Concerns Over the ECB’s Digital Euro Intensify

Recent discussions highlight a growing skepticism surrounding the European Central Bank’s (ECB) initiative to implement a digital euro. Despite initial endorsements from Eurozone finance ministers and an official rollout date set for 2029, there are significant apprehensions from banks, citizens, and even EU lawmakers regarding this project.

Just days ago, ECB President Christine Lagarde announced what she deemed “good news” for Euro Area residents: the support of 20 finance ministers for the ECB’s digital euro plans, urging a quicker implementation. Alongside this was the official launch date set for 2029.

The digital euro would complement banknotes and extend the benefits of cash to the digital sphere. This is important because euro cash brings us together. Europeans would have the freedom to use the digital euro for any digital payment, online or offline, throughout the euro… pic.twitter.com/XzNZbl6mD8

— European Central Bank (@ecb) October 31, 2025

There are notable distinctions between the ECB’s proposed digital euro and the digital currencies currently in circulation. The digital euro would be state-issued via the central bank, with commercial banks managing customer interactions, while users would have a limit of holding €3,000 at any given time. In contrast, existing digital currencies are privately managed.

As cash usage has dwindled—partially due to pressures from the EU Commission and ECB—so too has the public money flow within the economy. Both institutions now aim to counter this trend with a central bank digital currency (CBDC), which raises concerns about increased control over individual spending and broader economic implications.

However, the initiative faces substantial resistance. Major banks within the Euro Area, opposing the digital euro, are exploring private sector alternatives. Unease also looms among European lawmakers. According to the Financial Times:

The European Central Bank’s plan to launch a digital euro by 2029 has encountered serious opposition from EU lawmakers and the banking sector. Ahead of a pivotal parliamentary hearing, 14 banks, including Deutsche Bank and BNP Paribas, cautioned that the digital euro could jeopardize private payment systems. The banks have collaborated to establish a competitive system named Wero, launched last year, stressing that the current design of the retail digital euro addresses similar use cases as private solutions without evident benefits for consumers.

Fragmented Payment Systems

Due to the multifaceted nature of the EU, Wero is not the sole private payment system in development. Various national systems, such as Bizum in Spain and Bancomat in Italy, are forming alliances like EuroPA, illustrating ongoing fragmentation within the Euro Area’s banking infrastructure.

Two reports authored by Mario Draghi and Enrico Letta warned that achieving a unified EU-wide wallet would be impossible without making national payment systems interoperable or phasing them out entirely. Consequently, the euro area’s payment scenarios remain susceptible to the dominance of American payment giants, Visa and Mastercard.

Recently, opposition to the ECB’s digital euro initiatives has crystallized among EU lawmakers. For instance, Fernando Navarrete, a conservative Member of the European Parliament (MEP), proposes a scaled-back original project. His predecessor, Stefan Berger, vocally criticized the digital euro’s potential threats to small German savings institutions, fearing a bank run triggered by sudden withdrawal tendencies if digital euros were widely adopted.

According to Berger, the main concern for banks is that the digital euro could lead to rapid deposit withdrawals, resulting in destabilizing bank runs on smaller lenders. “It’s no longer the bank’s money [after it’s transferred],” he noted, emphasizing the average deposit for a small German bank aligns with the proposed €3,000 cap.

Proposed Alternatives

Both Berger and Navarrete have expressed a preference for limited central bank control over digital infrastructures, suggesting a wholesale CBDC for inter-bank transactions and, for retail payments, an offline digital currency system. This could involve users having a credit stored on dedicated devices, like cards or smartphones, enabling real-time transactions without internet reliance, ensuring anonymity, and bolstering system resilience during outages. Navarrete’s draft also suggests reducing the obligatory acceptance of digital euros in retail settings.

Norbert Häring, a noted German financial journalist, critiques Navarrete’s position, asserting it favors the banking sector. He points out that while Navarrete rightly questions the need for the digital euro, his suggestion of an offline alternative designed to rival cash may ultimately not enhance independence from foreign payment systems.

Navarrete accurately identifies a key problem with the digital euro initiative, yet his assertion that an offline euro would lessen dependence on overseas payment providers doesn’t stand scrutiny. Cash offers the highest level of independence. If replaced by a digital euro, we gain minimal advantage while losing much.

Moreover, some studies highlight that the ECB’s narrative on the necessity of a digital euro to curtail U.S. influence lacks credibility. Past actions by the EU Commission, including harsh sanctions against Russia and agreements perceived as detrimental to the union, tell another story of dependency.

What was all that talk about “European sovereignty”? For years, Brussels told us the EU was ending dependence on foreign powers.

— Daniel Foubert 🇫🇷🇵🇱 (@Arrogance_0024) July 28, 2025

Recent geopolitical events, including the withdrawal of key European leaders from a summit to avoid U.S. tension, epitomize the EU’s struggle for autonomy amidst global pressures.

Public Sentiments

Concerns about the digital euro extend beyond institutional factions to the populace. A BEUC survey revealed that 52% of participants fear losing cash payment options with the digital euro’s potential rollout, notably, 85% of young respondents believe that cash should still retain acceptance in retail environments. This insight indicates enduring support for cash across diverse age demographics.

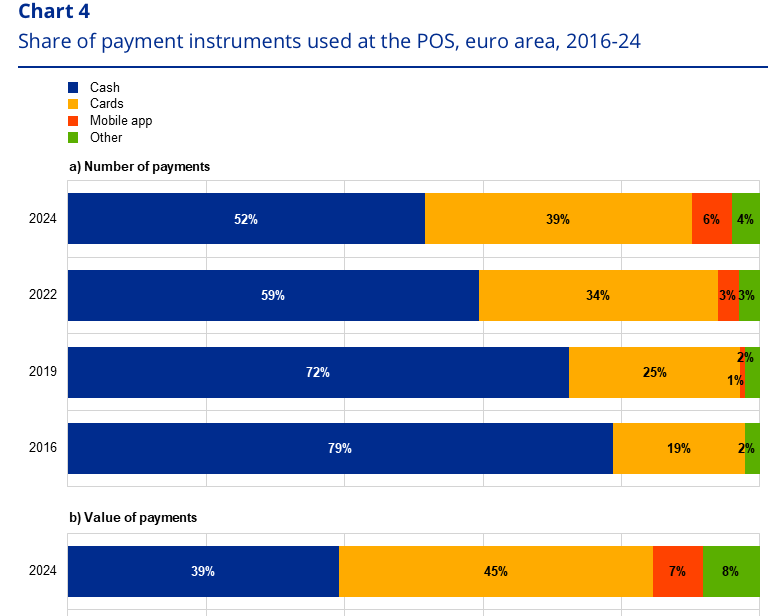

Data from the ECB shows a resurgence in cash demand, countering the prevailing assumption that a cashless society is inevitable. Cash remains a significant form of payment, comprising 52% of transactions at points of sale, according to a 2024 study.

[C]ash usage remains robust in the Euro Area, showcasing a persistent preference for tangible currency despite growing digital payment options.

As public opposition to the digital euro grows, the ECB and EU Commission must grapple with the challenge posed by stubborn resistance from banks, especially in Germany. The German Banking Industry Committee recently voiced support for alternative approaches, criticizing the current digital euro plans as overly complex and costly.

While the financial interests of the EU’s commercial banks cannot be denied, it is clear that the proposed digital euro carries significant concerns regarding public benefit, highlighting risks to privacy and the potential extinction of smaller financial institutions that cannot bear the newly imposed burdens.

As apprehensions about the rollout of central bank digital currencies persist, the narrative underscores a financial transformation that risks redefining money’s very essence into a tool for centralized control, far from the aspirations of citizen autonomy and localized banking.

In summary, the future of the digital euro hinges on navigating a landscape filled with significant opposition and skepticism from various stakeholders. Whether the ECB and the EU Commission can address these concerns remains to be seen, but the path forward demands open dialogue and consideration of public sentiment.

* The proposed €3,000 limit is seen as a compromise to alleviate concerns among financial institutions about mass withdrawals during banking crises. However, this attempt to please multiple parties may end up alienating them all, underscoring the larger conversation around the digital euro’s implementation.