Life often unfolds in ways that leave us bewildered and frustrated. We embark on our journeys with enthusiasm and determination, thinking we have all the right strategies in place. We envision grand outcomes and set ambitious goals.

Life often unfolds in ways that leave us bewildered and frustrated. We embark on our journeys with enthusiasm and determination, thinking we have all the right strategies in place. We envision grand outcomes and set ambitious goals.

However, the results can defy our expectations, sometimes leading us to outcomes we would never have anticipated. This unsettling reality can be likened to the surprises found in a box of chocolates. It also illustrates the unpredictable nature of expansive geopolitical projects.

In the aftermath of World War II’s destructive nationalism, European nations sought greater integration. The founders of the European Union imagined a unified continent characterized by a single market, a common currency, and shared economic prosperity to foster harmony. Yet, it took decades of careful planning to lay this groundwork.

The Hague Congress in 1948 was pivotal in this journey, establishing the European Movement International and the College of Europe, where future European leaders could coalesce. Continue reading

On Wednesday, Federal Reserve Chair Janet Yellen shared her insights, hinting at a potential interest rate increase. However, she emphasized that such a move is not imminent.

On Wednesday, Federal Reserve Chair Janet Yellen shared her insights, hinting at a potential interest rate increase. However, she emphasized that such a move is not imminent.

The Fed appears to believe that the economy is strengthening, albeit not sufficiently to justify raising the federal funds rate from its near-zero level, where it has remained for over six years. Any shift might threaten the current buoyant stock market.

Understandably, the Fed aims to maintain, if not bolster, the stock market. A rising market contributes to a sense of well-being, making people feel wealthier, sharper, and more youthful.

Following the Federal Open Market Committee meeting and the accompanying Fed statement, stock prices surged, with the DOW gaining 180 points. Yet, this momentum quickly waned, ending the day just 31 points above where it initially began. The next day, however, investor enthusiasm reignited, pushing the DOW up another 180 points. Continue reading

Last Saturday, Zimbabwe officially retired its dollar, closing the chapter on a disastrous monetary experiment that devastated the nation and saw its wealth flee abroad. The country is now left to piece together what little remains, a process likely to take generations.

Last Saturday, Zimbabwe officially retired its dollar, closing the chapter on a disastrous monetary experiment that devastated the nation and saw its wealth flee abroad. The country is now left to piece together what little remains, a process likely to take generations.

Recall that the Zimbabwean government seized farms from white landowners in the late 1990s, claiming to address the “injustices of colonialism.” However, the effectiveness of this move remains questionable.

Instead, this policy replaced skilled farmers with inexperienced ones, leading to a 45 percent drop in food production. As the banking sector collapsed, farmers were left without loans to salvage their failing enterprises.

By 2007, unemployment surged to 80 percent, prompting the Zimbabwe Central Bank to resort to printing vast amounts of currency. Continue reading

An unexpected event occurred this Tuesday—Los Angeles experienced rain in June. Although it was a mere trace, it was enough to reveal a hole in my shoe as I walked through John Fante Square.

An unexpected event occurred this Tuesday—Los Angeles experienced rain in June. Although it was a mere trace, it was enough to reveal a hole in my shoe as I walked through John Fante Square.

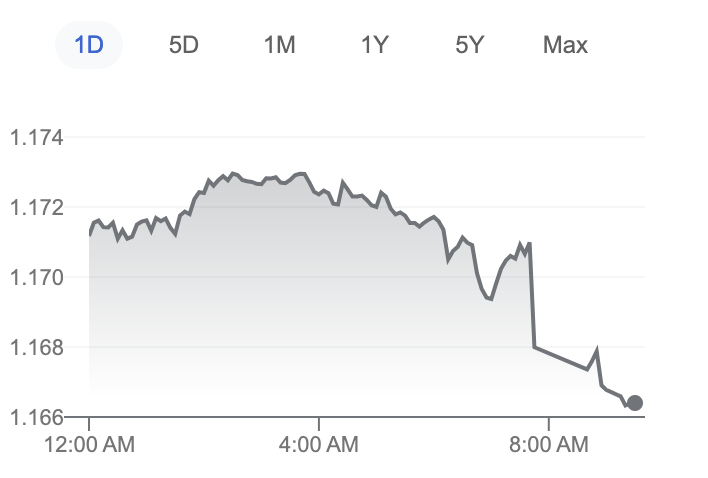

This wasn’t the only surprising occurrence that day. The bond and gold markets sent mixed signals, forecasting both inflation and deflation simultaneously. Yields on the 10-year Treasury note surged to 2.41 percent, suggesting inflation, while gold prices fell by 0.19 percent to $1,175 per ounce—hinting at deflation.

By Wednesday, the confusion continued. 10-year Treasury yields exceeded 2.47 percent while gold prices remained stable. Then, yields dipped back to 2.38 percent yesterday, with gold steady at around $1,182 an ounce and crude oil hovering around $60 per barrel.

The stock market continues its erratic pattern, with the DOW fluctuating without any significant gains. As of now, it stands roughly where it started the year. Continue reading

In this revamped article, the original ideas are preserved while enhancing readability and cohesion. The structure remains intact, ensuring a seamless flow from the introduction to the conclusion of each section.