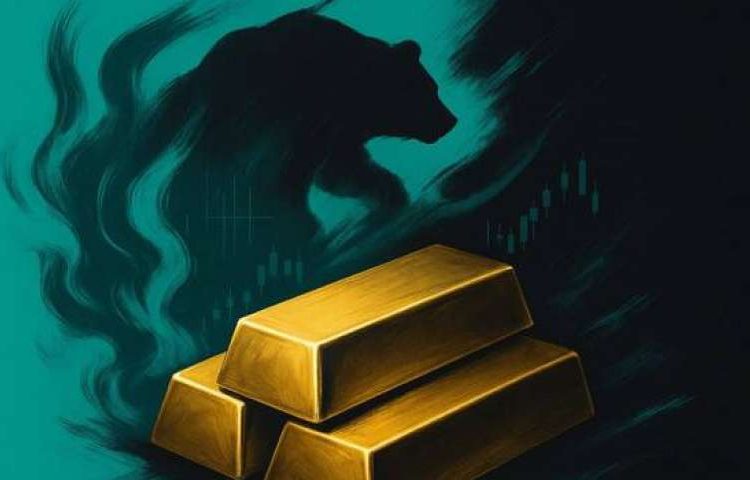

Saxo Bank: Gold Rally Becoming Unsustainable

In recent assessments, Saxo Bank has highlighted concerns regarding the sustainability of the ongoing gold rally. The financial institution believes that the current momentum in gold prices may not be able to hold up for much longer.

The Current Gold Market Landscape

Gold has traditionally been viewed as a safe haven asset, particularly during periods of economic uncertainty. However, Saxo Bank is warning that the recent surge in gold prices could be reaching a tipping point.

Key Factors Influencing Gold Prices

- Inflation Trends: With rising inflation, many investors flock to gold as a hedge against currency devaluation.

- Interest Rates: Central bank policies and interest rate hikes can significantly affect gold’s attractiveness.

- Geopolitical Tensions: Uncertainty in global politics often increases the demand for gold as a safe-haven asset.

Market Predictions

Saxo Bank’s analysts predict that the gold market may face headwinds that could challenge the present upward trajectory. As investors take stock of the broader economic environment, it is essential to assess whether the current gold price is justified.

Possible Scenarios Ahead

- Market Correction: A potential correction could lead to a reevaluation of gold’s current standing.

- Long-Term Outlook: While short-term fluctuations may occur, gold could remain valuable over the long haul.

Conclusion

In summary, Saxo Bank’s insight into the gold market serves as a cautionary tale for investors. As they navigate the complex landscape of asset prices, the bank underscores the importance of vigilance in the face of changing economic conditions.