In January 2026, Equifax introduced a suite of innovative fraud prevention and risk management tools. This included new offerings such as Credit Abuse Risk, Synthetic Identity Risk, along with Employment Insights and Income Confirm products, which utilize verified employment and income data sourced from The Work Number. These advancements signify Equifax’s commitment to enhancing its role in assisting lenders with fraud prevention and improving credit decision-making processes by merging AI-driven risk assessments with trusted employment and income data.

- In late January 2026, Equifax launched a series of fraud and risk tools, including Credit Abuse Risk and Synthetic Identity Risk, alongside new Employment Insights and Income Confirm products that integrate verified income and employment data from The Work Number into lending and auto finance workflows.

- Together, these launches underscore how Equifax is trying to deepen its role in lenders’ fraud prevention and credit decisioning processes by combining AI-driven risk scores with regulated, verified employment and income information.

- We will now examine how Equifax’s push into first-party fraud detection and richer income verification shapes the company’s broader investment narrative.

The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 25 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

What Is Equifax’s Investment Narrative?

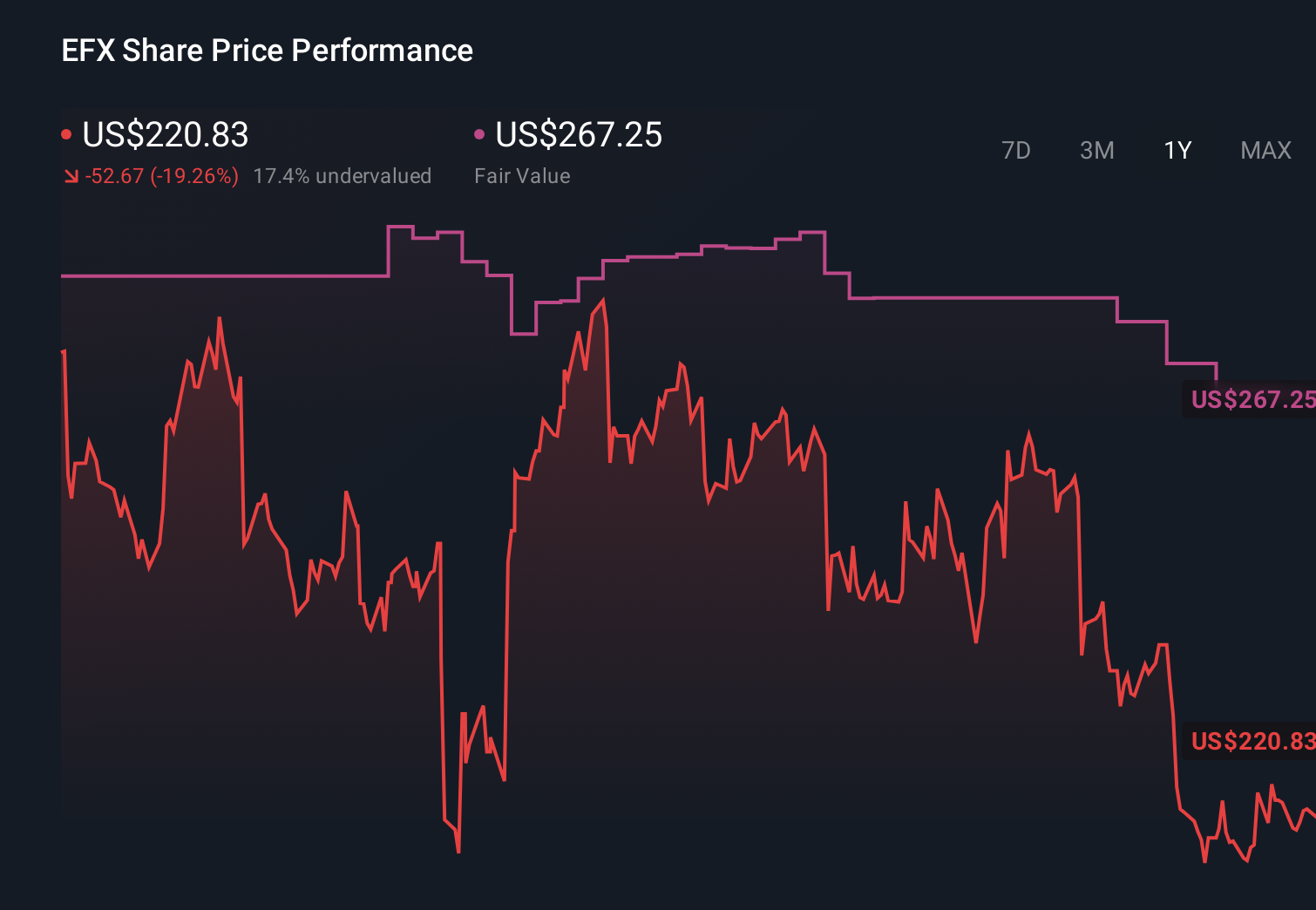

Equifax’s investment strategy hinges on whether its data capabilities, AI technology, and cloud services can sustain a high valuation despite anticipated slower revenue growth, considerable debt, and a recent decline in share prices. The introduction of tools like Credit Abuse Risk and Income Confirm signify a deeper engagement within fraud prevention and income verification — pivotal aspects for lenders, though substantial financial impact may take time to materialize. In the short term, attention will likely center on the Q4 2025 results, updates on debt management and capital allocation, and management’s insights into the demand for its premium analytics. Given the high price-to-earnings ratio and recent lackluster performance, the success of these new offerings is crucial.

Despite experiencing a downturn, Equifax’s shares might still be trading 48% above their fair value. Discover the potential downside here.

Exploring Other Perspectives

The Simply Wall St Community has fair value estimates for Equifax ranging from approximately US$256.57 to US$383.92, which illustrates the diverse opinions regarding the company’s value. This variation, set against high valuation metrics and increasing exposure to fraud-related products, highlights the importance of considering both potential gains and execution risks before forming a viewpoint.

Explore 5 other fair value estimates on Equifax – why the stock might be valued as much as 91% higher than its current price!

Build Your Own Equifax Narrative

If you disagree with the current assessment, create your own narrative in under 3 minutes. Extraordinary investment returns seldom arise from merely following the crowd.

No Opportunity In Equifax?

Markets are dynamic. These stocks won’t remain undiscovered for long. Capture the opportunity while it lasts:

This article by Simply Wall St presents general information. We provide commentary based on historical data and analyst forecasts using an unbiased methodology. Our articles are not intended to serve as financial advice. This content is not a recommendation to buy or sell any stock, nor does it account for your individual financial goals or situation. Our objective is to deliver long-term analysis rooted in fundamental data. Please note that our analysis may overlook the latest price-sensitive announcements or qualitative insights. Simply Wall St holds no positions in any stocks mentioned.

Valuation is complex, but we’re here to simplify it.

Discover if Equifax might be undervalued or overvalued with our in-depth analysis, which includes fair value estimates, potential risks, dividends, insider trading, and its financial status.

Do you have feedback on this article? Concerns about the content? Reach out to us directly.You can also email editorial-team@simplywallst.com