This is Naked Capitalism fundraising week. So far, 554 supporters have contributed to our mission to tackle corruption and predatory practices, particularly within the financial sector. We invite you to join us by visiting our donation page, where you can learn how to donate via check, credit card, debit card, PayPal, Clover, or Wise. Discover more about the purpose of our fundraiser, our achievements over the past year, and our current goal of supporting new features like Coffee Break/Sunday Movie.

Yves here. It has become evident that venture capital funding and valuations are now heavily influenced by artificial intelligence (AI)—much like public stocks. Wolf’s insights below shed light on this intriguing trend.

Financial market crashes typically don’t lead to broader financial crises unless they are fueled by significant leveraged purchases. In the wake of the Great Crash, the U.S. and other nations implemented margin lending restrictions to prevent such scenarios. However, stock market declines can trigger severe recessions. One reason for this is that individuals who experience substantial losses often retreat and reduce their spending. Additionally, companies impacted by the market crash may suffer due to vanished business prospects that previously inflated the bubble or loss of funding. During the dot-com boom, many consulting firms, including McKinsey, expanded rapidly in response to the frenzy, both to assist traditional companies and to advise internet startups in exchange for equity. McKinsey faced over $200 million in write-offs and reduced its North American workforce by 50% within two years, occasionally even giving away studies. Therefore, the extent of collateral damage can be significant.

By Wolf Richter, editor at Wolf Street. Originally published at Wolf Street

The combined post-money valuation of AI startups has skyrocketed to $2.30 trillion—up from $1.69 trillion in 2024 and a staggering increase from $469 billion in 2020, which itself was a significant record, according to PitchBook.

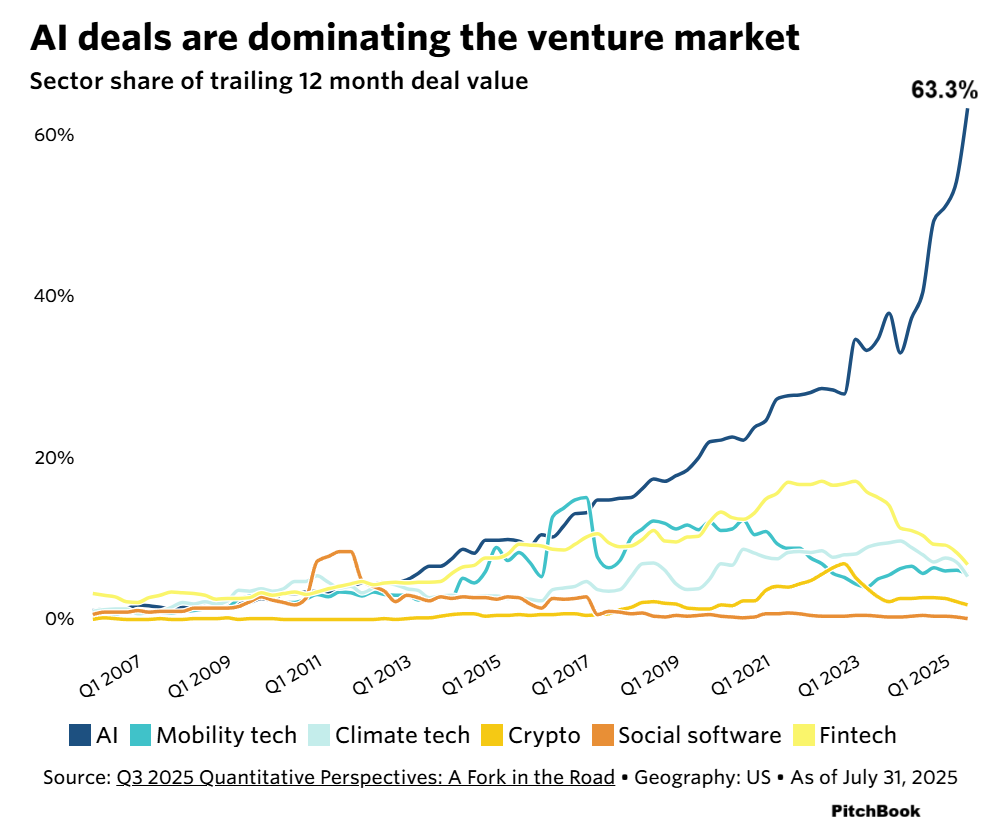

“AI deals are now dominating the entire venture capital landscape at an unprecedented pace, even surpassing the rapid investment concentrations seen in previous hype cycles such as cryptocurrency and mobility technology,” PitchBook reported.

AI startups represented 63% of all venture capital investments made in the past 12 months, a jump from 40% at the end of Q3 2024, and from 23% at the end of Q3 2020 (as illustrated by the blue line in the chart), according to PitchBook’s Q3 2025 Quantitative Perspectives: A Fork in the Road.

In early September, OpenAI achieved a valuation of $500 billion when it offered eligible former and current employees the opportunity to sell $10 billion of their shares in a secondary offering to other investors, led by SoftBank, as reported by CNBC. Back in April, OpenAI had reached an impressive post-money valuation of $300 billion during a funding round where it raised $40 billion, primarily from SoftBank. The potential is vast.

Elon Musk’s xAI aims for a valuation of $200 billion during a $10 billion funding round, according to sources quoted by CNBC, although Musk refuted this on X, labeling it as “fake news” and stating that “xAI is not raising any capital right now.” Well, not right now, or whenever that might be.

Anthropic recently announced a post-money valuation of $183 billion after securing $13 billion in a Series F funding round in early September.

These valuations for AI startups are astonishing. One pressing question remains: how will late-stage investors manage to exit these investments successfully?

For these companies to achieve a viable exit, they would need to go public with substantial IPOs, then see their stock prices appreciate enough to enable late-stage investors to sell their shares without adversely affecting the stock price.

AI ventures seem to attract significant funding. If 90% collapse and absorb all investor capital, and 8% struggle to survive, but 2% become $1 trillion companies at IPO and perhaps $2 trillion stocks within two months, and potentially $4 trillion stocks a year later, then perhaps the entire equation makes sense—this seems to be the logic underpinning current investments.

However, the largest AI IPO to date—and the most significant IPO of 2025—Figma has resulted in substantial disappointment. Its shares were priced at $33 during the IPO, surged 250% on the first trading day, further increasing on the second day to peak at $142.92, but then plummeted 63% to just $51.87 today.

While pre-IPO investors still enjoy considerable gains, most investors who purchased shares after the IPO are facing significant losses. If these early investors attempt to liquidate their remaining large stakes, they could further depress the stock price.

Figma’s current market capitalization stands at $25 billion. Similarly, AI company CoreWeave, which had the second largest IPO this year, is performing well, but its market cap is only $68 billion. Both figures are substantially smaller than what late-stage investors need for a successful exit from their major AI holdings.

The challenge remains: how can companies with staggering valuations, like the $500 billion valued AI firms, go public at a sufficiently high valuation and subsequently increase their share prices enough to allow late-stage investors to exit safely?

As history has shown during this tremendous bubble, sky-high expectations are often met with disappointment, and the road to success is fraught with obstacles. Yet, in light of these valuations, according to PitchBook, “exit hurdles become exceptionally large.”