In recent times, the popular narrative circulated by the mainstream media suggests that the economy is gradually improving and that brighter days are just around the corner. However, this optimistic view raises some questions.

In recent times, the popular narrative circulated by the mainstream media suggests that the economy is gradually improving and that brighter days are just around the corner. However, this optimistic view raises some questions.

Upon closer inspection, we observe that business activity isn’t thriving. Earnings are stagnant, profits are slim, and corporate layoffs have been enacted with indiscriminate rigor—Google has even announced job cuts.

If the economy were genuinely on an upswing, one would expect to see an increase in demand for raw materials and new construction equipment. Unfortunately, that doesn’t seem to be the case right now.

Just this week, Caterpillar’s CEO Doug Oberhelman stated, “Economic weakness persists globally, and therefore, many of our [Caterpillar’s] end markets remain challenged. In North America, there is an oversupply of used construction equipment, rail clients have a significant number of idle locomotives, and worldwide, many mining trucks remain unused.”

Oberhelman’s observations were part of Caterpillar’s third-quarter earnings report. His outlook for the upcoming year was not optimistic either: “We remain cautious as we look ahead to 2017.”

Structural Deficiencies

Perhaps Oberhelman is being overly cautious, but given his company’s focus on mining and construction equipment, he has a unique insight into the demand for these materials. His assessment reveals that global demand appears dismal. What does this signify?

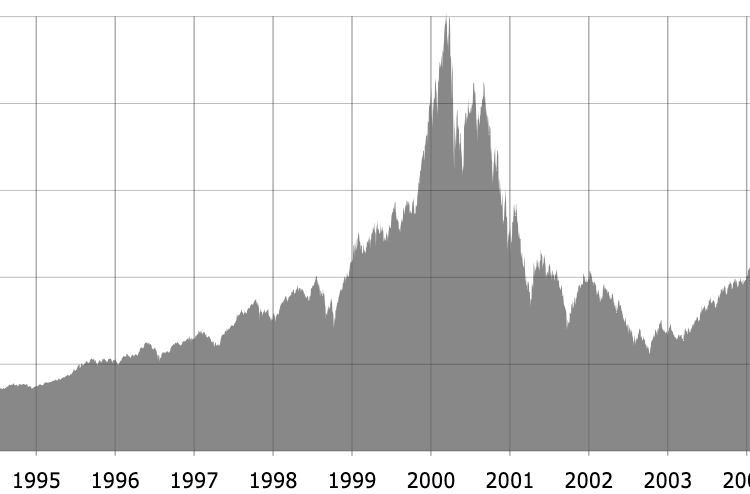

The surge in debt, combined with four decades of mass monetary debasement, has consistently borrowed demand from the future. Thus, today’s demand is already accounted for by yesterday’s actions, leading to significant slack in the current market.

In essence, these policies have stretched past their limits. The effort to stimulate demand through new debt is no longer yielding growth.

Even the introduction of negative interest rates has not appreciably boosted the economy. Capacity has outstripped demand to such an extent that a recession may be necessary to restore balance.

Sadly, measures taken to combat the Great Recession have not resolved the underlying structural issues; they have merely postponed them, potentially setting the stage for an even greater economic downturn.

Our assessment shows that the situation has become precarious. The U.S. stock market, as represented by the S&P 500, is nearing its all-time highs, while U.S. housing prices, measured by the Case-Shiller Index, are just 0.1% below their peak in July 2006. Meanwhile, in the last eight years, the national debt has surged to nearly $19.7 trillion.

Despite this surge in government debt and inflated asset values, the GDP is sluggish, resembling a heavy burden. The cost of continually increasing debt issuance now outweighs its benefits, yet the Federal Reserve remains committed to stimulating the credit market.

Here’s the reasoning behind this approach:

Meddling with Markets for Work and for Pleasure

Fed Chair Janet Yellen’s main liability isn’t her distinctive hairstyle; rather, it’s her lengthy career spent maneuvering credit markets.

Unfortunately, Yellen’s extensive experience has led her to mistakenly believe in her own efficacy. But how can she genuinely assess her performance?

If government statistics indicate that unemployment is at 5 percent, inflation at 2 percent, and GDP at 3 percent, does that signal success on her part? Or does it merely reflect the effectiveness of the propaganda machine? Any achievements she can claim are, in reality, superficial.

It’s essential to note that Fed Chair Janet Yellen has been interfering with credit markets—effectively the economy—since the dawn of time. That’s a considerable span for an activity that generally results in widespread economic harm.

Unquestionably, Yellen’s primary role has been to assist Wall Street and large banks in extracting wealth from the broader populace. Meanwhile, she bureaucratically navigates the lives of millions in a manner only the most fervent central planners would find gratifying.

Sincerely,

MN Gordon

for Economic Prism

Return from Meddling with Markets for Work and for Pleasure to Economic Prism