Conor here: Do you recall when the Democratic establishment concluded that Medicare for All was too costly and that our focus should be on enhancing Obamacare’s shortcomings?

By Phil Galewitz, a senior correspondent at KFF Health News, covering Medicaid, Medicare, long-term care, hospitals, and various state health issues. Originally published at KFF Health News.

As the federal shutdown stretches into its fourth week, a deadlock over the funding of health insurance for 22 million Americans on Affordable Care Act plans continues. A recent report reveals that over 154 million individuals holding employer-sponsored coverage are also bracing for significant price increases, with forecasts indicating that the situation may worsen.

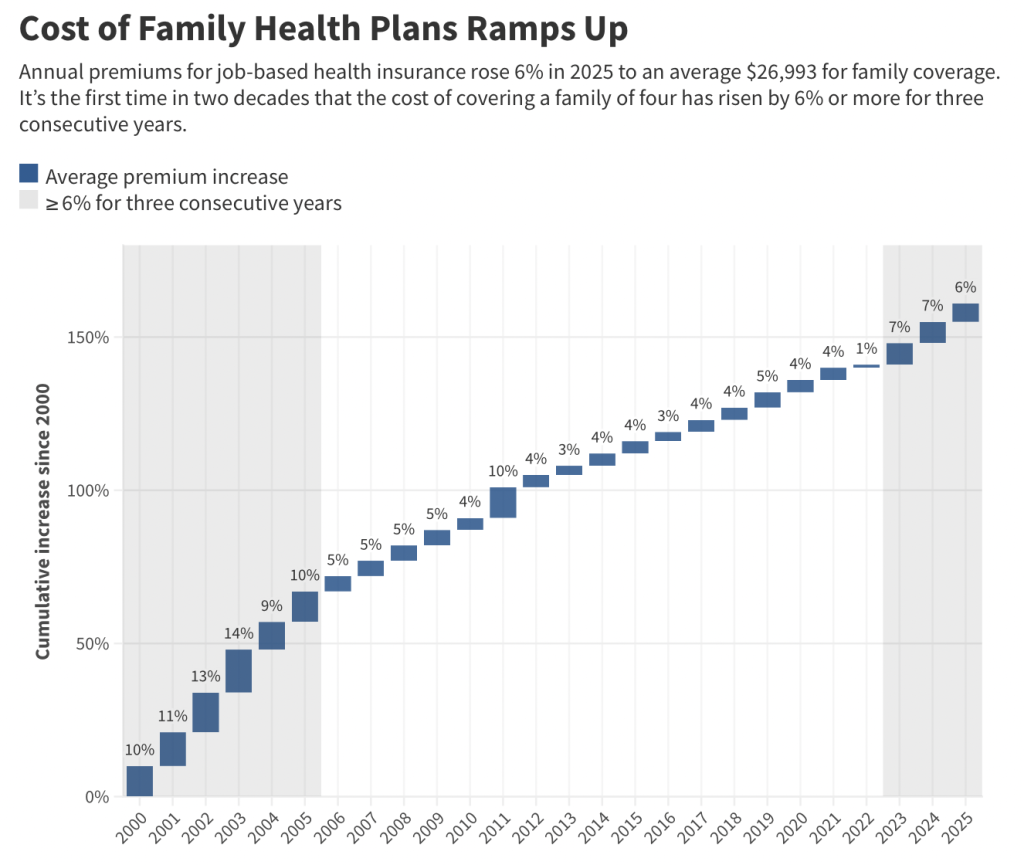

According to an annual employer survey released on October 22 by KFF, a health information nonprofit that includes KFF Health News, premiums for job-based health insurance surged by 6% in 2025, averaging $26,993 annually for family coverage.

This marks the first instance in two decades where the expense of insuring a family of four has jumped by 6% or more for three consecutive years, as reported by KFF.

Over the past five years, the average premium for family coverage has escalated by 26%, compared to a 29% rise in workers’ wages and nearly 24% inflation. Currently, the average cost of family coverage is roughly equivalent to a new Toyota Corolla hybrid.

The average annual premium for an individual health plan offered by employers has increased by 5% to $9,325, nearly $3,000 more than in 2016, according to the survey.

“The ongoing rise in health costs is concerning,” noted Eric Trump, controller at Steve Reiff Inc., a small business in South Whitley, Indiana, specializing in sandblasting and painting heavy machinery.

Trump, who is not related to former President Donald Trump, mentioned that his company saw an 8% increase in health insurance costs for the 2026 fiscal year, similar to trends from previous years.

Approximately half of the employees at Reiff choose to decline insurance, opting for coverage through family members or going uninsured. Trump explained, “We have limited options because our workforce isn’t large enough to distribute costs effectively.”

Most individuals with job-based insurance contribute to their premium costs, with the average worker paying $1,440 for individual coverage or $6,850 for family coverage this year.

Over time, many workers have faced progressively higher deductibles, the amounts they must pay out-of-pocket for medical services before their insurance kicks in. Current figures indicate that more than one-third of covered workers are enrolled in plans with individual deductibles of $2,000 or more. This share has risen by 32% in the past five years and by 77% over the last decade, as highlighted by the report.

Escalating drug and hospital costs are often identified as significant factors driving up health insurance costs, with no indication of relief in sight.

“Early reports indicate that cost trends for 2026 may be higher, potentially leading to steeper premium increases unless employers and plans find strategies to mitigate costs through adjustments to benefits, cost-sharing, or plan designs,” the KFF survey stated.

Note: Family Premiums Estimate for 2004, 2006, 2011, 2012, and 2023 is statistically different from the estimate for the previous year shown (p

A major concern for employers is the high cost of GLP-1 medications for weight loss, which an increasing number of businesses now cover. The steep prices combined with burgeoning demand have prompted some companies to restrict or withdraw coverage for weight loss treatments.

“Large employers recognize that these new, high-cost weight-loss medications are a vital benefit for their employees, but the expenses frequently surpass their expectations,” said Gary Claxton, a KFF senior vice president, in a press release. “It’s understandable that some are reconsidering access to these weight-loss drugs.”

Employers usually address rising health costs by passing expenses onto their workers, yet it remains uncertain how much more financial burden employees can endure. The survey revealed that nearly half of large employers acknowledged their employees have “moderate” or “high” concerns about their levels of cost-sharing.

While the increasing cost of employer-sponsored insurance has outpaced general inflation, this issue has garnered little focus in recent months on Capitol Hill. In efforts to finance tax cuts, Trump’s tax and spending legislation significantly reduces federal expenditures on Medicaid, the state-federal health insurance program that supports 70 million low-income and disabled individuals. Congressional budget analysts anticipate that these Medicaid cuts will lead to millions more individuals becoming uninsured over the next decade.

The federal government has been shut down since October 1, as Democrats withhold their votes on a new spending bill unless Republicans agree to prolong tax credits that assist around 22 million people in obtaining health coverage via ACA marketplaces. Without congressional action, these tax credits will expire, resulting in doubled premiums for many consumers beginning in January.

The KFF report is based on a survey conducted this year involving 1,862 randomly selected nonfederal public and private employers with 10 or more employees.