Zoom Communications Partners with Vizrt: New AI Tools Launched

Zoom Communications has recently joined forces with Vizrt to introduce innovative AI-powered engagement tools, named InteractifAI and CaptivAIte. These new solutions are designed to enhance the user experience during meetings and events.

- Zoom Communications (NasdaqGS:ZM) has partnered with Vizrt to roll out new AI-powered engagement tools, InteractifAI and CaptivAIte.

- The tools allow users to add personalized graphics and visual overlays directly onto Zoom video streams for meetings and events.

- The new solutions are available through Zoom’s ISV Exchange Program, targeting corporate communications, virtual events, and training sessions.

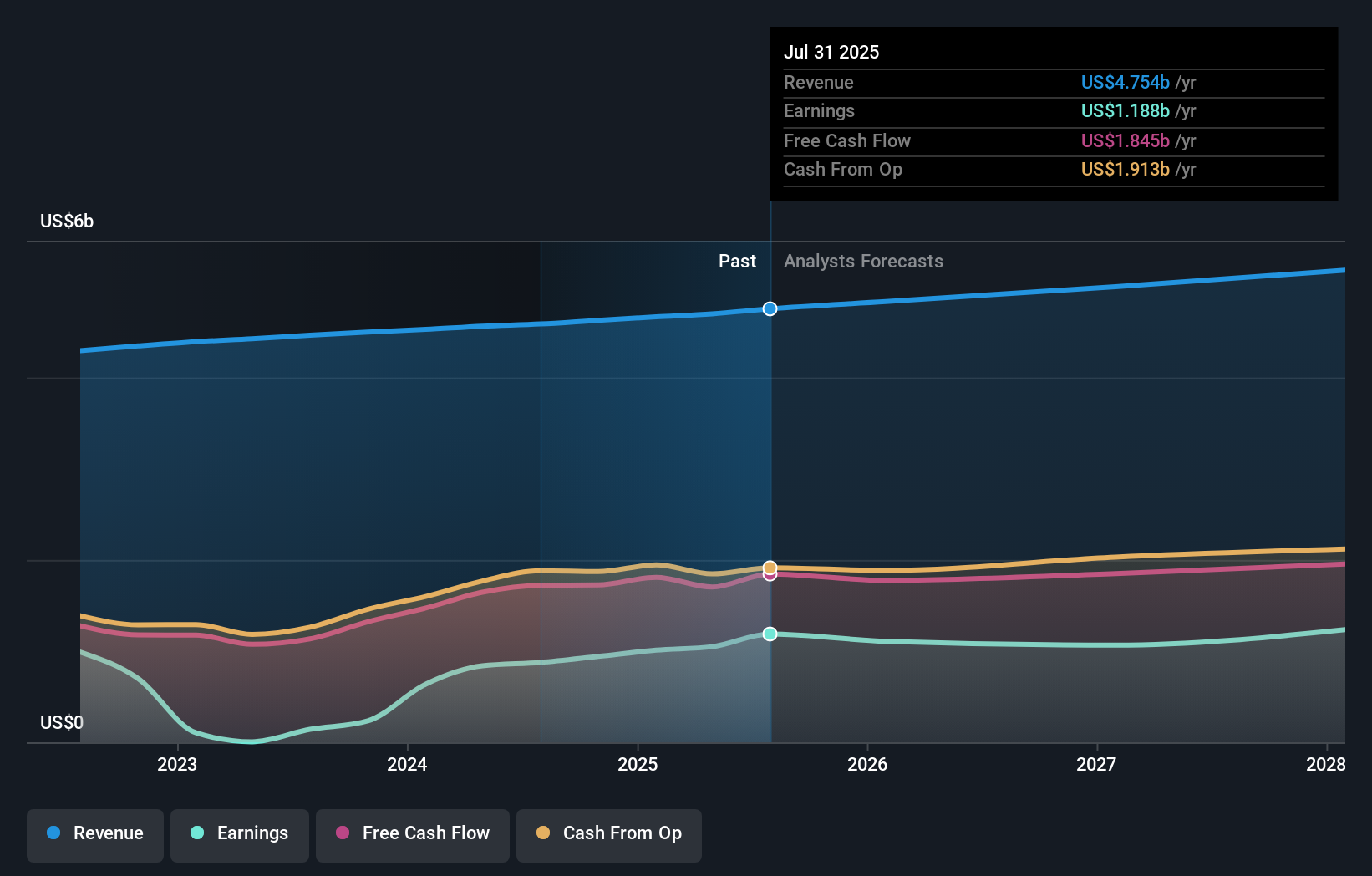

For investors keeping an eye on NasdaqGS:ZM, this product launch signifies Zoom Communications’ ongoing commitment to enhancing its core platform for enterprise clients. The stock recently closed at $92.20, reflecting a 6.4% increase over the past month and a 10.7% rise year-to-date. However, over the last five years, the stock has seen a notable decline of 78.7%, illustrating the market’s reevaluation of expectations since the height of the pandemic.

These AI-driven tools are part of Zoom’s broader strategy to elevate engagement in meetings beyond mere video connectivity. Investors may wonder whether features like InteractifAI and CaptivAIte will help Zoom maintain its relevance with large organizations that frequently conduct town halls, training sessions, and virtual events on its platform.

Stay informed about significant news regarding Zoom Communications by adding it to your watchlist or portfolio. Alternatively, explore our Community to gain new insights into Zoom Communications.

How Zoom Communications stacks up against its biggest competitors

By integrating InteractifAI and CaptivAIte into its meetings platform, Zoom aims to create more valuable use cases for corporate communications, training, and events rather than merely providing another video tool. Should these AI-powered features gain traction among customers who host numerous events, it could enhance user engagement on Zoom’s core platform and present new upselling opportunities compared to competitors like Microsoft Teams and Google Meet, which are also enhancing their AI capabilities.

How This Fits the Zoom Communications Narrative

The launch aligns with Zoom’s vision of becoming an AI-first collaboration platform rather than just a basic meetings app. Collaborating with Vizrt and leveraging the ISV Exchange Program reflects Zoom’s ongoing shift toward a partner-centric approach, where third-party developers and integrations enhance specialized use cases across its enterprise user base.

Investors: Risks and Rewards to Consider

- The tools offer Zoom an opportunity to enter higher-value use cases such as branded town halls and training sessions, potentially fostering stronger relationships with enterprise clients.

- Zoom’s robust balance sheet and profitability provide latitude to continue investing in AI features and partnerships, even if adoption is slow.

- However, the company still faces execution risks, as a maturing core meetings business necessitates that it demonstrates meaningful revenue growth from AI enhancements.

- Moreover, competition from bundled suites like Microsoft 365 and Google Workspace may restrict how much customers are willing to invest in Zoom’s event and engagement add-ons.

What to Watch Moving Forward

It will be crucial to observe how quickly these new tools emerge in customer case studies, whether Zoom begins to spotlight AI engagement products in its revenue reports, and how these developments connect with broader discussions surrounding billing growth and customer retention. For different perspectives on how this product launch fits into Zoom’s long-term vision, consider exploring community narratives on Zoom’s dedicated page.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts using an unbiased methodology. Our articles are not intended as financial advice. They should not be construed as a recommendation to buy or sell any stock and do not consider your objectives or financial situation. We focus on long-term analysis driven by fundamental data. Note that our analysis may not incorporate the latest price-sensitive company announcements or qualitative information. Simply Wall St holds no position in any stocks mentioned.

Valuation Made Simple

Uncover whether Zoom Communications may be undervalued or overvalued with our in-depth analysis, including fair value estimates, potential risks, dividends, insider trades, and financial condition.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com