CarGurus (CARG) is launching a new suite of AI-driven products, which includes CarGurus Discover, Dealership Mode, and PriceVantage, complemented by updated branding that will be presented at the NADA Show 2026.

Check out our latest analysis for CarGurus.

Despite the enthusiasm surrounding its AI initiatives and the company’s 20th anniversary, CarGurus has recently experienced a downturn in share price, with a 30-day decline of 12.01% and a year-long total shareholder return drop of 12.66%. However, its 3-year total shareholder return of 96.99% suggests that prior growth may now be easing.

If you’re following how digital platforms leverage AI to transform industries, this is a great opportunity to expand your perspective with high growth tech and AI stocks.

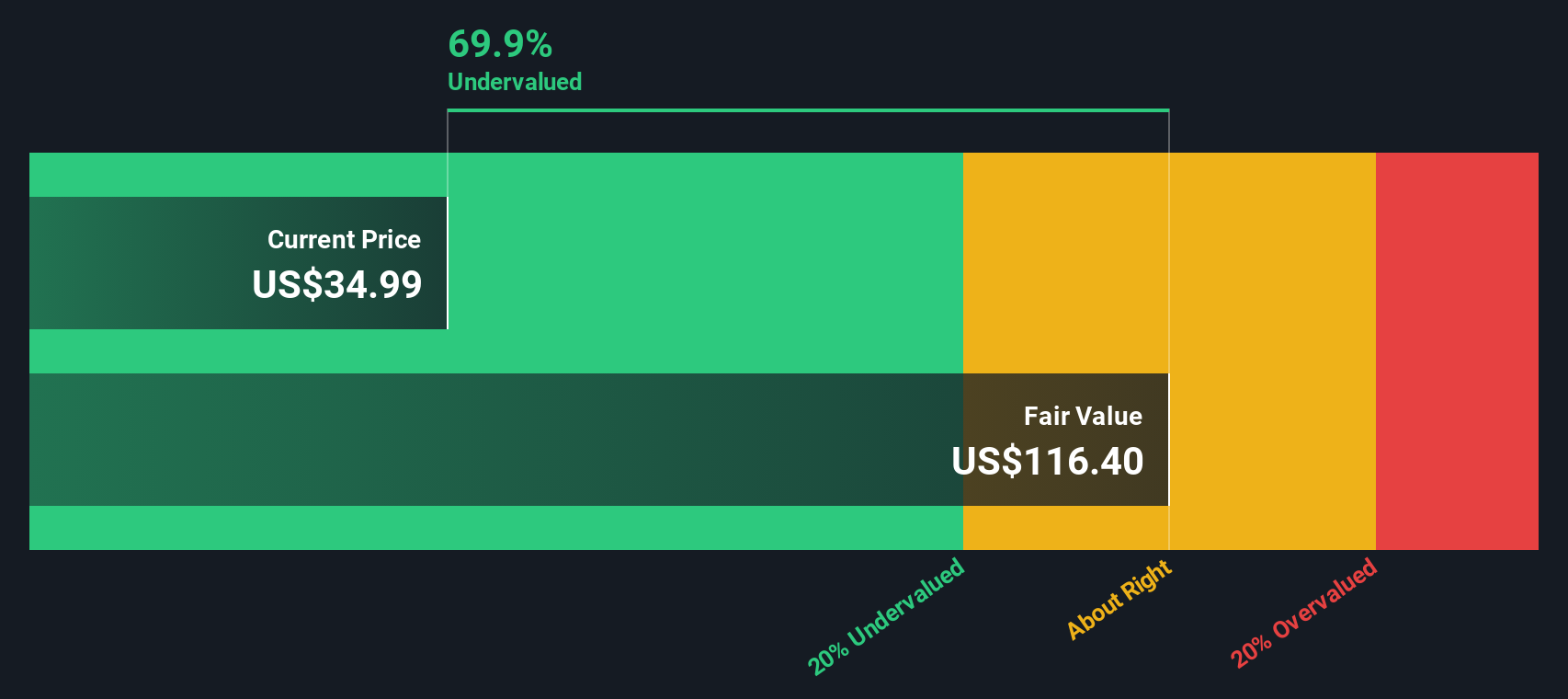

With CarGurus shares receding from their earlier peaks while still trading below the average analyst price target and flagged by some valuations as trading at a discount to intrinsic value, investors may wonder if there’s still an opening here or if the market has already accounted for future growth.

Most Popular Narrative: 17% Undervalued

The prevailing narrative places CarGurus’ fair value around $40.96, compared to its recent closing price of $34.00, highlighting a significant gap reliant on the long-term effectiveness of its marketplace and data tools.

Utilizing brand trust, scale, and consumer engagement through tailored, AI-enhanced shopping experiences and integrated dealer channels bolsters user retention and differentiation within a consolidating digital automotive marketplace, thus supporting long-term revenue growth, market share expansion, and increased profitability.

This assessment is influenced by expectations of faster earnings growth compared to revenue, increased margins, and a future earnings multiple that presumes the business will mature without losing its competitive advantage. The critical question remains: how do these components align, and what conditions must be met for the $40.96 estimate to hold true?

Result: Fair Value of $40.96 (UNDERVALUED)

Discover the complete narrative and insights behind the forecasts.

However, achieving this valuation relies on CarGurus maintaining its position against rising online competitors, including Amazon Autos, while effectively navigating its exit from wholesale without undermining its growth trajectory.

Learn about the key risks to the CarGurus narrative.

Another View: Earnings Multiple Sends a Different Signal

Our Discounted Cash Flow (DCF) model suggests that CarGurus is significantly undervalued at $113.24 per share when compared to the current price of $34. Simultaneously, the market is evaluating the stock with a price-to-earnings (P/E) ratio of 21.4x, which exceeds both its peers’ average of 11.8x and the fair ratio of 22.3x. This situation raises questions about whether this disparity offers a cushion or signals a potential warning if market sentiment shifts.

Explore how the SWS DCF model determines its fair value.

Build Your Own CarGurus Narrative

If you analyze the data and reach a different conclusion, or if you wish to test your own assumptions, you can easily construct a comprehensive view in just a few minutes by visiting Do it your way.

A solid starting point is our analysis, which highlights 4 key rewards that investors are optimistic about regarding CarGurus.

Looking for more investment ideas?

If CarGurus has prompted you to reconsider opportunities, don’t stop here. Expand your watchlist with tailored screens that reveal diverse types of stocks.

This article by Simply Wall St is general in nature. We provide analysis based on historical data and analyst forecasts using an unbiased methodology. Our articles are not intended as financial advice. They do not constitute a recommendation to buy or sell any stock, nor do they account for your specific objectives or financial situation. Our goal is to offer long-term focused analysis grounded in fundamental data. Please note, our analysis may not reflect the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener daily scans the market to uncover potential opportunities.

- Dividend Powerhouses (3%+ Yield)

- Undervalued Small Caps with Insider Buying

- High Growth Tech and AI Companies

Alternatively, you can build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com