim is to deliver focused long-term analysis based on fundamental data. Note that this evaluation may not account for the most current price-sensitive company announcements or qualitative factors. Simply Wall St holds no positions in any stocks mentioned.

New: AI Stock Screener & Alerts

Our innovative AI Stock Screener regularly scans the market to uncover new investment opportunities.

• Dividend Giants (Yielding 3%+)

• Undervalued Small Caps with Insider Purchases

• High-Growth Tech and AI Firms

Or customize your search using over 50 different metrics.

Have feedback about this article? Concerned with the content? Contact us directly. Alternatively, you can email editorial-team@simplywallst.com.