The world we live in often feels like a surreal circus. Every day brings fresh surprises, making it increasingly bizarre and unsettling. Just when we believe we have witnessed it all, something new emerges that leaves us astonished.

The world we live in often feels like a surreal circus. Every day brings fresh surprises, making it increasingly bizarre and unsettling. Just when we believe we have witnessed it all, something new emerges that leaves us astonished.

Take, for instance, Hillary Clinton’s recent appearance. My goodness! It’s quite the sight to behold. We can only speculate about what has transpired, but whatever it is, it’s certainly unsettling. It’s tough to look at.

For the astute observer, the absurdities of our time bring both amusement and annoyance. One moment, you might find yourself laughing heartily; the next, you could be overwhelmed with nausea at the absurdity of it all.

Did you know that the U.S. government allocated $400 million to federal employees who were essentially inactive? No joke, it really happened. Moreover, the IRS provided $17.5 million in tax relief to brothels in Nevada. Additionally, there was $1.23 million in federal funds allocated for housing for deaf seniors, which is unfortunately unusable due to the conditions of the apartments.

These instances walk the line between hilarious and appalling. Continue reading

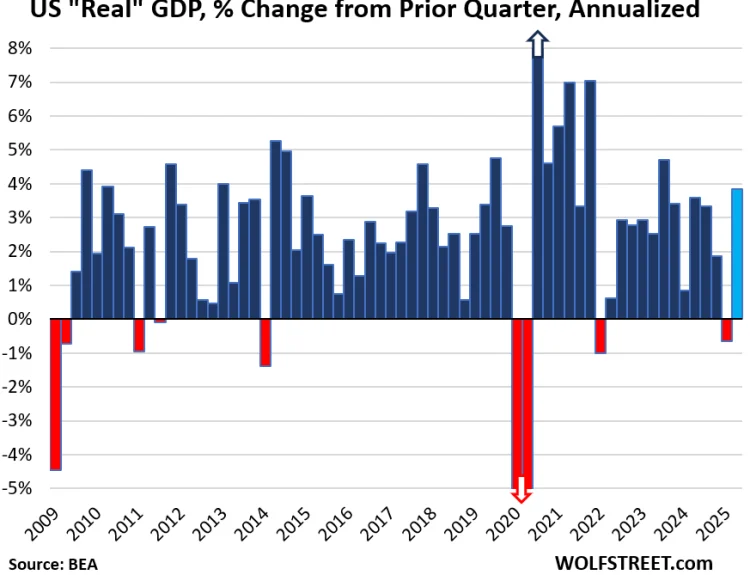

On August 28, the Bureau of Economic Analysis reported that the second-quarter GDP grew at an annualized rate of 4.2 percent. This comes on the heels of a 2.1 percent decline in the first quarter. So what sparked this turnaround?

On August 28, the Bureau of Economic Analysis reported that the second-quarter GDP grew at an annualized rate of 4.2 percent. This comes on the heels of a 2.1 percent decline in the first quarter. So what sparked this turnaround?

The BEA report explained that the increase in real GDP was largely due to improved exports, private inventory investment, accelerating personal consumption expenditures (PCE), and enhanced nonresidential fixed investment. State and local government spending, along with residential fixed investment, also contributed even as import acceleration somewhat offset these positives. It’s a remarkable turnaround and paints a picture of a robust economic expansion.

Yet, for many households, it doesn’t feel like improvement is on the horizon. The real hourly earnings of Americans, adjusted for inflation, are lower today than they were five years ago. Curiously, corporate profits are at record highs.

Given the economic growth and unprecedented corporate profits, one would expect to see a surge in job creation. Sadly, that’s not the reality. The pace at which new jobs are being produced remains disappointingly slow. Continue reading

“Stock prices have reached what looks like a permanently high plateau,” proclaimed economist Irving Fisher on October 17, 1929. “I do not believe there will be a drastic drop anytime soon, and I expect the market to rise significantly in the coming months.”

“Stock prices have reached what looks like a permanently high plateau,” proclaimed economist Irving Fisher on October 17, 1929. “I do not believe there will be a drastic drop anytime soon, and I expect the market to rise significantly in the coming months.”

At the time of Fisher’s assertion, the DOW stood at 341.86, having fallen from a peak of 381.17. Just days after Fisher made his prediction, the stock market’s downturn accelerated, taking a toll on Fisher’s reputation.

On October 23, 1929, with stocks plummeting by 20 percent, Fisher insisted that the business landscape remained “fundamentally sound.” Early footage of his ill-fated statement can be found here. Despite his confidence, Fisher was astonishingly mistaken.

The stock market and the overall economy were not as fundamentally strong as he had asserted. Stocks did not achieve the upward trajectory Fisher anticipated. Continue reading

A plentiful supply of oil can mask numerous economic flaws. Just consider Saudi Arabia, where oil comprises 95 percent of their exports and accounts for 70 percent of government revenue.

A plentiful supply of oil can mask numerous economic flaws. Just consider Saudi Arabia, where oil comprises 95 percent of their exports and accounts for 70 percent of government revenue.

Regrettably, the Saudi royal family has squandered this financial boon. Years of selling this invaluable resource have not led to empowering their people or diversifying their economy; instead, they remain heavily reliant on oil exports.

Oil constitutes 45 percent of Saudi Arabia’s GDP. During the significant downturn in oil prices in the 1990s, per capita income dropped from a high of $11,700 in 1981 to $6,300 in 1998. Conversely, when oil prices surged in the 2000s, per capita income climbed back up to $15,000.

Rather than facilitating growth, high oil prices became a crutch for Saudi Arabia, obscuring its economic vulnerabilities. Instead of pursuing economic diversification, the nation continued to lean on its dominant resource.

Today, Saudi Arabia and similar oil-dependent economies face monumental challenges. Continue reading