In recent discussions about the global economy, significant attention has been directed toward the status of the US dollar and its implications for international trade. Yves provides an analysis of current market trends, emphasizing that while predictions indicate a gradual weakening of the dollar, the immediate impact of investment flows remains pivotal in determining its future. In this context, the dollar’s resilience against bilateral trade in local currencies illustrates that its dominance in the financial landscape is far from being jeopardized.

BRICS advocates often point to GDP growth in the Global South to predict a seismic shift in the economic balance. However, investment flows dominate financial markets, overshadowing the influence of either population metrics or GDP weight. We must reiterate that the burgeoning enthusiasm for countries evading US sanctions by engaging in direct trade using their own currencies is insufficient to threaten the dollar’s supremacy. A recent Bank for International Settlements (BIS) study revealed that trade transactions account for roughly 3% of total foreign exchange transactions. Furthermore, the latest BIS survey shows that the dollar’s share of foreign exchange transactions has actually increased since 2022:

Highlights from the 2025 Triennial Survey of turnover in OTC FX markets:

- Trading in OTC FX markets reached $9.6 trillion per day in April 2025 (“net-net” basis,2 encompassing all FX instruments), representing a 28% increase from $7.5 trillion three years prior.

- FX spot and outright forwards saw turnover increases of 42% and 60%, respectively. Their shares in global turnover similarly rose, moving from 28% and 15% to 31% and 19%. In contrast, FX options turnover more than doubled, while FX swaps experienced a moderate growth leading to a decrease in their share to 42% (down from 51% in 2022).

- The US dollar continued to dominate worldwide FX markets, being involved in 89.2% of all trades, a rise from 88.4% in 2022. Meanwhile, the euro’s share dropped to 28.9% (from 30.6%), the Japanese yen remained stable at 16.8%, and the share of sterling declined to 10.2% (from 12.9%). Notably, the shares of the Chinese renminbi and the Swiss franc increased to 8.5% and 6.4%, respectively.

- Inter-dealer trading constituted 46% of the global turnover (a slight decrease from 47% in 2022). The share of transactions involving “other financial institutions” climbed to 50% (up from 47%). At $4.8 trillion, turnover with these financial institutions surged by 35% compared to 2022, driven primarily by a 72% rise in outright forward trading and a 50% increase in spot transactions.

- Sales desks located in the major jurisdictions—namely the United Kingdom, the United States, Singapore, and Hong Kong SAR—accounted for 75% of total FX trading (“net-gross” basis2). Singapore’s market share increased to 11.8% from 9.5% in 2022.

Advanced economies maintain significantly higher GDP per capita, which translates into greater investment capabilities. However, what may impact the dollar negatively in the near future is the shift in sentiment regarding dollar investments. The recent “Liberation Day” sell-off of Treasuries led to a noticeable decline in the dollar’s value. Although some recovery has been observed, a study from VoxEU discovered that Treasuries have once again, for now, regained their status as a secure investment during turbulent times.

Political developments, including Trump’s ongoing push for deregulation and the promotion of cryptocurrency scams, may further undermine the perceived safety of US financial markets. Events like an AI market shock or turmoil in private debt markets could also trigger a withdrawal from dollar-denominated assets.

By Wolf Richter, editor at Wolf Street. Originally published at Wolf Street

A recurring theme aimed at elevating the appeal of cryptocurrencies, gold, silver, and even equities is the so-called “currency debasement trade.” This concept proposes that if enough traders endorse a shared narrative, it can influence prices upward, allowing for substantial profits and trading fees.

This debasement theme operates on the premise that increasing government borrowing and monetary expansion will lead to a significant and rapid erosion of the US dollar’s value. Consequently, it anticipates that investors will flock to assets like cryptocurrencies, gold, silver, and stocks, resulting in sharp price increases. And indeed, such movements have been observed.

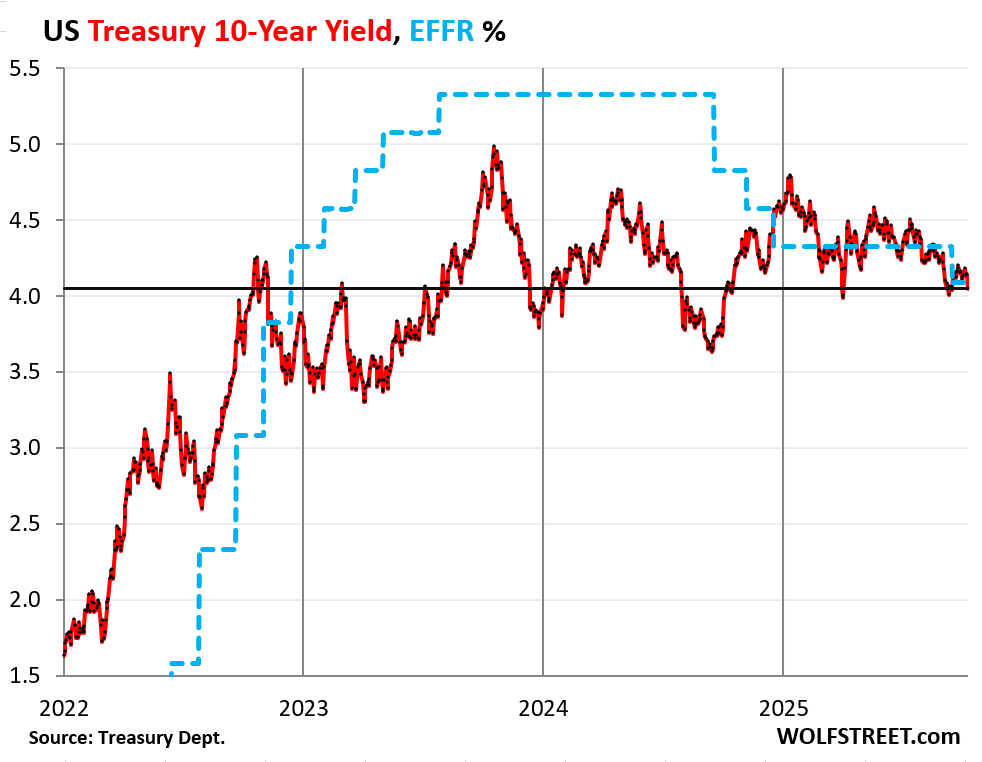

However, the expansive bond market seems to be betting against this trend. The $29 trillion Treasury market, alongside an $11 trillion corporate bond market, a $9 trillion residential mortgage-backed securities market, and a $4 trillion municipal bond market, show that yields have declined this year and have remained relatively stable for the past three years.

Bond investors are banking on the expectation that inflation will recede in the long term. They believe that the relatively modest yields available on these securities will sufficiently compensate them for both inflation and associated risks, while a further cooling of inflation may reduce yields, thereby elevating the prices of previously issued bonds with higher yields.

Were the bond market genuinely worried about rapid and significant debasement of the US dollar—an idea frequently touted by advocates of the debasement trade—it would demand considerably higher yields. But this has not been observed.

The 10-year Treasury yield, for instance, is currently hovering just above 4% as of the past Friday (bond markets were closed today), following a downward trend that has persisted throughout the year, staying within a relatively narrow range for three years:

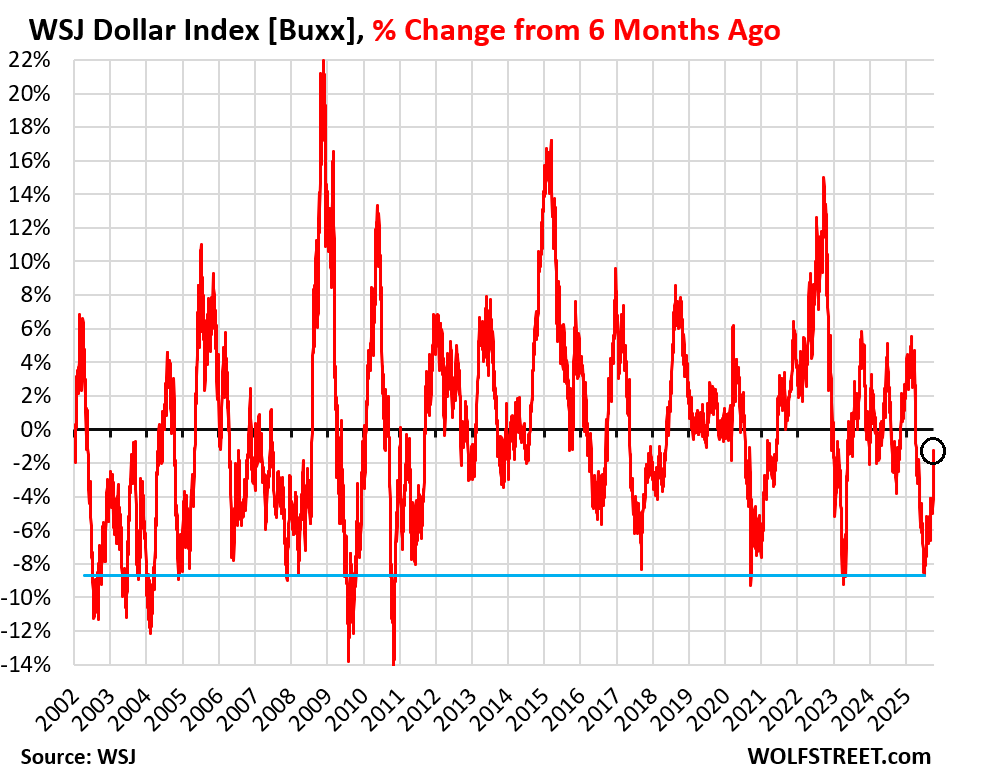

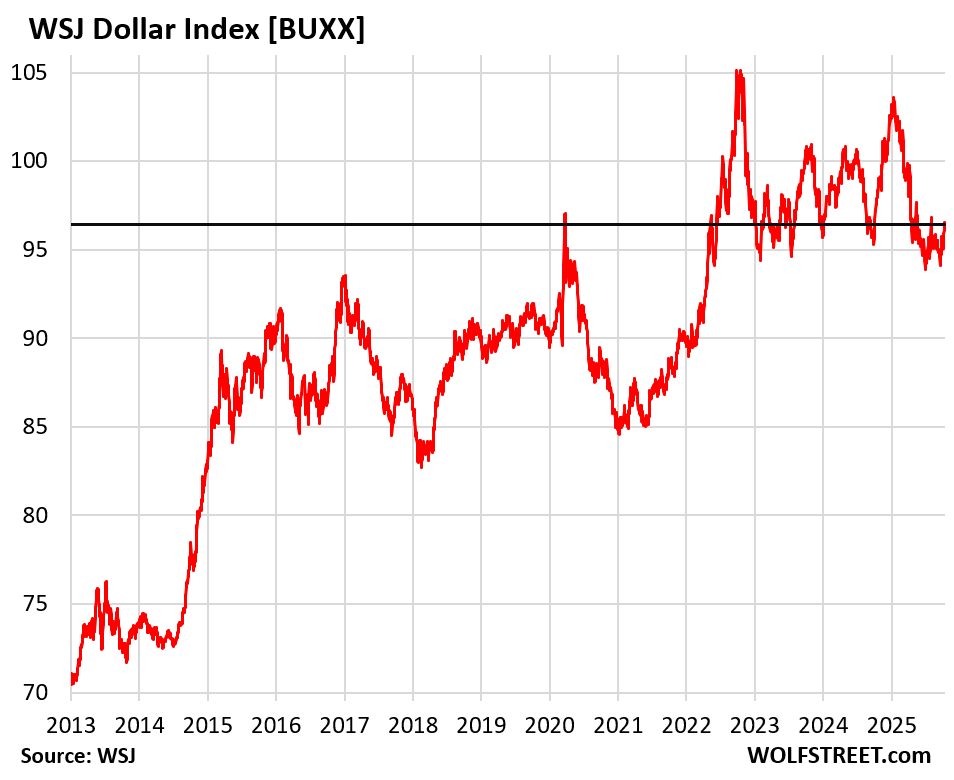

Regarding the US dollar, the narrative surrounding its decline during the first half of 2025 has been sensationalized by clickbait headlines and misguided media commentary, characterized as “the most significant drop in over fifty years,” among other statements.

In reality, the dollar indices soared in the last four months of 2024, peaking at the year’s end. Subsequently, this four-month surge was unwound during the first half of 2025, with the euro and yen-driven DXY Dollar Index experiencing an 11% drop, while the broader WSJ Dollar Index [BUXX] fell by 9% during the same timeframe.

However, even more substantial six-month declines have occurred historically, including:

- April 2023

- September 2020

- November 2010

- August 2009

- April 2008

- June 2007

- And many others extending back in time.

The uniqueness of the 2025 drop was merely its starting point, as similar declines have occurred repeatedly.

This chart illustrates the six-month percentage change of the WSJ Dollar Index [BUXX], which tracks a basket of 16 major currencies:

The blue line signifies a 9% decline from January to July. Note the more significant past drops that have exceeded this rate over the last 23 years.

Since early July, the dollar has experienced a partial recovery, with the WSJ Dollar Index now reflecting a rise to 96.4, representing a 2.6% increase from its low point earlier in July.

The 16 currencies represented in the trade-weighted index are: Euro, Japanese Yen, Chinese Yuan, Canadian Dollar, Mexican Peso, South Korean Won, New Taiwan Dollar, Indian Rupee, Hong Kong Dollar, Singapore Dollar, British Pound, Australian Dollar, New Zealand Dollar, Norwegian Krone, Swiss Franc, and the Swedish Krona.

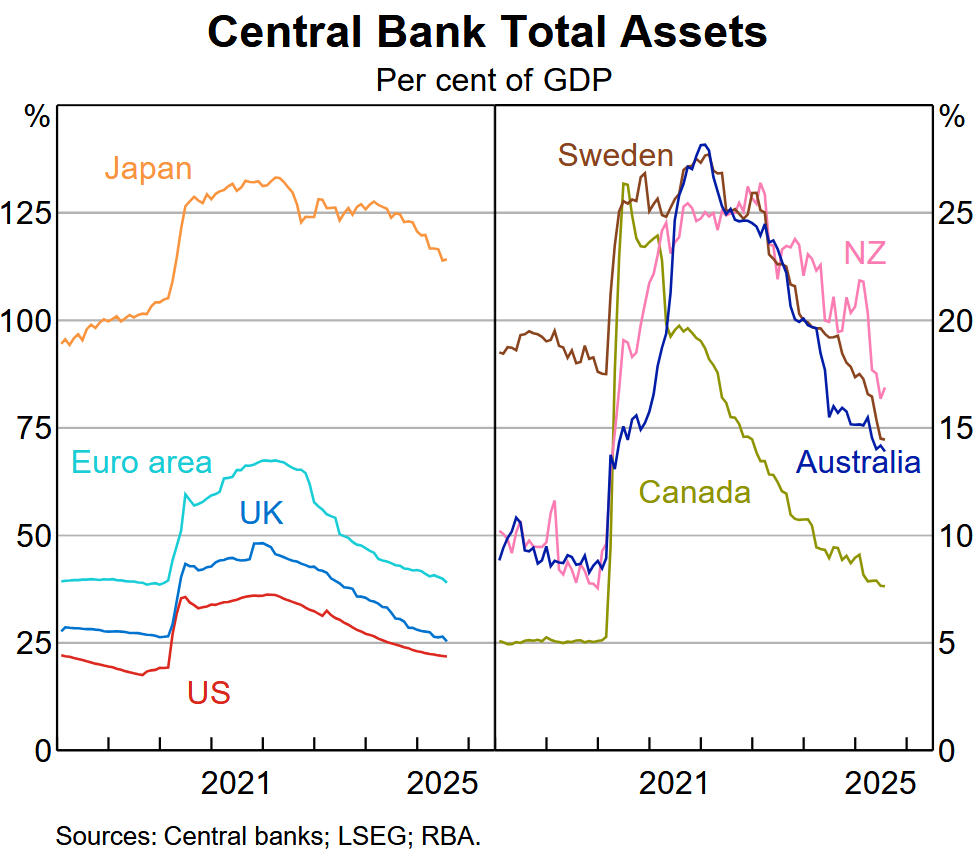

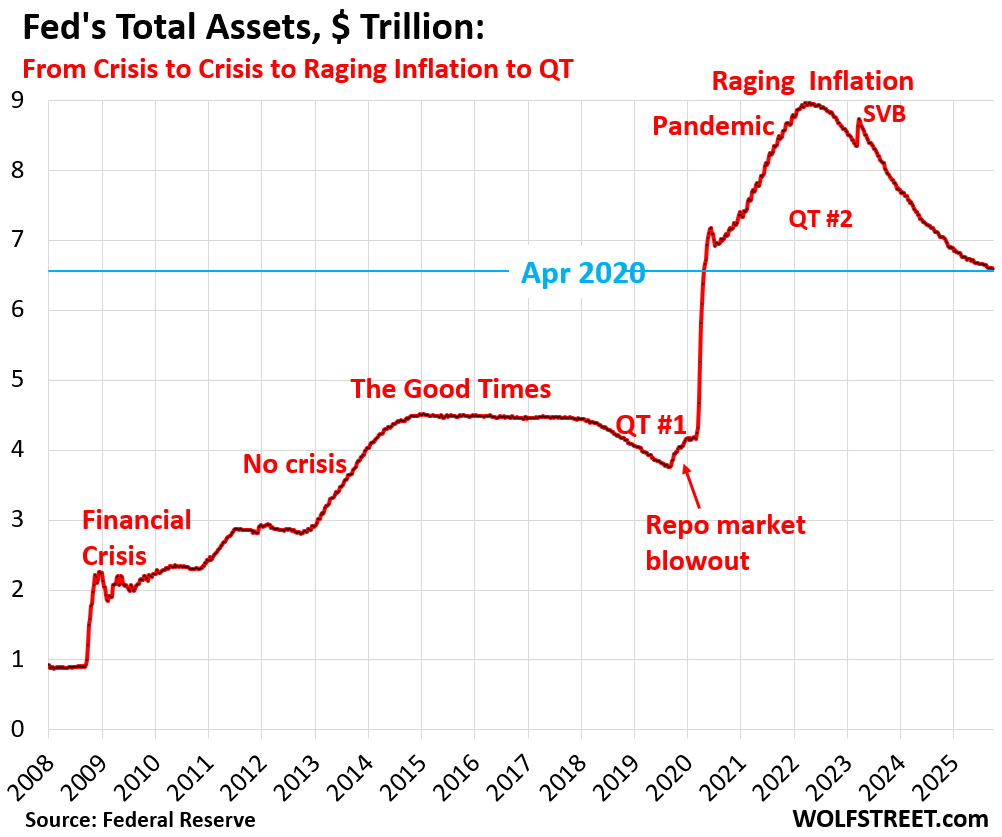

Contrary to expectations of “money printing,” the Federal Reserve has engaged in the opposite strategy for over three years, reducing assets by $2.4 trillion—termed “money unprinting?”—while continuing its Quantitative Tightening program. Advocates of the debasement trade would do well to consider these facts:

Other central banks have also been reducing assets under their Quantitative Tightening initiatives, most notably the ECB and the Bank of Japan. Examining balance sheets of major central banks in relation to their economies provides valuable insights into the challenges faced by the debasement narrative: Amazing How the Money-Printing World Has Reversed.